This policy brief is based on Deutsche Bundesbank Discussion Paper No 41/2024 “Who pays the Greenium and why? A decomposition”. The views expressed represent the authors’ personal opinions and do not necessarily reflect the views of the Deutsche Bundesbank or the Euro system.

Abstract

The transition towards a climate-neutral economy is one of the biggest challenges of our times and will require massive investments, both from the public and the private sector. A tentative consensus has emerged that sustainable (clean, green, etc.) assets tend to have higher prices and thus lower expected returns than otherwise equivalent non-sustainable assets, the so-called greenium. In a recent research paper we investigate which investors pay the greenium and why they do so. The average yield differential between a green and a matched conventional bond amounts to minus 3 basis points in our sample. We decompose this greenium along the bonds’ ownership structure and document that investment funds, banks and insurance companies pay most of it. Dissecting further, the greenium paid by investment funds (and their clients) features an average level effect, in line with the popular narrative of non-pecuniary sustainability preferences. The greenium paid by banks cannot be explained by such preferences. Rather banks overweight specific green bonds with a sizeable greenium, pointing towards an interaction between the greenium and bank-related financial frictions.

The transition towards a climate-neutral economy is one of the biggest challenges of our times and will require massive investments, both from the public and the private sector. Hence, it is no coincidence that the market for sustainable investments is growing fast, with an increasing number of investors explicitly seeking to finance green projects. A tentative consensus has emerged that sustainable (clean, green, etc.) assets tend to have higher prices and thus lower expected returns than otherwise equivalent non-sustainable assets (see, e.g., Boermans et al. (2024) for specific evidence on corporate bond markets) This difference in yields or expected returns is often referred to as the “greenium”. In a recent research paper (Fricke and Meinerding, 2024), we take the research about the greenium one step further and address the open question which investors pay the greenium and why they do so.

To this end, we zoom in on one particularly relevant market segment that provides a unique laboratory for this purpose, namely the green bond market. A green bond is characterized by the issuer committing to use its proceeds to finance specific environmental and climate-friendly projects, and this commitment is mostly also verified externally. Focusing on green bonds has the major advantage that we can construct a unique dataset that combines matched green and conventional bond yields from the same issuer (like in Zerbib (2019) or Flammer (2021)) with granular information on the ownership structure of these bonds. For the latter, we draw upon the Eurosystem’s confidential Securities Holdings Statistics (SHS), which has also been used by Pietsch and Salakhova (2022) and Boermans (2023). We exploit the rich cross-sectional and time variation in the both the greenium and the bond ownership in order to better understand who pays for financing the green transition and why?

To address these two research questions, we propose a methodology that fully decomposes the greenium along two dimensions: the ownership structure and the cross-section of green bonds. We proceed in two steps. In the first step, we split the greenium across different investor groups based on their green bond ownership shares, which allows us to answer the question who pays the greenium.

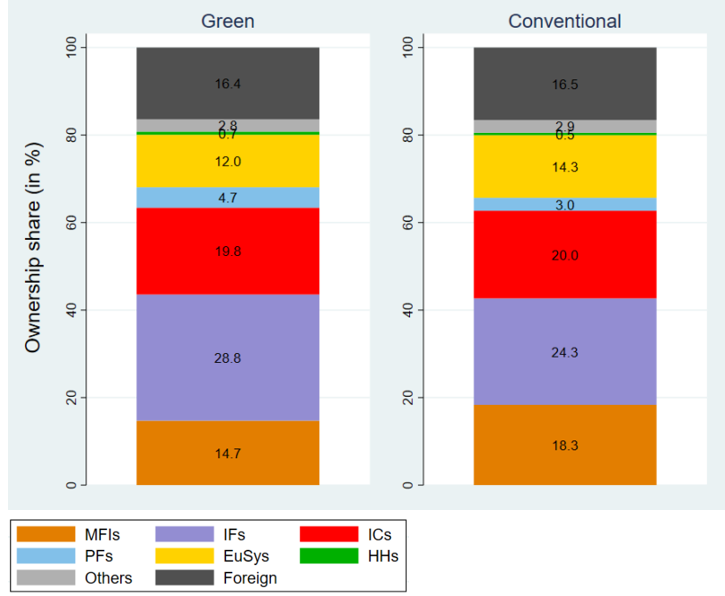

We document a statistically significant average greenium of around minus 3 basis points in our sample. The average green bond investor thus pays a greenium, i.e., forgoes a few basis points in bond yield as compared to an otherwise equivalent conventional investment. Figue 1 depicts the average ownership shares of the different investor groups, aggregated over the entire sample of green and matched conventional bonds. We observe that, in terms of levels, banks (MFIs), investment funds (IFs) and insurance companies (ICs) are the predominant investor groups for green bonds, albeit with striking differences between green and conventional bond holdings, which become relevant in the second step below. From the basic ownership levels, combined with data on the greenium of each individual bond, we conclude that banks, investment funds and insurance companies pay the bulk of the greenium.

Figure 1. Aggregate ownership structure – matched green/conventional bonds

Note: we differentiate between monetary financial institutions (MFIs), investment funds (IFs), insurance companies (ICs), pension funds (PFs), the Eurosystem (EuSys), households (HHs), all other euro area investors (Others), non-euro area investors (Foreign).

