This paper was delivered as a lecture at OMFIF’s Economic and Monetary Policy Institute on the evolution of the global monetary system in London on 13 November 2024. It covers some of the core themes of work carried out over my tenure at the Bank for International Settlements (BIS). It would be inappropriate to thank only some people for their comments on this specific presentation. I would rather take this opportunity to thank all those colleagues with whom I have worked closely over the years and to whom I am deeply intellectually indebted, some of whom are included in the references. The views expressed are my own and not necessarily those of the BIS.

Abstract

From its tentative beginnings, inflation targeting has spread to become the de facto global monetary standard. Historically, only the Gold Standard has had a longer lifespan. Inflation targeting has done its job: helping to hardwire a low-inflation regime, even in the face of the post-Covid inflation surge. But the journey has been far from easy. Inflation targeting had to contend with the rise of financial instability, most spectacularly in the form of the Great Financial Crisis. In the wake of that crisis, it struggled to push inflation back up to point targets, and it saw a historical erosion in the room for policy manoeuvre. This paper assesses these challenges and considers possible adjustments to the framework. These include more systematic consideration of the longer-term damage that financial factors can cause to the economy and of the importance of safety margins in the conduct of policy. And all this should be grounded on a clear recognition of what monetary policy can and cannot deliver.

This policy note shares some personal reflections on monetary policy based on my long career at the Bank for International Settlements (BIS). The word “personal” is important. Taking such a perspective will allow me to be more open and provocative. While similarities with the BIS institutional view are natural, for the evolution of that view, I would strongly encourage you to read the BIS Annual Economic Reports.

Let me stand back and assess the success and limitations of what has become the de facto global monetary standard – inflation targeting (IT).

This will allow me to revisit themes that are close to my heart: how policy regimes interact with the environment, springing challenges from unsuspected quarters; the difference between calendar and economic time; the power and limitations of intellectual paradigms; and the importance of realism and long-term horizons in policymaking.

Given the objective, you will excuse me for not elaborating on specific evidence for the various claims. I will simply provide my personal reading of the extant body of research, to which my co-authors and I have contributed.1 The focus is on a specific perspective.

What are the key takeaways?

IT has achieved what it was designed to achieve: help deliver an era of price stability. This is no mean feat, as price stability is a precondition for prosperity.

However, I worry that, to make it fit for purpose longer term, IT would need to adapt in ways that do not figure prominently in the current debate. One is more systematic consideration of the longer-term damage that financial factors can cause to the economy. Another is more systematic consideration of the importance of safety margins in the conduct of policy. And all this is grounded on a clear recognition of what monetary policy can and cannot deliver.

I shall first briefly recall the success story – the uncontroversial part of my remarks. I shall then probe in more detail into the limitations of IT frameworks – the less uncontroversial part. Based on that, I shall propose some refinements.

For current purposes, I will define an IT regime as one with three key features. First, numerical targets for inflation. Second, doing away with intermediate targets and relying on the direct link between instruments and the final objective. The interest rate has been the instrument of choice, although over time central banks have also increasingly relied on balance sheet policies, in assets denominated in both domestic and foreign currency.2 Finally, a supporting communication strategy designed to strengthen transparency and accountability. More often than not, IT has come along with institutional safeguards for the central bank’s independence, but strictly speaking, this is not part of the regime.

Looking back, IT had a hesitant and inauspicious beginning. It was first adopted by countries that had tried everything else and failed. New Zealand, Canada and then the United Kingdom come to mind. What else could on earth one try? Recall also that IT was adopted before it was theorised in academia.

Compared with the intermediate target strategies that had preceded it, IT represented a certain leap of faith. Until then, the issue had been framed in terms of how to achieve a given final objective – the control problem. This recognised the serious informational limitations that plague policy (information lags, transmission lags, knowledge gaps, etc), which undermine the link between instruments and final goals. IT, in contrast to, say, monetary targeting or an exchange rate peg, was silent about these issues. It seemed to be a prima facie case of “if you cannot will the means, will the end”.3

Despite the inauspicious start, IT has gone from strength to strength.

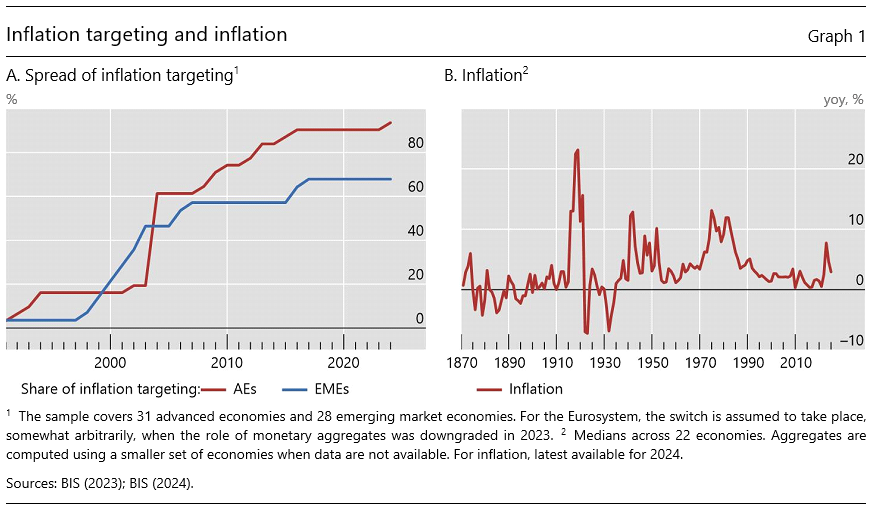

The regime became increasingly widespread (Graph 1.A). Even countries that did not formally adopt it for some time, de facto increasingly behaved as if they had. The regime has survived momentous upheavals, including the Great Financial Crisis (GFC) and, later, the Covid-19 crisis. And some 35 years on, IT has passed the defining “no-regret” test: no country that has adopted IT has abandoned it or expressed regrets. Historically, only the Gold Standard has had a longer lifespan.

Moreover, big picture and judged on its explicit objective, IT has been a major success story: inflation has remained generally stable across the world (Graph 1.B). And when recently severely tested by the surprising post-Covid inflation surge, the regime has coped.

To be sure, circumstances often helped along the way. Inflation was already on a downward trend when the regime was first adopted (same graph). And the country that had set that shift in motion – the United States – had not achieved disinflation by relying on it. In addition, globalisation generated powerful disinflationary pressures (I will come back to this).

But the role of IT in hard-wiring a low-inflation regime is undeniable, especially when coupled with central bank independence. IT has enhanced discipline in the pursuit of price stability. Within central banks, it has provided an unambiguous focus to organise thinking, processes and decisions. And outside central banks, it has provided a clear objective to anchor expectations and a framework to evaluate central banks’ performance.

In other words, IT has done its job of fostering, institutionalising and making operational the public’s and body politic’s support for price stability.

So much for the uncontroversial part of the story. The more controversial part concerns the challenges that IT has faced. To what extent are they exogenous to the regime or the result of how the regime has been operated, ie endogenous to the regime itself? Forming a view is key to identifying possible adjustments.

My thesis is that some of the challenges are in part the result of the specific regime’s operation. I will focus on two such challenges: the GFC and the difficulties in pushing inflation back to point targets post-GFC.

