References

Gorodnichenko, Y. (2024) Yuriy Gorodnichenko on Inflation Expectations. In Markus’ Academy. https://www.youtube.com/watch?v=rgzFKV4LFB0.

Kydland, F. and ED. Prescott (1977) Rules rather than discretion. Journal of Political Economy 85, 473-492.

Rudd, J. (2021) Why Do We Think That Inflation Expectations Matter for Inflation? (And Should We?): Federal Reserve Board. Finance and Economics Discussion Series 2021-62.

https://www.federalreserve.gov/econres/feds/files/2021062pap.pdf.

Rudd, J. (2024) Practical Guide to Macroeconomics. Cambridge University Press.

Werning, I. (2024) Speech at the American Economic Association 2024 Winter meeting Lunch Seminar. https://www.aeaweb.org/webcasts/2024/aea-afa-luncheon.

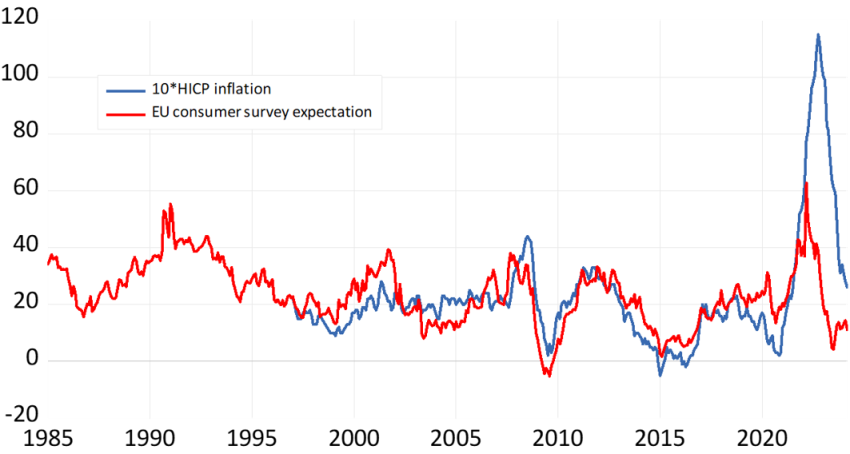

Notes: Inflation denotes HICP inflation in the Euro area and expected inflation the corresponding excess share of respondents in EU commission consumer survey expecting an increase in the price level during the next 12 months.

Notes: Inflation denotes HICP inflation in the Euro area and expected inflation the corresponding excess share of respondents in EU commission consumer survey expecting an increase in the price level during the next 12 months.