This brief is based on the paper entitled “Macro uncertainty, unemployment risk, and consumption dynamics“, and it was first published in the International Economic Review on 23 August 2024.

Abstract

Households’ income heterogeneity is important to explain consumption dynamics in response to aggregate macro uncertainty: an increase in uncertainty generates a consumption drop that is stronger for lower-income households. At the same time, labor markets are strongly responsive to macro uncertainty as the unemployment rate and the job separation rate rise, while the job finding rate falls. A heterogeneous agent New Keynesian model with search and matching frictions in the labor market can account for these empirical findings. The mechanism at play is a feedback loop between lower-income households who, being subject to higher unemployment risk, contract consumption more in response to heightened uncertainty, and firms that post fewer vacancies following a drop in demand.

The Great Recession and, more recently, the Covid-19 pandemic and the war in Ukraine, have sparked a wide debate on the impact of macroeconomic uncertainty on the macroeconomy. Close attention has been devoted to study the consequences of uncertainty shocks over the business cycle. While macro uncertainty has been shown to have contractionary effects on aggregate output and its subcomponents, less is known regarding its heterogeneous effects. For instance, heightened uncertainty might have a heterogeneous impact on households, who respond differentially to it.

In Oh and Rogantini Picco (2024), we shed light on the heterogeneous effects of macro uncertainty on households’ consumption dynamics and propose a mechanism underling this heterogeneity. Using U.S. survey data, we uncover two main empirical facts. First, we show that households’ consumption responds differentially along the income distribution. Namely, only income poorer households contract their consumption in a significant way in response to heightened macro uncertainty. Second, we find a strong reaction of aggregate labor market variables to an increase in uncertainty. The unemployment rate and the separation rate rise, while the job finding rate drops. We argue that the reason why poorer households are more responsive to heightened uncertainty is that they are less equipped to face unemployment risk. When uncertainty increases and unemployment risk goes up, poorer households are disproportionally affected. We show that a model with some degree of households’ heterogeneity in insurance against the risk of becoming unemployed when uncertainty increases can account for our empirical findings.

To measure the impact of uncertainty along the income distribution, we use consumption and income household-level data from the Consumer Expenditure Surveys in the US. We run a Bayesian vector autoregression with a recursive identification to study how the consumption of households located in different quintiles of the income distribution responds to macro uncertainty as measured by Jurado et al. (2015)’s index.

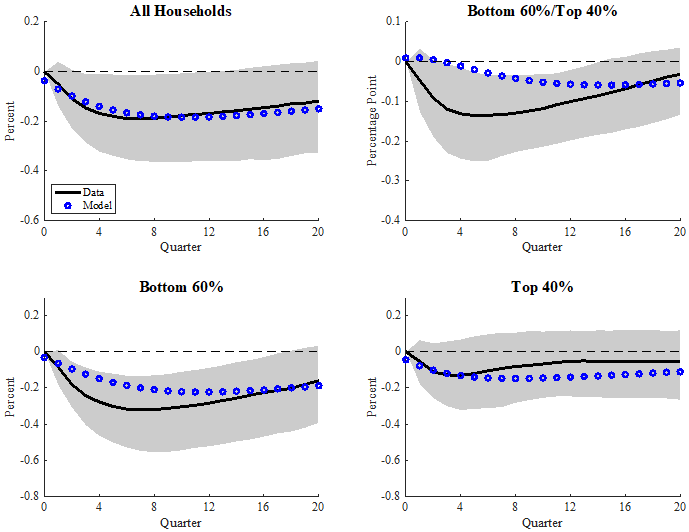

We then study how the consumption of households located in different quintiles of the income distribution responds to macroeconomic uncertainty. As illustrated by the black solid line in (Figure 1), we show that only the consumption of households in the bottom three quintiles contracts in a significant way in response to increased uncertainty.

Figure 1. Empirical and Model-implied Impulse Responses of Consumption across the Income Distribution to One-Standard Deviation Macro Uncertainty Shocks. “Bottom 60%” and “Top 40%” denote the consumption response of households respectively in the lowest 60% and the highest 40% of the income distribution. Dark and light grey areas indicate respectively 68 and 90 percent confidence bands.