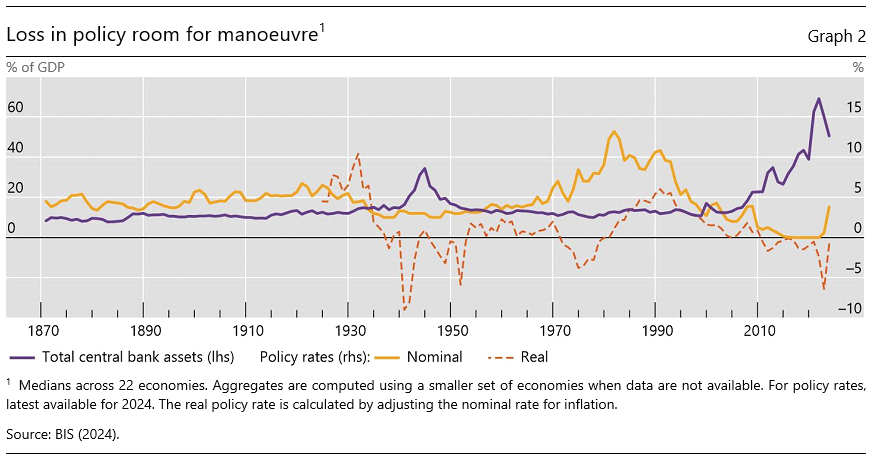

Connecting these challenges – and a kind of “summary statistic” of the problems faced – is the historic loss in room for policy manoeuvre that monetary policy had already suffered before the Covid-19 crisis struck (Graph 2). In nominal terms, interest rates had never been so low, even hovering in negative territory. In fact, in real terms, they had not been negative for as long even during the Great Inflation era of the 1970s. And central bank balance sheets had reached peaks previously approximated only during wars. The Covid-19 crisis simply exacerbated this condition.

Let me say a few words about each challenge in turn, although they are just two phases of the same journey.

I recall that when IT was first adopted, the main concern was that “negative supply shocks” would pose the toughest test. They would depress output and push up inflation, raising the trickiest economic and political economy dilemmas for central banks. This is also the view now as the economic landscape is evolving. I will return to this point.

Instead, my inclination was to think that the biggest tests would come from the financial side: it was financial instability that could threaten the regime. And from this perspective, paradoxically perhaps, positive supply shocks – or, better put, positive supply forces – could be more threatening. 4

As IT was spreading, the economic landscape was fundamentally changing in the wake of policy-induced tectonic forces. On the one hand, financial liberalisation was providing bigger scope for disruptive financial expansions and contractions – or financial cycles 5 – in the form of self-reinforcing shifts in credit and asset prices, notably property prices. Recall that, by the early 1990s, the transition from a government-led to a market-led financial system – to use Padoa-Schioppa and Saccomanni’s felicitous expression6 – was largely complete. On the other hand, the globalisation of the real side of the world economy – the positive supply force – had started blowing powerful disinflationary tailwinds.7 Recall, in particular, the integration of former communist countries and China into world trade and the opening up of emerging market economies. This added something like 1.6 billion lower-wage workers to the effective global labour force, drastically shrinking the share of advanced economies, by about half by 2015, and transforming the wage-price nexus – the inflation engine.8

In this context, the new IT regime could inadvertently accommodate the build-up of financial imbalances. There would be no incentive to tighten monetary policy as long as inflation remained under control, especially since the new regime dispensed with credit and monetary aggregates.

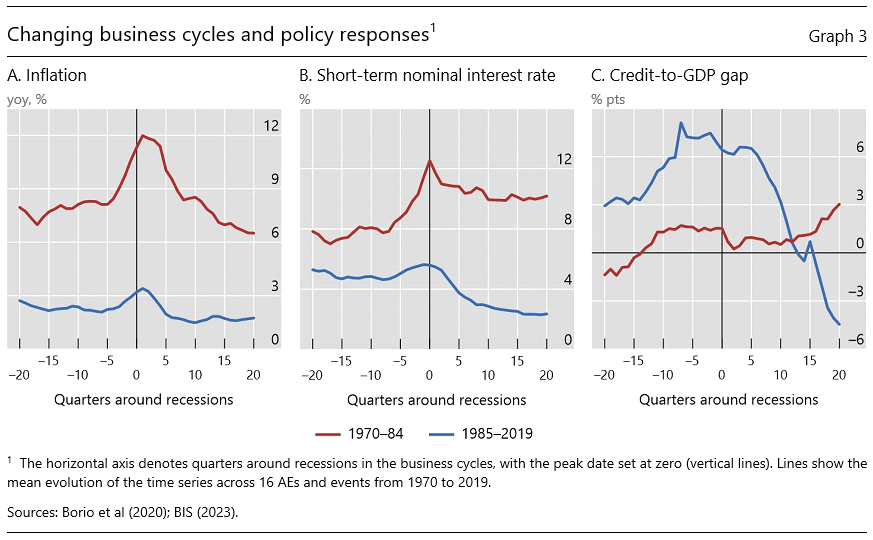

Indeed, the evidence indicates that from the mid-1980s a subtle change in the business cycle took place – from inflation-induced to financial-cycle-induced recessions (Graph 3). Until then, the typical trigger of a downturn would be a tightening of monetary policy to quell inflation. Indicators of the financial cycle would move comparatively little, as illustrated in the graph by the credit gap – the deviation of the ratio of private credit to GDP from a slow-moving trend. Thereafter, inflation would not rise much and monetary policy would have to tighten less, but large financial expansions would turn into contractions. The GFC is just the most spectacular example. The downturns of the early 1990s had already exhibited similar patterns. In fact, some had ended in full-blown banking crises (in Japan and the Nordic countries) or at least serious banking strains (the United States).

Put differently, inflation became an unreliable signal of the sustainability of economic expansions. That role was largely taken over by the unsustainable build-up of financial imbalances.

Importantly, the unreliability of inflation as a signal was transmitted to the natural rate of interest, also known as r-star. 9 And this was precisely at a time when the concept was having a revival in policymaking owing to the abandonment of intermediate targets.

As we know, r-star is typically defined as the short-term real interest rate consistent with output at potential and hence stable inflation – ideally at target – absent business cycle disturbances, ie in a steady state. Thus, a common practice when inflation would turn out lower than expected was to adjust estimates of potential output upwards and hence of r-star downwards. In turn, this would call for lower policy rates to keep the stance unchanged.

You can see how this pattern can lead to a loss in the room for policy manoeuvre over successive business and financial cycles. Lower rates accommodate the build-up of financial imbalances. And when the boom turns to bust, even lower rates are needed to nurse the economy back to health. Moreover, they may be needed for longer, since financial-cycle-induced downturns tend to be deeper and recoveries from them lengthier. The economy struggles to absorb the debt overhang and misallocation of capital.

One could say that low rates beget lower rates.

In the post-GFC phase, I worry that over-reliance on r-star may have encouraged a further loss in room for policy manoeuvre. And, paradoxically, it may have done so precisely as a result of attempts to regain that headroom – a key consideration in the post-GFC review of policy frameworks.