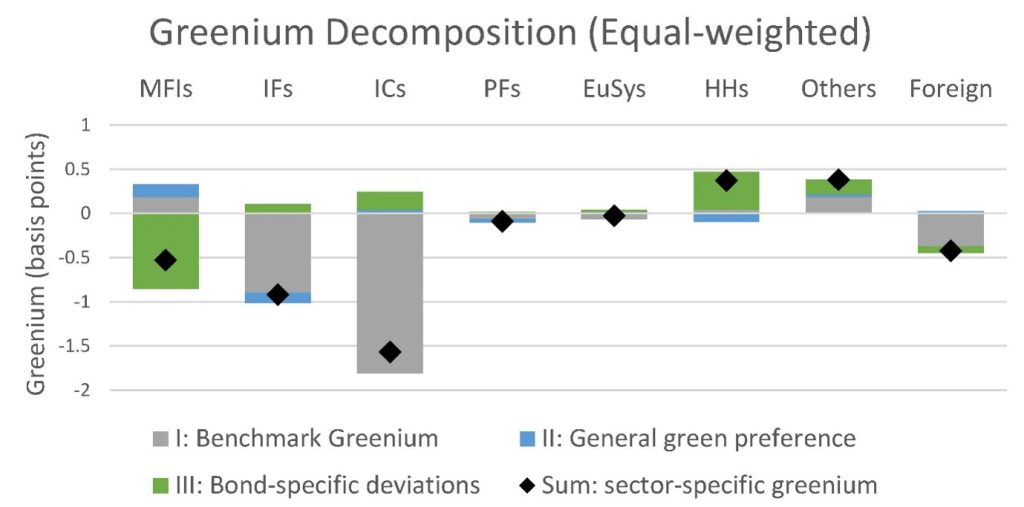

The second step of our analysis addresses the question why the different investor groups do so. To this end, we propose a novel approach to fully decompose the sector-specific greenium into three distinct subcomponents. We label them as (I) the benchmark greenium, (II) the green preference component, and (III) the bond-specific over-/underweighting component. Figure 2 shows the breakdown of the sector-specific greenium into the three components for all investor groups, providing evidence for at least two distinct channels being at play.

The first component (benchmark greenium) is the hypothetical greenium that would be paid/earned if the shares of each investor group in each green bond were exactly identical to the shares in the respective conventional twin. We view this benchmark as representing a simple null hypothesis, quantifying a sector’s greenium that would be observed if the sector treated green and conventional bonds equally and thus simply replicated the ownership shares. From an economic perspective, this component could reflect general preferences for (conventional) bonds from certain issuers.

The second component (green preferences) is the part of the greenium which is paid/earned because an investor group over-/underweights green bonds relative to conventional bonds on average, across the entire green bond market, irrespective of the greenium of an individual bond. We find that the green preference component (II) is statistically and economically significant for investment funds. Specifically, as illustrated in Figure 1, investment funds overweight green bonds relative to conventional bonds on average, across the entire green bond market. Arguably, investment funds closely stick to an investment mandate (as delegated by their clients) and we therefore take our evidence as pointing towards the popular narrative that clients of investment funds have particularly strong non-pecuniary green preferences.

The residual third component reflects the part of the greenium which is paid/earned through over-/underweighting of specific green bonds whose greenium substantially deviates from the average greenium across the entire market. Figure 2 shows that banks pay the greenium largely due to this residual component (III). The greenium paid by banks is thus markedly different from the one for investment funds and insurances. It cannot be explained by green preferences because banks underweight green relative to conventional bonds on average (Figure 1). Instead, the covariance between bond yields and ownership shares indicates that banks display a tilt towards a very specific subset of green bonds with a sizeable greenium. In additional analyses, we find that the covariance term is particularly pronounced for young bonds, small bonds, and bonds issued by the financial sector. We draw the tentative conclusion that banks (and their clients) pay a significant greenium because they hold specific green bonds for motives other than general green preferences. The results point towards an interaction between the greenium and bank-specific financial frictions, for instance along the lines of intermediary asset pricing theory.

Figure 2. Greenium decomposition

Note: we differentiate between monetary financial institutions (MFIs), investment funds (IFs), insurance companies (ICs), pension funds (PFs), the Eurosystem (EuSys), households (HHs), all other euro area investors (Others), non-euro area investors (Foreign).

Taken together, our findings contribute to the ongoing debate about the peculiarities of the market for sustainable investments. We exploit the rich cross-sectional and time-series variation in both the greenium and the securities holdings data in order to better understand who pays for financing the green transition and why. More broadly, we view our results as evidence that supply and demand, and eventually prices and quantities, on the market for sustainable assets are driven by more than investors’ non-pecuniary green preferences. Overall, this constitutes an interesting avenue for future research.

Boermans, M., M. Bun, and Y. van der Straten (2024). Funding the Fittest? How investors respond to climate transition risk in the corporate bond market. SUERF Policy Brief No. 882.

Boermans, M. (2023). Preferred habitat investors in the green bond market. Journal of Cleaner Production 421(1).

Flammer, C. (2021). Corporate green bonds. Journal of Financial Economics 142 (2), 499-516.

Fricke, D., and C. Meinerding (2024), Who pays the greenium and why? A decomposition. Bundesbank Discussion Paper No. 41/2024.

Pietsch, A. and D. Salakhova (2022). Pricing of green bonds – drivers and dynamics of the greenium. SUERF Policy Brief No. 487.

Zerbib, O. (2019). The effect of pro-environmental preferences on bond prices: Evidence from green bonds. Journal of Banking and Finance 98(1), 39-60.