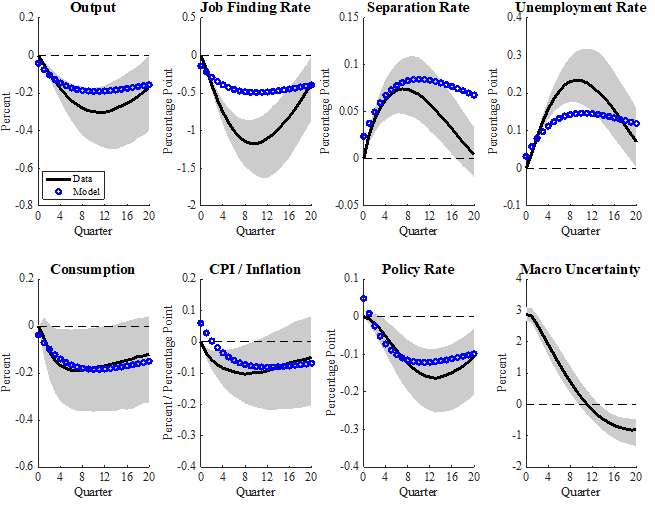

We next argue that the differential response of households is driven by their different exposure to unemployment risk. We provide evidence at aggregate level that a rise in macro uncertainty generates a strong response of labor market variables. (Figure 2) shows that higher uncertainty generates a drop in the job finding rate as well as an increase in the unemployment rate and the separation rate.

Figure 2. Empirical and Model-implied Impulse Responses to One-Standard Deviation Macro Uncertainty Shocks. Dark and light grey areas indicate respectively $68$ and $90$ percent confidence bands.

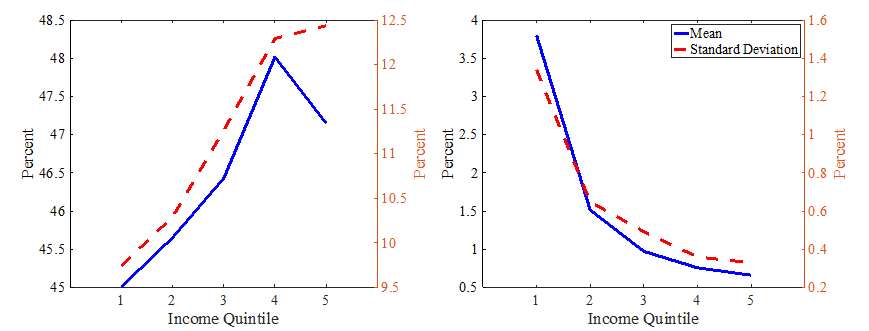

In addition, we use data from the Survey of Income and Program Participation to understand how the job finding and separation rate vary across the households’ income distribution. As illustrated by (Figure 3), while both rates show heterogeneity, the biggest cross-sectional variation appears in the job separation rate, which is five times lower and four times less volatile for households in the top income quintile than for households in the bottom income quintile.

Figure 3. Moments of Job Finding Rate and Job Separation Rate by Income Quintile. Data is from the SIPP over the period 1996-2019. Job finding rate and separation rate by income quintile are computed following Birinci and See (2023).

To rationalize our empirical findings, we build and estimate a New Keynesian model with heterogeneous households and search and matching frictions in the labor market, following Challe et al. (2017)’s framework. Households are heterogeneous in that they are differentially exposed to unemployment risk, but some of them can only partially insure against it as they are borrowing constrained. Within this framework, we study how a positive uncertainty shock propagates throughout the economy.