Here, the notion that r-star is exogenous to monetary policy plays a key role. If the “equilibrium” real interest rate is exogenous, the only way to regain room for policy manoeuvre on a durable basis is to boost inflation. This means reducing interest rates so as to be able to raise them as higher inflation eventually takes hold. In other words, it means losing room for policy manoeuvre for sure today in the expectation of regaining it tomorrow. Thus, if inflation does not respond as envisaged, central banks end up losing, not regaining, policy headroom.

As it turned out, central banks did struggle to push inflation back to point targets even as economies recovered. And although the shortfalls always remained contained within a handful of basis points, concerns about a de-anchoring of expectations and ultimately deflation provided an additional reason to push harder.

I can see at least two reasons why central banks struggled.

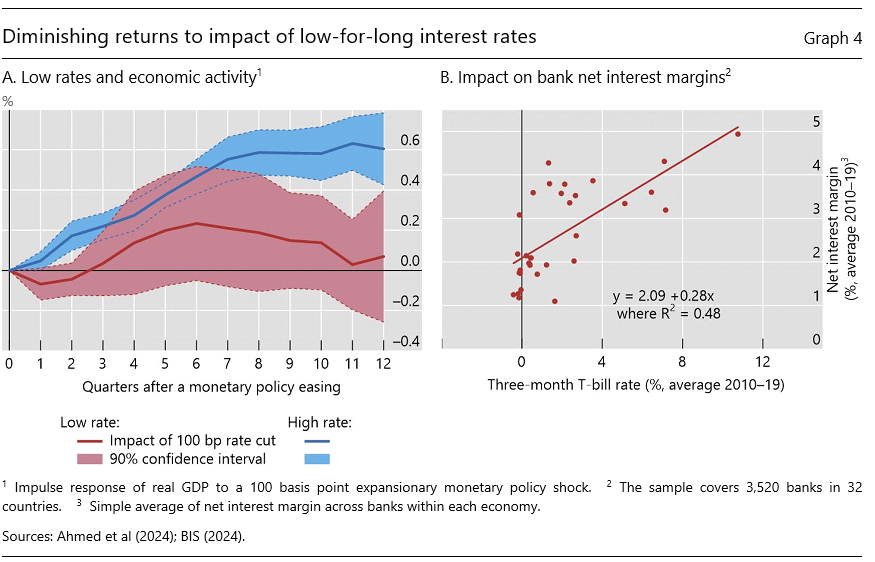

First, the impact of policy easing on aggregate demand may exhibit diminishing returns after a certain point. After all, monetary policy ultimately operates by bringing demand forward from the future to the present. And there are surely limits to that process. Intuitively, it is difficult to see how, once interest rates are close to zero, additional basis points could make that much difference. Moreover, we know that rates that remain very low for long can also sap the profitability of banks10 and hence their credit-granting capacity. Casual observation aside, there is indeed empirical evidence supporting these claims (Graph 4).11

Second, inflation may respond less to aggregate demand pressures when it settles at a low level. One possible explanation, specific to the post-GFC episode, is the continued impact of the positive supply forces that had operated pre-GFC: the globalisation tailwinds were perceived as headwinds once central banks sought to boost inflation rather than keep it down. A more general explanation has to do with the inherent properties of inflation in a low-inflation regime.12 Let me dwell on this point for a minute, since it has broader implications.

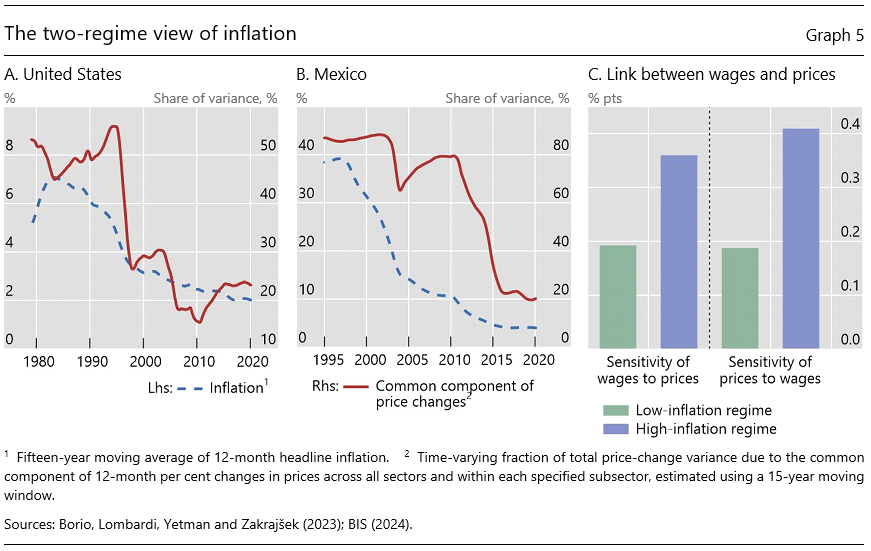

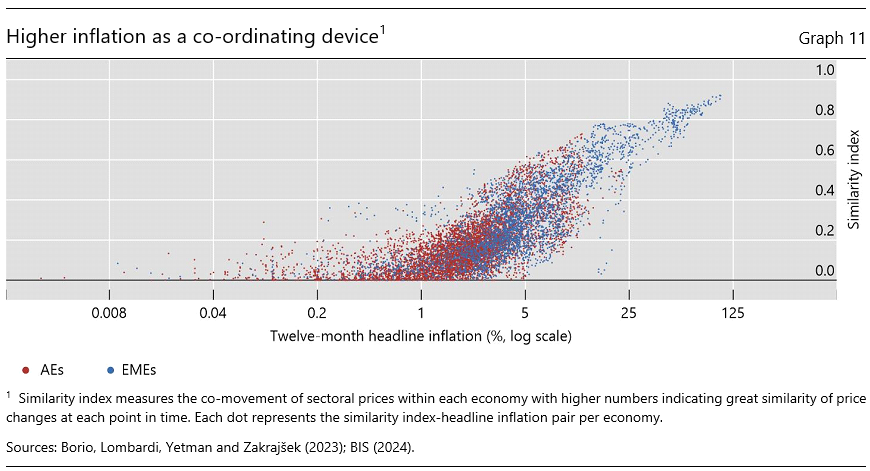

Recent work with colleagues has confirmed that inflation behaves very differently in low- and high-inflation regimes (Graph 5). In a low-inflation regime, what we measure as inflation is in fact the result of largely idiosyncratic or sector-specific price changes that leave little imprint on inflation itself. Put differently, the “common component” of price changes is small. In addition, wages and prices are only loosely linked. By contrast, in a high-inflation regime, no such self-stabilising properties are at work. The common component is higher, and wages and prices are more tightly linked. As a result, shocks to sector-specific prices get embedded in inflation more easily.

In turn, the self-stabilising properties of inflation in a low-inflation regime likely reflect two mutually reinforcing factors. One, well appreciated, is the credibility of monetary policy: economic agents’ confidence that inflation will not get out of control.13 Another one, more general and often not stressed enough, is that when inflation is sufficiently low it does not materially influence people’s behaviour. Economic agents become rationally inattentive to it. I will return to this point later.

