The coronavirus crisis and the decline in economic activity led to a steep rise in the need for financing. As a result, net issuance of public and private debt securities in the euro area has increased to unprecedented levels. The main buyers are central banks and banking institutions, and, to a lesser extent, non-euro area residents.

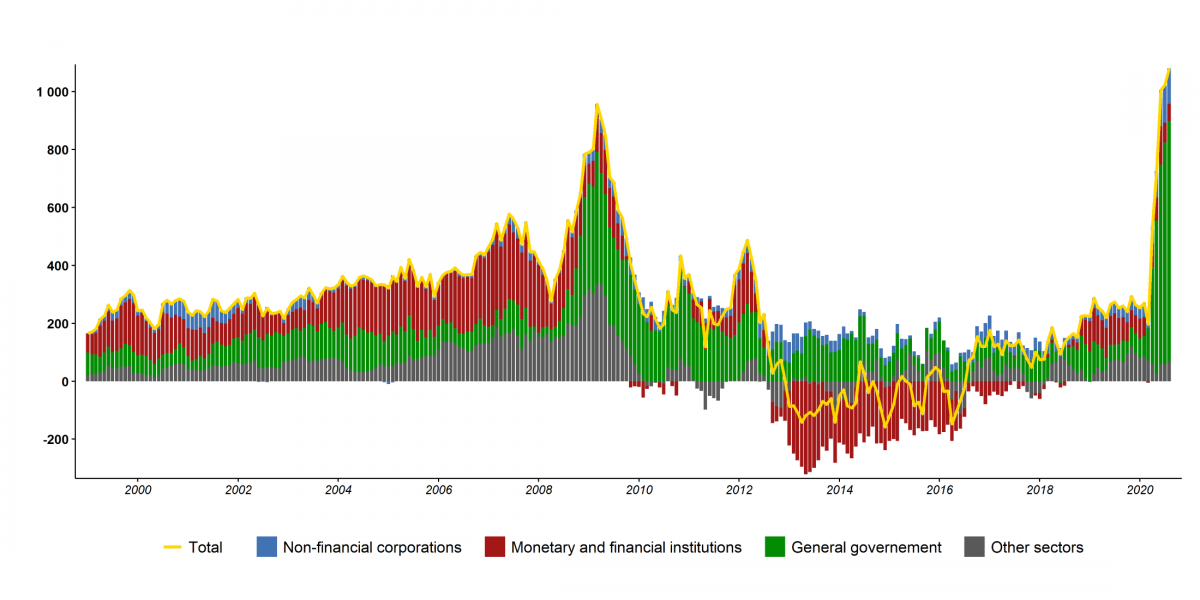

Chart 1: Public and private debt issuance has reached record levels in the euro area

(Seasonally adjusted data, EUR billions)

Source: European Central Bank (author’ s calculations).

Note: Net debt issuance in the euro area, by issuing sector (six-month moving sums).

The public and private financing needs associated with the decline in activity since March 2020 have led not only to a sharp rise in bank credit in the euro area, but also to an intensification of debt issuance. This brief focuses exclusively on debt securities issued in the market, and not on bank credit.

In the euro area, all sectors combined have issued a net total of EUR 1,116 billion of debt securities since the start of the coronavirus crisis (i.e. in the six months from March to August 2020; see Chart 1). Long-term securities, with a maturity greater than one year, made up three quarters of this amount (EUR 821 billion), while short-term securities account for EUR 295 billion. Issuance has increased across all sectors, although with some variations that reflect the specificities of the health crisis.

General government issuance in the euro area has risen to unprecedented levels, reaching a total of EUR 874 billion in the six months from March to August 2020 (equivalent to the total amount of net issuance in the 18 months following the financial crisis, from September 2008 to February 2010). This borrowing activity has been triggered by the need to cover the huge financing gap caused by the historic drop in activity during the lockdown. 78% of total net issuance over the period has been by general government.

Non-financial corporations (NFCs) raised a net EUR 122 billion between March and August 2020, nearly twice as much as the previous record set in the six months after December 2012 (EUR 70 billion). 95% took the form of long-term securities. This probably reflects borrowing by companies to cover their cash needs, as well as precautionary behaviour in the face of the economic and health risks (Bank for International Settlements, 2020).

