In Faryna et al. (2021), we use a standard new Keynesian model to examine the cost of disinflation in a small open economy vis-à-vis a closed economy. In this Policy Brief, we highlight three main results: (1) the welfare benefit of disinflation is lower in the small open economy; (2) the cost of disinflation in terms of the sacrifice ratio and the central bank’s loss is higher in the small open economy; and (3) lack of credibility is more costly in terms of the central bank’s loss in the small open economy.

Studies of the cost of disinflation have a long tradition in monetary economics. Recently, a number of theoretical papers have examined the cost in a closed economy framework by using the new Keynesian model, see Ascari and Ropele (2012a, 2012b, and 2013). In Faryna et al. (2021), we extend the analysis in the papers by Ascari and Ropele to a small open economy. This is of theoretical interest, but it is also of practical interest for policymakers in many small open economies. Over the last 30 years inflation has been decreasing in many emerging market economies – many of which are small open economies – to a level where inflation is only about 2-3 percentage points higher than the typical 2 percent target in developed economies.2 Hence, the cost of further reducing inflation by a few more percentage points is of real interest for many small open economies.

In a disinflation episode, the real exchange rate can play an important role. Consider first a closed economy. When the central bank announces a new and lower inflation target, households and firms revise their inflation expectations downwards towards the new target and inflation starts to fall. In the long-run, the lower inflation target must be accompanied by a lower policy rate in line with the Fisher equation. However, during the transition period the policy rate typically decreases at a slower rate than inflation, which leads to a short-run increase of the real interest rate. This gives households an incentive to substitute current consumption for future consumption. Hence, they also work less and output – being a linear function of hours worked – therefore falls.

In the small open economy, the uncovered interest rate parity condition provides an additional channel through which inflation and other variables can be affected. The initially higher real interest rate leads to a short-run appreciation of the real exchange rate (the foreign real interest rate is held constant). This lowers import prices, which has two main implications. First, it puts downward pressure on CPI inflation. Depending on policy, this can translate into a faster transition of inflation to the new target or it can translate into a lower policy and real interest rate. Second, it gives households an incentive to substitute domestic consumption for imported consumption goods. This will have a negative effect on net exports and domestic output. However, total consumption will steadily increase to a new and higher long-run level, due to cheaper imported goods.

In the standard new Keynesian framework with a Calvo model of staggered price-setting, the lower inflation target leads to less price dispersion in the long-run and as a consequence higher output and consumption. This mechanism increases long-run welfare in both the closed and small open economy.

In the small open economy, there is an additional effect due to a long-run depreciation of the real exchange rate (we assume zero net exports in steady state). The depreciation stimulates production and domestic consumption. However, in terms of welfare, more domestic consumption is outweighed by less leisure and less imported consumption goods from higher import prices.

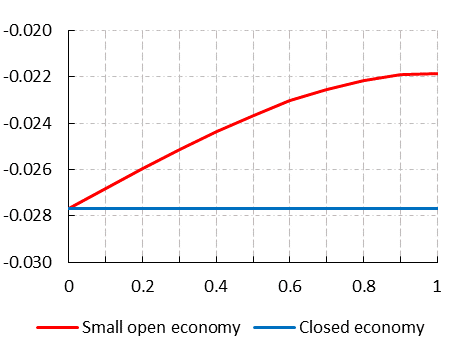

The long-run welfare benefit – which depends on total consumption and leisure – therefore declines as the level of openness increases from no openness to complete openness. Figure 1 shows how the long-run welfare cost (a negative number is a benefit) increases as openness increases. Note that the inflation target is lowered from 5 to 2 percent in this and the other disinflation episodes we present. The interpretation of the welfare cost is the following. If, for example, there is complete openness, a household in the small open economy – compared to a household in the closed economy – would require 0.006 percentage points extra initial steady state consumption each period (per each percentage point of reduced inflation) to be indifferent between living in a 5 per cent inflation target regime and a 2 per cent inflation target regime.