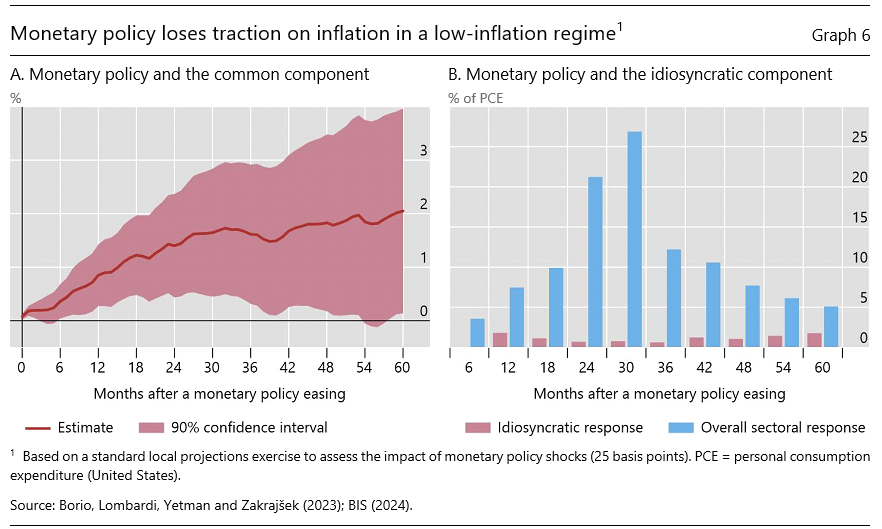

Now, critically, what a small common component of price changes does is weaken the response of inflation to adjustments in the policy stance. After all, intuitively, changes in the stance work precisely through that component, which is more closely tied to aggregate demand and exchange rates.

The evidence confirms this intuition (Graph 6). The impact of policy is much larger on the common component. In addition, in a low-inflation regime, changes in the stance operate through a remarkably narrow set of prices, largely in the more cyclically sensitive services sectors (blue bars).

To recap. The reaction function central banks followed in IT regimes may have contributed to the progressive loss of room for policy manoeuvre that preceded the Covid-19 crisis. At each point in time, what central banks took as an exogenous interest rate was to some extent the result of their own past actions.

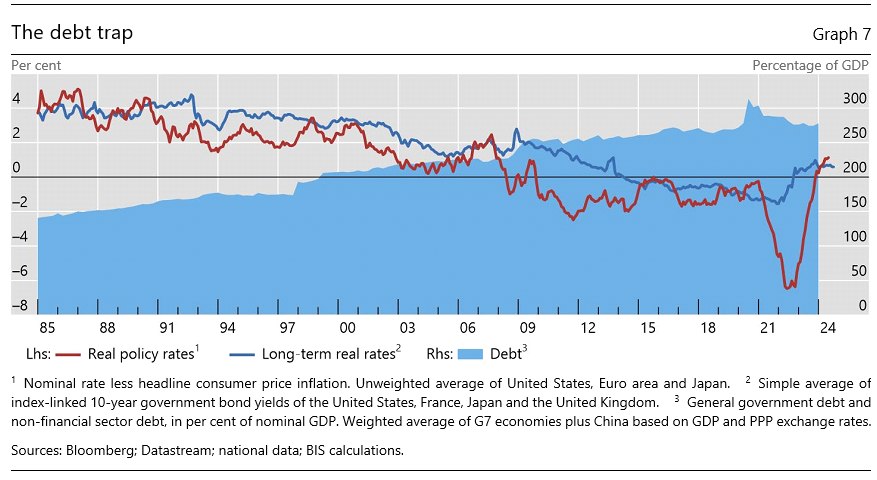

This also raised the ultimate risk of a “debt trap” (Graph 7).14 Lower rates could, over time, encourage further indebtedness, which would in turn make it harder to raise rates without causing damage to the economy.

Indeed, that risk is higher once we also consider the public sector. To a degree, private sector indebtedness waxes and wanes with the financial cycle, as busts induce protracted deleveraging. But the public sector is less subject to such restraint. Fiscal positions ease during downturns but do not consolidate during upturns to the same degree.15 It is no coincidence that, even pre-Covid, government debt-to-GDP ratios had reached historical peaks across the world, in line with World War II levels. The belief that interest rates would remain low as far as the eye could see no doubt played a significant role.16

It took a huge exogenous shock to jolt the system away from its path, at least temporarily. To be sure, at first the Covid-19 crisis required central banks and governments to further consume the room for manoeuvre they had left. But then the unexpected inflation flare-up called for a forceful monetary policy tightening. Central banks regained the room for manoeuvre they had long coveted, but at the expense of governments, whose fiscal positions deteriorated further.17

Now the key question is: where will interest rates settle as inflation is brought back under control? If the analysis is correct, this will partly depend on any further evolution of IT frameworks.

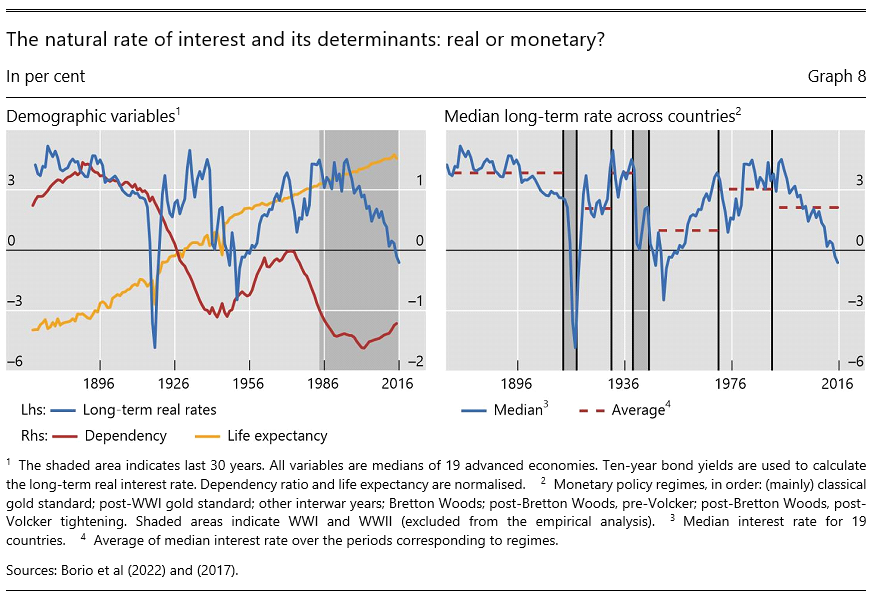

At this point, I am sure you are asking yourselves: what about the body of evidence suggesting that r-star is determined by fundamental slow-moving forces such as productivity growth, demographics, income distribution and the like?

My answer is threefold.

First, the previous analysis suggests that monetary policy can have a very persistent impact on real interest rates through its effect on the financial system. For all intents and purposes, this is indistinguishable from an impact on r-star.

Second, as analysed in detail elsewhere and already covered in a previous OMFIF lecture,18 the empirical evidence is not as strong as normally believed. When the data are allowed to speak, there is no evidence of a systematic link between the “usual suspects” and real interest rates over long horizons beyond the standard period – since the mid-1980s or so (Graph 8). This suggests that the observed link may in part reflect spurious trending relationships. In fact, if the sample is extended back to the 1870s, a robust relationship emerges with monetary policy regimes across time and countries (Graph 8).