In the financial sector (banks, insurers, pension and investment funds), debt securities issues has also increased since March 2020, but to a far lesser extent than during the 2008 financial crisis (EUR 107.5 billion in 2020 compared with EUR 409 billion in the six months following the collapse of Lehman Brothers in September 2008). A possible explanation is the large amount of liquidity provided to banks by the Eurosystem as well as the overall better financial conditions of the financial sector in 2020 as compared to 2008.

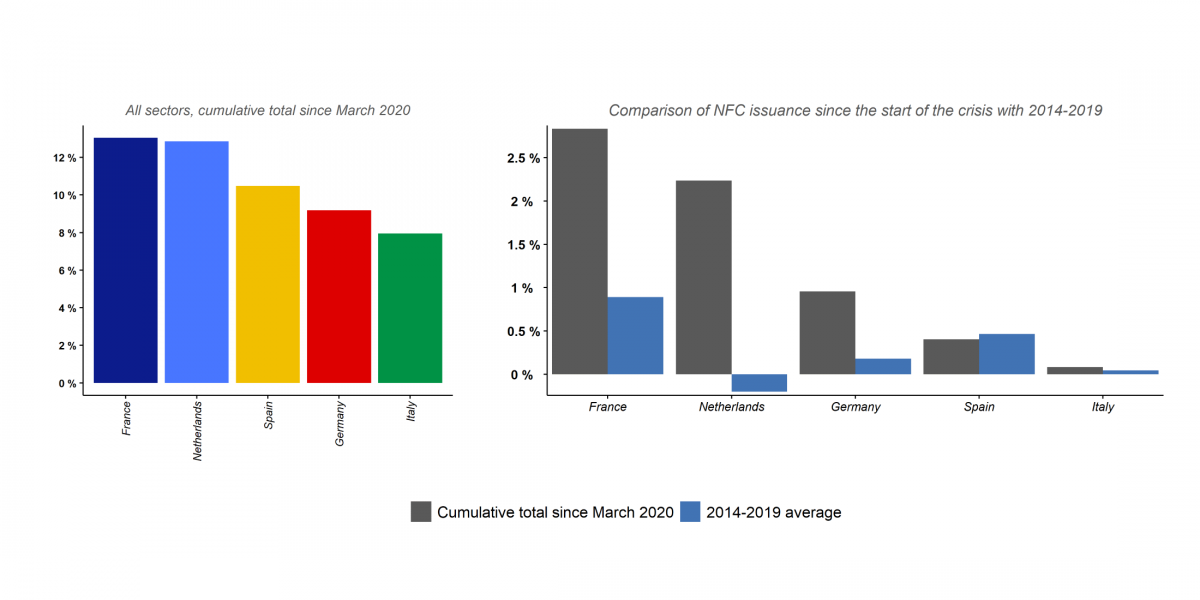

The rise in total net issuance can be observed in all euro area countries (see Chart 2). However, if we take net issuance over the period as a share of GDP, France ranks first in the region with issues equivalent to 13.0% of GDP, while the Netherlands ranks second at 12.9%. France’s high issuance-to-GDP ratio is attributable to short-term general government borrowing, especially by social security funds (38% of euro area short-term public debt issuance between March and August 2020, Banque de France). France also ranks first for outstanding debt securities issued by the NFC sector. French NFCs raised EUR 63 billion (2.8% of GDP) in the debt markets over the period, compared with EUR 17 billion for Dutch NFCs (2.2% of GDP) and EUR 32 billion for German NFCs (0.9% of GDP). This can notably be explained by the structurally higher use of market financing by French and Dutch companies. It should also be noted that, as in the rest of the euro area, but to a greater extent, the sharp rise in French NFC debt has also been accompanied by almost an equivalent rise in their cash holdings (Banque de France).

Chart 2: France has issued more net debt than the rest of the euro area since the start of the crisis

Sources: ECB, IMF.

Note: Net public and private debt issues, as a percentage of national GDP (WEO projections, October 2020). The 2014-2019 average corresponds to the mean of the cumulative net issuance for each period expressed as a share of GDP.