Quantitatively, the long-run (steady state) welfare benefit of disinflation is substantially larger than the short-run (transition) welfare cost in both the small open economy and closed economy, see Faryna et al. (2021) where these numbers are formally provided. The (total) welfare effect of disinflation is therefore in practice fully determined by the long-run benefit of disinflation.

Figure 1. The long-run welfare cost of disinflation in per cent of extra initial steady state consumption for different levels of openness. The openness parameter increases from zero (no openness) to one (complete openness). Note that a negative number indicates a benefit.

A common measure of the cost of disinflation is the sacrifice ratio. It shows the percentage of output the economy has to give up for each percentage point reduction of inflation. A potential problem with this measure is that it does not account for the cost of deviating from the new inflation target. To account for the possible trade-off between inflation and output stabilization, we compute a different measure of the disinflation cost, i.e., the central bank’s loss. We assume a standard central bank loss function with equal weights on the inflation gap (inflation deviations from the inflation target) and the output gap (output deviations from steady state output).

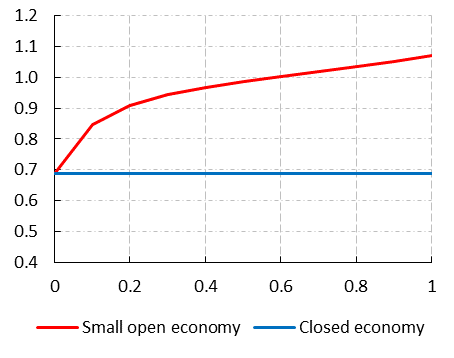

To compute the sacrifice ratio, we assume that monetary policy follows a standard Taylor rule in both economies. As already explained, there is an initial increase of the real interest rate and therefore a short-run loss of output. In the small open economy, there is an additional negative effect on output from the short-run appreciation of the real exchange rate. This makes the sacrifice ratio an increasing and approximately concave function of openness, see Figure 2. Quantitatively, the sacrifice ratio is about 0.4 percentage points higher in the small open economy when openness is complete.

Figure 2. The sacrifice ratio (per cent) as openness increases from no openness to complete openness.

Monetary policy is an important determinant of the cost of disinflation. When we evaluate the cost in terms of the central bank’s loss, we let the central banks choose so-called optimised simple monetary rules. To compute these rules, the reaction coefficients on the inflation gap and the output gap are chosen to minimise the loss function during the disinflation episode. In the small open economy, the central bank can – in addition to the inflation gap and output gap – react to changes in the real exchange gap, i.e., deviations of the real exchange rate from its long-run value. Hence, these rules are designed to perform well during the disinflation episode. From a policymaker’s perspective, optimised rules can be very useful in terms of policy implications since they are easy to understand due to their simplicity and they are easy to compare to the Taylor rule, which is a common benchmark rule.

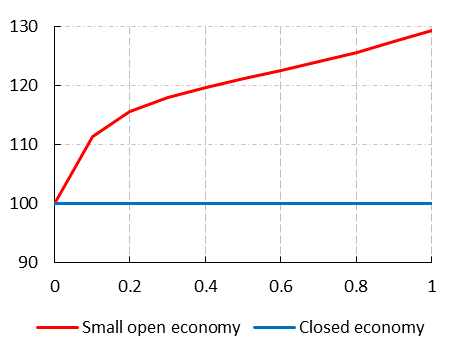

Figure 3 shows the central bank’s loss for different levels of openness, i.e., openness increases from no openness to complete openness. The loss is higher in the small open economy for all levels of openness. Moreover, the loss increases continuously as openness increases. Quantitatively, when openness is complete the loss is about 30 percent higher in the small open economy.3

Figure 3. The central bank’s loss as openness increases from no openness to complete openness. The loss is normalised to 100 for no openness and monetary policy follows optimised simple rules.