Finally, this suggests to me that the link between the real interest rate and output at potential and stable inflation is not that tight. Too many other factors come into play, including broader aspects of financial conditions and the role of nominal interest rates themselves. I would hypothesise that a range of real policy rates can be broadly consistent with such outcomes, even over extended periods – the link is more like a thick correspondence than a function. This may indeed be a reason why estimates of r-star that rely on that link have such large confidence bands. It is not so much that a precise relationship is measured imprecisely, but that the relationship itself is imprecise.

If this analysis is correct, what does it suggest for possible adjustments to current IT frameworks?19 Any such adjustments would need to take into account a number of considerations.20

First, the framework needs to be robust to alternative possible economic environments. The policy regimes shaping the landscape evolve and interact in unexpected ways. When I look at recent adjustments, I have the sense that they may have been unduly influenced by a specific set of economic conditions.

Arguably, in the years to come the world could be structurally more inflationary.21 If deglobalisation takes hold, labour and capital could regain pricing power. Geopolitics, the green transition and demographic trends could generate more persistent headwinds. And high levels of public and (likely) private debt may provide incentives to inflate debt away.

At the same time, we cannot rule out that the key features of the pre-Covid environment will persist. For instance, inflation is returning to pre-Covid rates quite quickly. And wage pressures have so far been remarkably subdued, despite the surprise inflation-induced erosion of purchasing power.

Second, the importance of long policy horizons cannot be stressed enough. This was already prominent in the context of ensuring price stability. Central banks should not yield to the temptation to boost output in the near term at the cost of entrenching inflation in the longer term – what economists call “time inconsistency”.

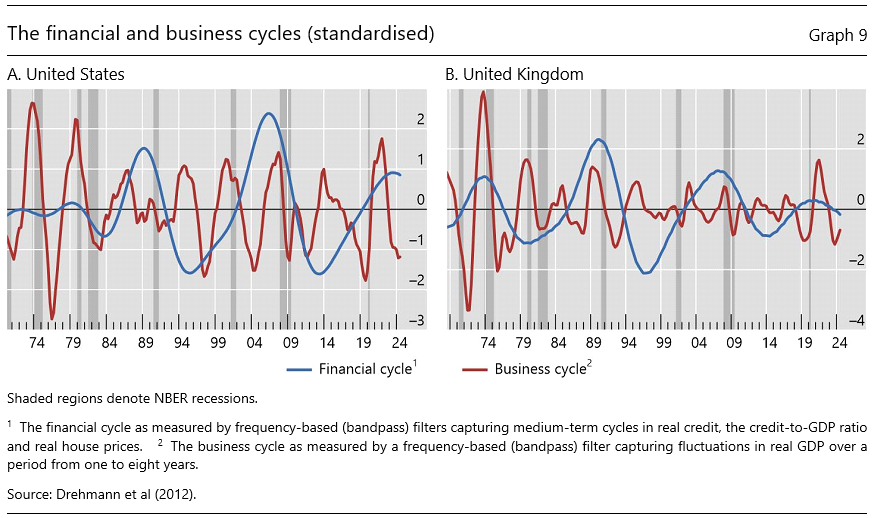

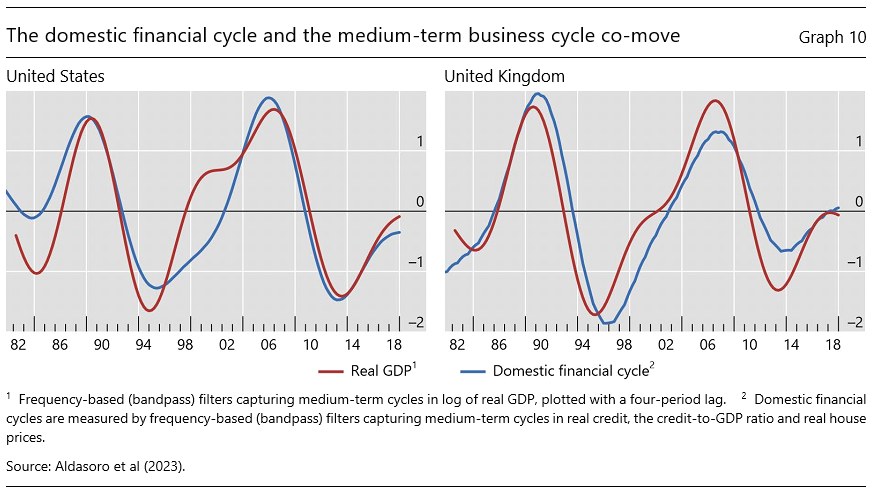

And the financial cycle raises a form of time inconsistency that may be more insidious than the one with which we have become so familiar in the context of inflation.22 The reason is that the financial cycle is much longer than how the business cycle is traditionally measured, by some estimates almost twice as long (Graph 9), exacerbating the problem. It is as if its emergence had slowed down economic time relative to calendar time: the economic forces that matter most take longer to play out. Indeed, applying statistical filters like those used to measure the financial cycle reveals a medium-term business cycle that moves remarkably in sync (Graph 10).

Third, there is a need to systematically incorporate the importance of safety margins (or buffers) in the conduct of policy. Economies that operate without safety margins are vulnerable to both the inevitable next recession and unexpected exogenous shocks, such as Covid. In all walks of life, the need to retain safety margins is an explicit guide to action. Why should it be different in monetary policy? If something is valuable, it should be worth paying a price for.

Finally, it is essential to have a realistic view of what monetary policy can and cannot deliver. As long as it is prepared to pay the price, monetary policy can prevent inflation from becoming entrenched. As long as it has fiscal backing, monetary policy can stabilise the financial system at times of stress even when solvency concerns mount. The central bank plays its traditional role of lender or, increasingly, market maker of last resort. And as long as prudential policy is supportive, monetary policy can help restrain financial imbalances and contain their damage.23

But monetary policy cannot fine-tune inflation within basis points, let alone economic activity within narrow ranges. Nor can it be relied on as a de facto engine of growth.24 When I see the media and financial industry’s razzmatazz surrounding policy decisions, I worry that we have long lost that sense of realism.

I see a dangerous and growing expectations gap between what monetary policy can deliver and what it is expected to deliver. This complicates the conduct of policy and decision-making. And, ultimately, it could even undermine the central bank’s independence and legitimacy.

These broad considerations have implications for objectives and the strategies to pursue them.

First, hardwiring a low-inflation regime should remain a priority. Here, I very much like the behavioural definition of price stability suggested by Volcker and Greenspan – a condition in which inflation does not materially influence people’s behaviour.25 Put differently, the ultimate objective should be not so much anchoring inflation expectations but making them irrelevant.

This also means that raising current targets, as several observers have proposed, would be a bad idea. Quite apart from undermining the central bank’s credibility, this would endanger that condition and hence also the self-stabilising properties that inflation has in a low-inflation regime. Inflation would risk drifting out of the region of rational inattention into that of sharp focus. And it could then act as a more effective coordinating device for people’s behaviour. As the common factor behind price changes increases and these become more similar, the inflation rate becomes more representative of the price changes individual agents care about (Graph 11). Critically, this is one reason why transitions from low- to high-inflation regimes tend to be self-reinforcing.

