This policy brief is based on ECB Working Paper 3010. The views expressed in this brief are those of the authors and do not necessarily reflect the position of the ECB, DNB or the Eurosystem.

Abstract

Most central banks in advanced economies typically follow a gradual and predictable pace in reducing their balance sheets. Exploiting the recalibration of ECB’s outstanding central bank funding in 2022, we show that a sharp reabsorption of bank liquidity channels a tightening impact on credit supply. The tightening originates from the sudden need for banks accustomed to large liquidity holdings to more rapidly adapt to the new environment. The associated reduction in credit supply has an impact on the real economy.

When contracting their balance sheets, central banks in advanced economies tend to be very vocal about the gradual and predictable manner in which they plan to proceed. Arguments in favour of these principles normally range between the potential signaling effects seen during the Taper Tantrum of 2013 (see, for example, Chari et al. (2020)) and concerns about market functioning (see, e.g., Logan and Bindseil (2019) and Copeland et al. (2024)). Comparatively, the role that these principles play in the bank-based transmission of monetary policy are considerably less explored.

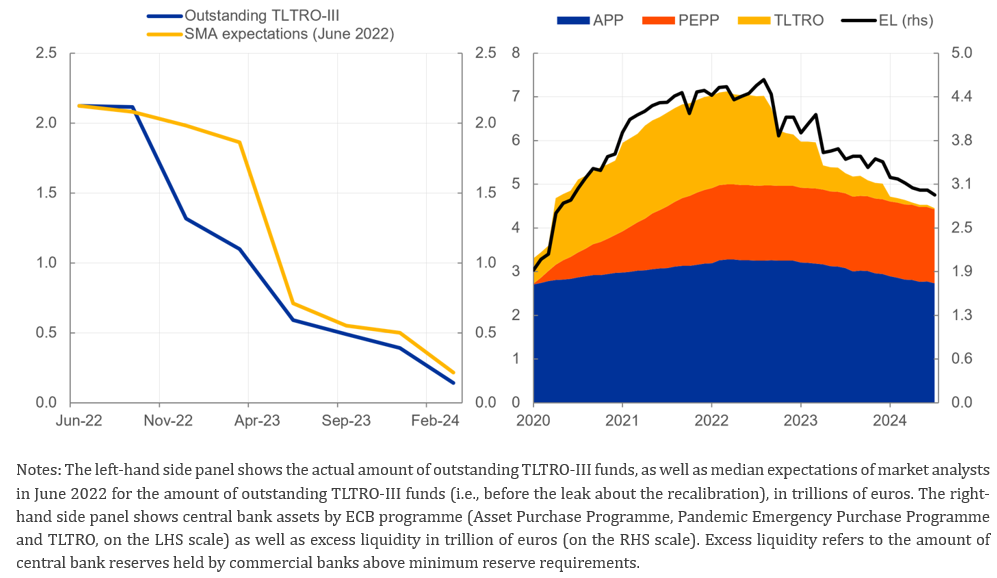

The exceptional circumstances of the inflationary pressures in 2022 prompted the ECB to change the terms of its targeted longer-term refinancing operations (TLTRO III) on 27 October 2022. This program had initially been designed to provide banks with cheap funding, encouraging them to lend more to businesses and households. The recalibration removed the impediments for an early voluntary repayment of borrowed funds, inducing banks to opt to repay more than EUR 1 trillion of central bank funding by over 6 months earlier than originally preferred and leading to a rapid contraction in aggregate liquidity (Figure 1). As a consequence, central bank reserves contracted at a pace and magnitude never experienced before in the Eurosystem. In parallel, bank credit slowed down sharply.

Figure 1. Central bank funding and reserves in the euro area (EUR bn)