Imperfect central bank credibility is generally an important factor for the cost of disinflation. When credibility is imperfect, households and firms revise their expectations of the new inflation target gradually. Over time – as new information becomes available – they put greater weight on the new inflation target. This implies among other things that the central bank’s loss due to deviations from the inflation target can be large.

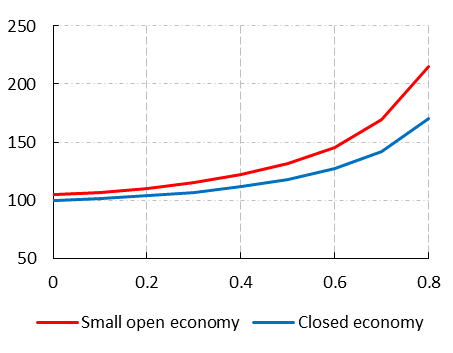

Consider a case where the central banks follow optimised simple rules and the openness parameter in the small open economy is set to 0.4, which is the typical value for many small open economies. Figure 4 shows that the central banks’ loss in both economies is an increasing and convex function of imperfect credibility. Although, the lack of credibility is more costly in the small open economy, e.g., when credibility is low – a value of the credibility parameter of 0.8 – the loss is about 26 per cent higher in the small open economy than in the closed economy. This can be compared to about 5 per cent when credibility is perfect.4

Figure 4. The central bank’s loss as credibility deteriorates from perfect to low credibility (when the credibility parameter on the X-axis equals 0.8). The loss is normalised to 100 for perfect credibility in the closed economy.

Quantitatively, the welfare benefit of disinflation is positive in both the small open economy and the closed economy. Even though this is the case, policymakers can still be reluctant to disinflate for various reasons. It can be due to political pressures or that they look at other measures than welfare. For example, policymakers may look at the sacrifice ratio or the central bank’s loss to evaluate the disinflation cost. From a policymaker’s perspective, the cost from these measures could be perceived as larger, and perhaps also more relevant, than the welfare benefit.

Our results suggest that policymakers in small open economies can be particularly reluctant to disinflate due to three reasons that we have highlighted in this Policy Brief: (1) the welfare benefit of disinflation is lower in the small open economy; (2) the sacrifice ratio and central bank’s loss are higher in the small open economy; and (3) the lack of credibility is relatively more costly in terms of the central bank’s loss in the small open economy. This last factor can be particularly important. If the central bank gives up on disinflation this action can in itself reinforce the lack of credibility and the central bank can be stuck in a “credibility trap”. Staying away from this trap should be especially important for policymakers in small open economies.

Ascari G. and T. Ropele (2012a), “Disinflation in a DSGE perspective: Sacrifice ratio or welfare gain ratio?”, Journal of Economic Dynamics & Control 36 (2), 169–182.

Ascari G. and T. Ropele (2012b), “Sacrifice ratio in a medium-scale new Keynesian model”, Journal of Money, Credit and Banking 44 (3), 457–467.

Ascari G. and T. Ropele (2013), “Disinflation effects in a medium-scale new Keynesian model: Money supply rule versus interest rate rule”, European Economic Review 61, 77–100.

Daly K. and L. O’Doherty (2019), “The great disinflation in emerging and developing economies”, VoxEU.org, 11 April 2019.

Faryna O., M. Jonsson and N. Shapovalenko (2021), “The cost of disinflation in a small open economy vis-à-vis a closed economy”, Sveriges Riksbank Working Paper Series No. 407.

World Bank (2019), “Global economic prospects: Darkening skies”, World Bank Group, Washington.

We thank Johan Almenberg and Ricardo Reis for valuable discussions. The opinions expressed in this Policy Brief are the sole responsibility of the authors and should not be interpreted as reflecting the views of the National Bank of Ukraine or Sveriges Riksbank.

See Daly and O’Doherty (2019) and Box 1.1. in World Bank (2019).

This number is computed as (129-100) ⁄ 100∙100 ≈ 30%.

These numbers are computed as (215-170)/170∙100 ≈ 26% and (105-100)/100∙100 = 5%.