Second, relative to how the targets have been generally interpreted in the past, the key adjustment would be greater tolerance for moderate, even if persistent, shortfalls of inflation from narrowly defined targets. This would help retain precious room for manoeuvre, exploiting the self-stabilising properties of inflation in low-inflation regimes. And it would allow the central bank to take into account more systematically the longer-term damage that arises from the consequences of low interest rates, which weaken the financial side of the economy.

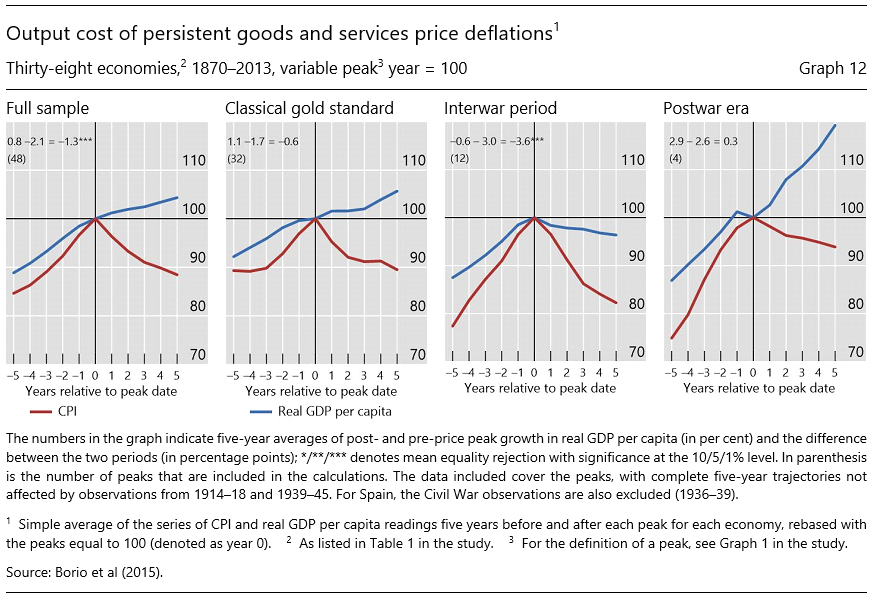

Implementing such a strategy would also require addressing what Feldstein and Rajan26 have aptly termed the “deflation bogey man”. This is the view that deflation is a kind of red line that, once crossed, gives rise to a self-reinforcing downward spiral in economic activity or to a depression trap. Empirically, the evidence is not consistent with this view. There is no systematic link between falling price levels and weak economic activity (Graph 12).27 The Great Depression is very much an exception and reflected a broader set of forces. Conceptually, it is not clear why the link should exist if gradually falling prices reflect favourable supply factors and if productivity growth avoids the need for reductions in possibly rigid nominal wages.28

Third, further thought should be given to how best to use the additional room for manoeuvre to tackle the financial cycle. Here, I don’t have specific answers but just a direction of travel. This would call for lengthening horizons as far as possible. It would require upgrading the role of financial conditions, credit aggregates and property prices among the set of indicators that central banks follow.29 And, analytically, it would call for less reliance on macroeconomic models based on the standard “shock-propagation-return-to-steady-state” paradigm and more on approaches that allow for endogenous and possibly unstable fluctuations.30

Making such adjustments would help address what might be called the “unfinished recessions” risk.31 An outsize response to market jitters or drops in equity prices may provide further fuel to property prices and set up trouble further down the road. Arguably, this is what happened following the 1987 stock market crash and the burst of the dot.com bubble in the early 2000s. Equity prices are more closely aligned with the traditional business cycle than the financial cycle, where property prices play a key role. It may also give financial markets the impression that the central bank is providing a “put” and lull them into a false sense of security.

Finally, a couple of further adjustments can enhance the effectiveness of the framework, contributing to its nimbleness and the retention of safety margins.

One is less reliance on forms of forward guidance that provide specific information about the future path of interest rates beyond the central bank’s reaction function. These can unduly constrain the central bank’s ability to respond to rapidly changing conditions. And they can also unduly compress risk premia and encourage risk-taking. Think, for instance, of the “measured pace of rate increases” ahead of the GFC.32 In the extreme, rather than guiding markets, the central bank may end up being taken down the wrong path, as the emergence of fragilities in the financial system can force its hand.

Another adjustment is putting a premium on exit strategies whenever the central bank is called upon to take exceptional measures to stabilise the system and the economy. The difficulties in reducing the historically large and risky central bank balance sheets are testimony to the challenges involved.

A reasonable principle is that central bank balance sheets should be as small and riskless as possible, subject to fulfilling mandates effectively. As argued elsewhere recently, except possibly for the need to hold foreign exchange reserves for precautionary purposes, balance sheets can be quite small.33

Central bank balance sheets should be elastic – ready to increase when circumstances require it – not large. Given the economic and political economy costs of larger balance sheets, the initial size is a hindrance, not a plus.

These various considerations help draw the picture of the regime that I have in mind.

It is a regime in which the central bank keeps a sharp focus on the medium term. The central bank seeks to ensure that the financial side of the economy, which it influences and through which it operates,34 does not end up derailing the economy, whether through inflation or financial instability, broadly defined.35 That is, the central bank sets the monetary preconditions for sustainable growth but does not end up being relied on as the engine of growth.

It is a regime in which the operational definition of the inflation target is consistent with that overarching objective. This means the target is low enough so that inflation does not materially influence agents’ behaviour, but flexible enough to allow the central bank to take into account the financial forces that can generate damage down the road.

It is a regime in which the central bank’s reaction function calls for forceful responses when inflation threatens to get out of control but allows for greater tolerance for moderate, even if persistent, shortfalls from target.

Does this have implications for mandates? Not so much if by mandate we mean the general goals that may be set out in the central bank’s law or in agreements with the government. We have seen IT regimes being operated in broadly similar ways despite different mandates. But it does have implications for the way in which mandates are interpreted and, above all, communicated. The word often missing here is “sustainable”. Once sustainability is added as an explicit consideration, whether in terms of inflation, output, employment or financial stability, all the pieces of the jigsaw puzzle fall into place. The lens though which we see the economy is more important than the ultimate goal, on which there is greater consensus.

Let me conclude with a couple of broader reflections.

Looking ahead, I worry that the toughest challenges for monetary policy regimes are still to come. For one, the political environment is becoming less conducive to a stability-oriented monetary policy. The pressure on central banks to take a short-term view is growing alongside the demands placed on them. In such an environment, institutional safeguards such as central bank independence become all the more precious – the option is “in the money”. But they can help only up to a point.36

In this context, we should not take too much comfort from the recent rather painless reduction in inflation compared with the past. Circumstances have been extraordinary. The typical future fight against inflation is likely to follow more familiar patterns and cause bigger costs. This would be especially the case if it took place in a less globalised world: firms and workers would regain pricing power and would make it easier to resist a drop in purchasing power and profit margins.