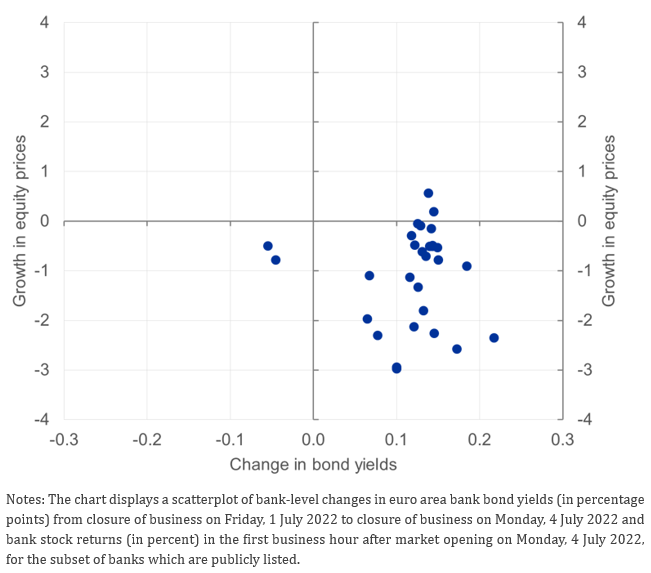

In this paper we use differential exposure to the recalibration of TLTRO III as a measure of the sudden withdrawal of liquidity. For identification, we use the market reactions that followed the publication of a news report on 3 July 2022 (Financial Times (2022)), which anticipated some features of the recalibration announced in October of the same year. Bank bond yields showed increases in bank funding costs around this event (Figure 2), reflecting the market’s views of the liquidity and funding pressures stemming from either using banks’ own liquidity or fetching the necessary liquidity via alternative funding sources to face the front-loaded repayments needs. Importantly, this impact came on top of the well-anticipated increase in funding costs associated with the then-ongoing phase-out of TLTRO III.

Figure 2. Market reactions to the news of a TLTRO recalibration

(percentage points and percent)

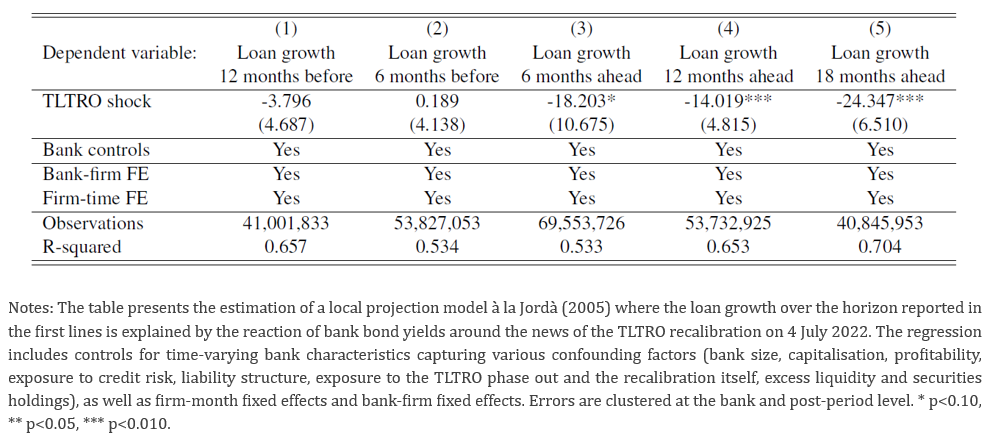

First, we show that the heterogeneous impact of the recalibration of TLTROs across banks, reflecting investors’ views on the impact of the reabsorption of liquidity brought forward by the recalibration, decreased credit supply in the months following the shock (Table 1).1 To trace the impact of this shock to loan supply, we control for loan demand conditions via a Khwaja and Mian (2008) empirical set-up and include a large battery of variables capturing banks’ exposure to concomitant monetary policy tightening cycle, fiscal policy measures against the energy crisis of 2022 and lingering impacts of the pandemic, among others. We document that the contraction in credit supply hit existing borrowers in the intensive margin but also applied to the extensive margin, reducing the likelihood of new loans and increasing the likelihood of loan terminations. Moreover, at the firm level there also was a noticeable drop in credit for firms more exposed to the shock, pointing to the existence of aggregate effects of the policy.

Table 1. Impact of accelerated absorption of central bank reserves (‘TLTRO shock’) on lending