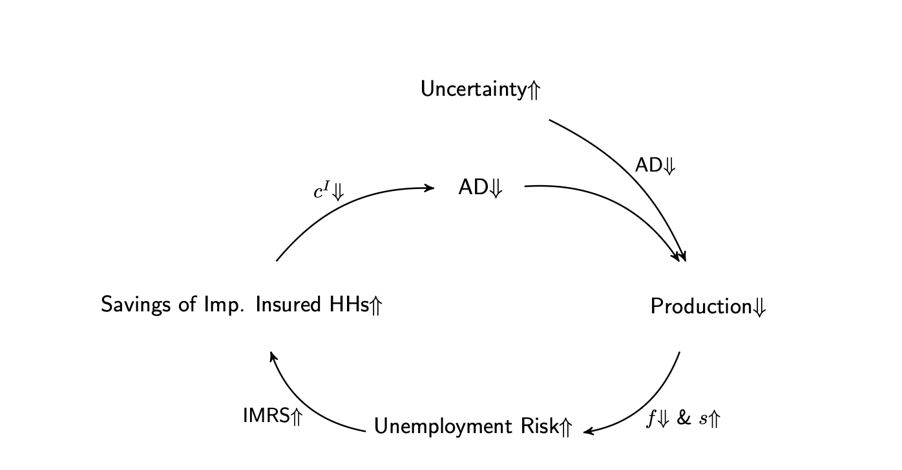

The main channel through which our heterogeneous-agent framework amplifies the propagation of uncertainty shocks is precautionary saving and works as illustrated by (Figure 4). The initial drop in aggregate demand caused by higher uncertainty induces firms to lower vacancy posting. This reduces households’ job finding rate and increases their separation rate, leading to higher unemployment risk. Since some households are borrowing constrained and can only partially insure against unemployment risk, a rise in such risk pushes them to further strengthen their precautionary saving behavior. This feedback effect amplifies the responses of output, consumption, unemployment rate, job finding rate, and separation rate in a way which is consistent with our empirical evidence.

Figure 4. Propagation Mechanism of Positive Uncertainty Shocks.

The differential response of the perfectly and imperfectly insured households in the model can guide the interpretation of our empirical responses in (Figure 1), where we found that only the bottom 60% of households along the income distribution were contracting consumption significantly. We read this result as the consequence of households at the bottom of the distribution being more exposed to unemployment risk than households at the top of the distribution. Households who are perfectly insured against unemployment risk contract consumption only mildly in response to higher uncertainty. To the contrary, households who cannot fully insure against unemployment risk, are much more responsive to heightened uncertainty and contract consumption more. We interpret these households as the model counterpart to the poorer income households in the bottom three quintiles of our empirical analysis. With this interpretation, our model replicates the empirical finding that income poor households contract consumption more in response to heightened uncertainty. This can be seen by comparing the black bold line with the dashed blue line in (Figure 1).

We have argued that households’ income heterogeneity combined with uninsured unemployment risk is an important feature to explain the consumption dynamics in response to higher macro uncertainty that we document in the US data. By estimating a Bayesian VAR with data from the Consumer Expenditure Surveys we have shown that in response to heightened macro uncertainty households in the bottom three quintiles of the income distribution decrease consumption more than those in the top quintile. Moreover, using aggregate data we have provided evidence that an increase in macro uncertainty has significant effects on labor markets, generating a drop in the job finding rate, and a rise in the unemployment and the separation rate. To rationalize these empirical findings, we have built a New Keynesian model with imperfectly insured unemployment risk and search and matching frictions. In response to a positive uncertainty shock, the interaction between the precautionary saving behavior of partially insured households and the labor market search and matching frictions is able to generate responses of output, consumption, unemployment rate, job finding rate, and separation rate that are in line with our empirical evidence. Moreover, we can replicate the empirical result that lower-income households –who correspond to imperfectly insured households in the model– contract consumption in response to higher uncertainty, while higher-income households barely do.

Birinci, S. and K. See, “Labor Market Responses to Unemployment Insurance: The Role of Heterogeneity,” American Economic Journal: Macroeconomics 15 (2023), 388–430.

Challe, E., J. Matheron, X. Ragot and J. F. Rubio-Ramirez, “Precautionary Saving and Aggregate Demand,” Quantitative Economics 8 (2017), 435–478.

Jurado, K., S. C. Ludvigson and S. Ng, “Measuring Uncertainty,” American Economic Review 105 (2015), 1177–1216.

Oh J., and A. Rogantini Picco, “Macro Uncertainty, Unemployment Risk, and Consumption Dynamics”, International Economic Review, forthcoming.