In addition, and closely related, the unsustainability of fiscal trajectories represents another major threat. As discussed in detail in the BIS Annual Economic Report in 2023, it is probably the biggest longer-term threat to macroeconomic and financial stability in the years ahead – and hence, ultimately, a threat to the monetary policy regime itself. Monetary and fiscal policy are joined at the hip.37 And there are clear limits to what monetary policy can ultimately do if fiscal policy is out of kilter. Both policies need to operate firmly with a “region of stability”,38 consistent with sustainable growth.

These threats are also likely to make the adjustments I propose even…less likely. But IT regimes cannot afford to stay still. IT does not represent the end of monetary policy history, as it were. It is just one, if exceptionally long, chapter in that history. It is up to all of us to help write the next few pages.

Ahmed, R, C Borio, P Disyatat and B Hofmann (2024): “Losing traction? The real effects of monetary policy when interest rates are low”, Journal of International Money and Finance, vol 141, March. Also available as BIS Working Papers, no 983, November 2021.

Aldasoro, I, S Avdjiev, C Borio and P Disyatat (2023): “Global and domestic financial cycles: variations on a theme”, International Journal of Central Banking, vol 19, no 5, pp 49–98. Also available as BIS Working Papers, no 864, May 2020.

Bank for International Settlements (BIS) (2019): “Monetary policy frameworks in EMEs: inflation targeting, the exchange rate and financial stability”, Annual Economic Report 2019, June, chapter II, pp 31–53.

——— (2022): “Inflation: a look under the hood”, Annual Economic Report 2022, June, chapter II, pp 41–73.

——— (2023): “Monetary and fiscal policy: safeguarding stability and trust”, Annual Economic Report 2023, June, chapter II, pp 83–41.

——— (2024): “Monetary policy in the 21st century: lessons learned and challenges ahead”, Annual Economic Report 2024, June, chapter II, pp 41–89.

Borio, C (2003): “Towards a macroprudential framework for financial supervision and regulation?”, CESifo Economic Studies, vol 49, no 2, pp 181–215. Also available as BIS Working Papers, no 128, February.

——— (2004): Wrap-up panel remarks on “The future of inflation targeting”, Reserve Bank of Australia Annual Conference, 9–10 August, Sydney.

——— (2006): “Monetary and prudential policies at a crossroads? New challenges in the new century”, Moneda y Crédito, vol 224, pp 63–104. Also available as BIS Working Papers, no 216, September.

——— (2014a): “The financial cycle and macroeconomics: what have we learnt?”, Journal of Banking & Finance, vol 45, August, pp 182–98. Also available as BIS Working Papers, no 395, December 2012.

——— (2014b): “The international monetary and financial system: its Achilles heel and what to do about it”, BIS Working Papers, no 456, August.

——— (2017): “Through the looking glass”, OMFIF City Lecture, London, 22 September.

——— (2019): “Central banks in challenging times”, SUERF Annual Lecture, Milan, 8 November; reprinted as SUERF Policy Notes, no 114, November. Also available as BIS Working Papers, no 829, December.

——— (2021a): “Navigating by r*: safe or hazardous?”, keynote address reprinted as SUERF Policy Note, no 255, September. Also available as BIS Working Papers, no 982, November.

——— (2021b): “Back to the future: intellectual challenges for monetary policy”, Finch Lecture, University of Melbourne, 2 September; reprinted in Economic Papers, vol 40, no 4, pp 273–87. Also available as BIS Working Papers, no 981, November.

——— (2023): “Getting up from the floor“, BIS Working Papers, no 1100, May.

Borio, C and P Disyatat (2010): “Unconventional monetary policies: an appraisal”, The Manchester School, vol 78, no s1, pp 53–89. Also available as BIS Working Papers, no 292, November 2009.

——— (2011): “Global imbalances and the financial crisis: link or no link?”, BIS Working Papers, no 346, May.

——— (2014): “Low interest rates and secular stagnation: is debt a missing link?”, VoxEU, June.

——— (2021): “Monetary and fiscal policy: privileged powers, entwined responsibilities”, SUERF Policy Note, no 238, May.

Borio, C, P Disyatat, M Juselius and P Rungcharoenkitkul (2022): “Why so low for so long? A long-term view of real interest rates”, International Journal of Central Banking, vol 18, no 3, pp 47–87. Longer version available as BIS Working Papers, no 685, December 2017.

Borio, C, M Drehmann and D Xia (2020): “Forecasting recessions: the importance of the financial cycle”, Journal of Macroeconomics, vol 66, December. Also available in extended form as “Predicting recessions: financial cycle versus term spread”, BIS Working Papers, no 818, October 2019.

Borio, C, M Erdem, A Filardo and B Hofmann (2015): “The costs of deflations: a historical perspective”, BIS Quarterly Review, March, pp 31–54.

Borio, C, M Farag and F Zampolli (2023): “Tackling the fiscal policy-financial stability nexus”, BIS Working Papers, no 1090, April.

Borio, C and A Filardo (2007): “Globalisation and inflation: new cross-country evidence on the global determinants of domestic inflation”, BIS Working Papers, no 227, May.

Borio, C, C Furfine and P Lowe (2001): “Procyclicality of the financial system and financial stability: issues and policy options”, BIS Papers, no 1, March.

Borio, C, L Gambacorta and B Hofmann (2017): ”The influence of monetary policy on bank profitability”, International Finance, vol 20, no 1, pp 48–63. Also available as BIS Working Papers, no 514, October 2015.

Borio, C, M Lombardi, J Yetman and E Zakrajšek (2023): “The two-regime view of inflation”, BIS Papers, no 133, March.

Borio, C and P Lowe (2002): “Asset prices, financial and monetary stability: exploring the nexus”, BIS Working Papers, no 114, July.

Borio, C, I Shim and H S Shin (2023): “Macro-financial stability frameworks: experience and challenges”, in C Borio, E Robinson and H S Shin (eds), Macro-financial stability policy in a globalised world: lessons from international experience, World Scientific Publishing. Also available as BIS Working Papers, no 1057, December 2022.

Borio, C and W White (2004): “Whither monetary and financial stability? The implications of evolving policy regimes”, in Monetary policy and uncertainty: Adapting to a changing economy, proceedings of the Jackson Hole Symposium, Federal Reserve Bank of Kansas City, 28–30 August. Also available as BIS Working Papers, no 147, February.

Borio, C and H Zhu (2012): “Capital regulation, risk-taking and monetary policy: a missing link in the transmission mechanism?”, Journal of Financial Stability, vol 8, no 4, pp 236–51. Also available as BIS Working Papers, no 268, December 2008.

Crockett, A (2000): “Marrying the micro- and macroprudential dimensions of financial stability”, remarks at the Financial Stability Forum, before the Eleventh International Conference of Banking Supervisors, Basel, 21 September.

Drehmann, M, C Borio and K Tsatsaronis (2012): “Characterising the financial cycle: don’t lose sight of the medium term!”, BIS Working Papers, no 380, June.

Feldstein, M (2015): “The deflation bogeyman” Project Syndicate, 28 February.

Friedman, M and A Schwartz (1963): A monetary history of the United States, 1867–1960, Princeton University Press.

Greenspan, A (1994): Testimony before the Subcommittee on Economic Growth and Credit Formation of the Committee on Banking, Finance and Urban Affairs, US House of Representatives, 22 February.