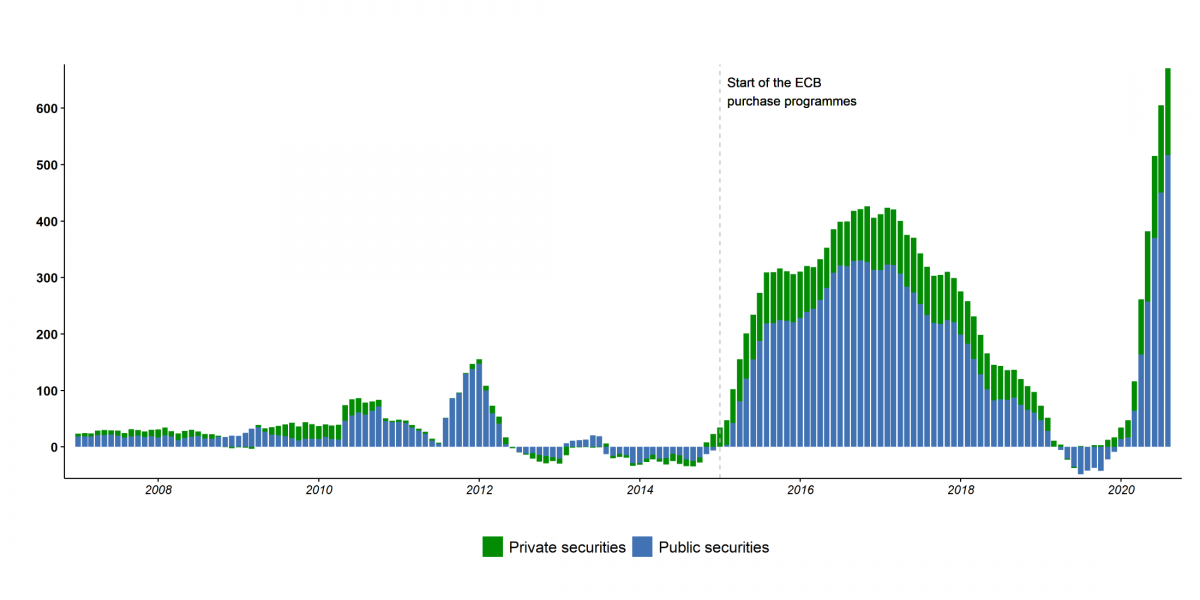

Several sectors increased their holdings of debt securities. First, the Eurosystem played a determinant role in absorbing the supply of euro area debt (Odendahl et al, 2020). Balance sheet data for euro area monetary entities show that the 19 national central banks in the euro area purchased 63.1% of the private debt and 59.2% of the public debt issued in the euro area between March and August 2020. A more detailed analysis shows that the Eurosystem purchased EUR 565.6 billion of debt securities under its PEPP, EUR 157.2 billion under the PSPP and EUR 33.9 billion under the CSPP.

Chart 3: Eurosystem purchases of debt securities since the start of the health crisis

Source: European Central Bank (own calculations).

Note: Net purchases of public and private euro area debt in EUR billions (six-month moving sums).

The other monetary financial institutions in the euro area (MFIs excluding central banks) also increased their holdings of debt securities. Between March and August 2020 they purchased approximately EUR 317 billion of public and private debt, of which EUR 271 billion (85%) were public issues. These securities have notably been used to build up the collateral pools required to subscribe to the TLTRO III operations set up by the ECB in response to the health crisis. If we compare these purchases with total net general government debt issuance in the euro area, MFIs (excluding central banks) absorbed a third of all the securities issued between March and August 2020, after selling a net share of 35% in the same period in 2019. In contrast, the holding rate (outstanding securities owned as a share of total outstanding debt) by euro area MFIs (19%) remains well below the levels in 2009 (25.3%) and 2012 (22.5%). By comparison, the holding rate of private debt securities by euro area insurers is higher (22.3% in Q2 2020), but has not changed significantly since the onset of the health crisis.

In contrast with 2008, non-euro area investors only purchased 10.4% of the public and private debt securities issued in the euro area between March and July 2020 (EUR 115.9 billion in six months). They mainly bought short-term debt securities (EUR 164 billion), in particular French issues, while selling a total of EUR 48.2 billion of securities with a maturity of over one year. By way of comparison, in the six months after the Lehman Brothers collapse in September 2008, non-euro area investors purchased 18.0% of total euro area net debt issues.

The health crisis has led to a sharp rise in the issuance of debt securities in the euro area. This growth can be observed in all countries, with some variations depending on the issuer sector. On the demand side, the Eurosystem and other monetary financial institutions played a predominant role in absorbing the supply of debt.

This article was first published in Banque de France‘s Eco Notepad as blog post n°188.