Juselius, M C Borio, P Disyatat and M Drehmann (2017): “Monetary policy, the financial cycle and ultra-low interest rates”, International Journal of Central Banking, vol 13, no 3, pp 55–89. Also available as BIS Working Papers, no 569, July 2016.

Leijonhufvud, A (2009): “Stabilities and instabilities in the macroeconomy”, VoxEU, 21 November.

Maechler, A (2024): “Monetary policy in an era of supply headwinds – do the old principles still stand?”, speech at the London School of Economics, London, 2 October.

Padoa-Schioppa, T and F Saccomanni (1994): “Managing a market-led global financial system”, in P Kenen (ed), Managing the world economy: fifty years after Bretton Woods, PIIE Press, pp 235–68.

Rajan, R (2015): Panel remarks at the IMF conference on “Rethinking Macro Policy III”, Washington, DC, 15–16 April.

Rey, H (2015): “Dilemma not trilemma: the global financial cycle and monetary policy independence”, NBER Working Papers, no 21162, May.

Volcker, P (1983): “We can survive prosperity“, remarks at the Joint Meeting of the American Economic Association and American Finance Association, San Francisco, 28 December.

White, W (2006): “Is price stability enough?”, BIS Working Papers, no 205, April.

For similar reasons, given the nature of the presentation, the references in the bibliography are almost exclusively to those contributions. Those pieces of work include a broader set of references to the literature.

For an early discussion and categorisation of what can be termed “balance sheet policies”, see Borio and Disyatat (2009).

This peculiarity is also reflected in the nature of the recent IT framework reviews, which have largely focused on how to define operationally the target itself rather than on the strategies to achieve it.

For an elaboration of these points, see Borio (2004) and (2006). One way of putting it is that the monetary regime exhibited an “excessive elasticity” due to the lack of sufficiently solid anchors, also on the financial side, especially in the face of favourable supply-side developments; see Borio and Lowe (2002). For an analysis of the same issues, from a more conjunctural perspective as well, see Borio and White (2004). See also White (2006).

For a discussion of the concept and measurement of the financial cycle in the context of the broader literature, see Borio (2014a) and references therein.

See Padoa-Schioppa and Saccomanni (1994).

In addition, by freeing untapped resources, globalisation no doubt greatly improved growth prospects – in jargon, it represented a major outward shift in the world’s production possibility frontier. This likely provided fertile ground for asset price booms. See Borio (2006).

The view that globalisation had helped disinflation was originally quite controversial, although it is more generally accepted these days. For an early study, see Borio and Filardo (2007).

For a detailed elaboration of these points, see Borio (2021a).

For an early analysis of the impact of low rates on profitability, see Borio, Gambacorta and Hofmann (2015).

See Ahmed et al (2024) and references therein.

For a detailed discussion of the two-regime view of inflation, see Borio, Lombardi, Yetman and Zakrajšek (2023) and references therein and BIS (2022).

From the perspective of the performance of the IT regime, this can give rise to a kind of “credibility paradox” (Borio and Lowe (2002)): the credibility of the anti-inflation commitment would be one reason why imbalances did not show up in the form of inflation but in that of unsustainable financial expansions.

See Borio and Disyatat (2014).

Indeed, financial cycles can cause great damage to the fiscal accounts, as they hugely flatter their strength during booms and can cause havoc during busts; see eg Borio, Farag and Zampolli (2023) for an analysis of causes and remedies, including references to previous research with co-authors to develop specific assessment tools and indicators.

It may seem curious that such a situation in which policy rates were at their historical troughs, including negative in nominal terms, and central bank balance sheets and government debt at historical peaks was labelled the “new normal”; “new abnormal” might be a better description.

Since both policies would eventually have to regain policy headroom, it was inevitable that if one gained it, the other would lose it unless growth picked up exogenously. Had fiscal policy consolidated in the pre-inflation surge environment, this would have put further pressure on monetary policy to ease.

See Borio (2021a) and (2017).

The analysis that follows does not address the specificities of emerging market economies, which are more exposed to the vagaries of global financial conditions. For a discussion of these issues, and the operation of the international monetary and financial system more generally, see eg Borio and Disyatat (2011), Borio (2014a), Borio, Shim and Shin (2023) and BIS (2019) and references therein. At the heart of challenges involved is the interaction between the so-called global financial cycle (Rey (2015)) and the (domestic) financial cycles discussed in these remarks; for an elaboration, see Aldasoro et al (2023).

See also BIS (2024).

See also Maechler (2024).

For a further discussion of this issue, see Borio (2014b).

The complementary role of prudential policy – both micro- and macroprudential – is essential here. The adoption of macroprudential frameworks post-GFC has helped alleviate the trade-offs monetary policy faces in this context. For early analyses setting out the contours of the frameworks, see Crockett (2000) and Borio (2003). That said, the adoption has also probably, and somewhat paradoxically, reduced the incentive to adjust IT frameworks.

The same applies to fiscal policy. Both policies can be subject to a “growth illusion”, which can in turn help explain the systematic loss of room for policy manoeuvre over time; see BIS (2023).

See Volcker (1983) and Greenspan (1994).

See Feldstein (2015) and Rajan (2015). See also Friedman and Schwartz (1963).

See Borio et al (2015) and references therein.

Moreover, to the extent that changes in the price level remain within the region of rational inattention, concerns with the systematic and destabilising increase in real interest rates at the zero lower bound would not apply.

For one possible example, see Juselius et al (2017).

On this, see in particular Borio (2021b). There are still two souls often coexisting uneasily in central banks. Those working in the monetary area rely heavily on the “shock-propagation-return-to-steady-state” paradigm, while those in the financial stability area think in terms of the financial cycle and hence endogenous fluctuations. This divide has proved very difficult to overcome so far. At the heart of the endogenous fluctuations is the notion of the procyclicality of the financial system; for an early and systematic analysis, see Borio et al (2001).

See Drehmann et al (2012).

This is just one of the broader set of channels through which monetary policy operates by influencing risk perceptions and attitudes towards risk (Borio and Zhu (2012)). This channel is quite intuitive for market participants – think, for instance, of the impact of persistently low rates – but it had been neglected in the economic literature. It has now become well accepted.

See Borio (2023).

The huge influence of monetary policy on the financial side of the economy cannot be stressed enough. In effect, the central bank sets the “universal price of leverage” in a given currency.

The broad definition of financial instability I have in mind goes beyond banking or financial crises and includes the sizeable financial amplification of business fluctuations.

For a specific take on central bank independence and its link with globalisation, see Borio (2019).

Some of the links are in plain sight; others operate more under the radar. For example, large-scale central bank purchases of long-term government debt amount to a huge debt management operation at the level of the consolidated state sector balance sheet (government plus central bank). They replace long-term debt with “debt” indexed at the overnight rate (bank reserves, ie deposits held at the central bank). While the government debt may look long term and hence insulated from the impact of higher rates, the fiscal position ends up being more sensitive to them – through lower revenues in the form of transfers or remittances from the central bank. See eg Borio and Disyatat (2010) and (2021).

For an elaboration and the corresponding notion of the “corridor of stability”, drawing on Leijonhufvud (2009), see Borio and Disyatat (2021).