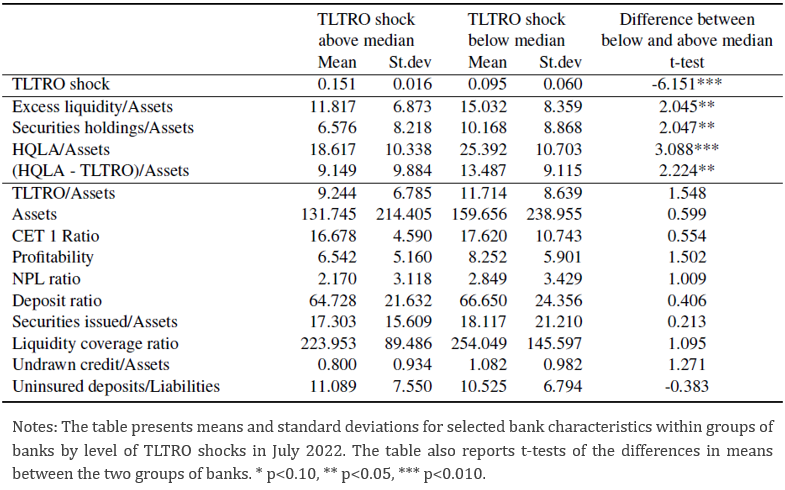

Second, we show that the mechanism underlying this contraction was related to the pre-existing liquidity constraints and was mostly independent of banks’ pre-existing liquidity levels due to the endogeneity of off-balance sheet exposures to the availability of liquidity (Table 2). On the one hand, low-liquidity banks faced a larger need to gather expensive funding and therefore contracted credit because of the higher funding costs, consistent with the bank lending channel (Bernanke (1983)). On the other hand, high-liquidity banks had larger off-balance sheet exposures backed by the very same liquidity to unwind, so they resorted to faster, more abrupt contraction in on-balance sheet exposures (Acharya et al. (2023)). As a result, credit supply contracted for both types of banks, signaling that credit supply tightening stemming from the pace of balance sheet reduction acts independently from decisions on the magnitude of the reduction, or the starting point in terms of liquidity levels.

Table 2. Bank characteristics by level of exposure to TLTRO shock

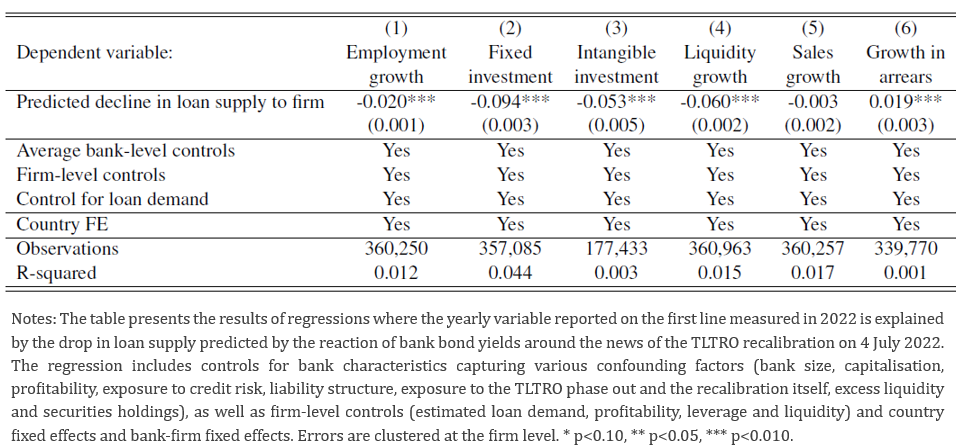

Third, we document that the contraction in credit supply stemming from the sudden increased incentive of repaying central bank funding at the bank level had real effects, with exposed firms contracting employment and investment (Table 3). This evidence is consistent with a large body of literature showing that credit contractions do leave a mark on the real economy. Moreover, while borrowers exposed to the shock were also more likely to fall into arrears, banks did not rebalance their portfolios towards safer borrowers in response to the shock as would be expected by a more standard interest rate hike (see Gambacorta and Song (2018)). This contrasts with what had been observed with the pandemic recalibration of the same TLTRO III programme just two years earlier, when changes in the pricing of the policy had led to large take-up and an increase in loan supply towards safer borrowers (Barbiero et al. (2022)).

Table 3. Measuring real effects of TLTRO shock via credit supply

Our findings underscore the critical importance of the modality in which central banks implement changes to their balance sheets. The recalibration of TLTRO III in 2022 reached its stated goals to reinforce the transmission of our policy rates to bank lending conditions so that TLTRO III contributed to the transmission of the monetary policy stance needed to ensure the timely return of inflation to the ECB’s 2% medium-term target. It contributed to normalise funding costs and removed deterrents to early voluntary repayments of outstanding TLTRO funds, with an associated large reduction of bank liquidity in a context of still ample reserves. In doing so, the recalibration of TLTRO III also taught us that faster adjustments in bank liquidity can indeed reduce bank credit and reach the real economy, possibly offering a bank credit perspective to how central banks should calibrate the pace at which central banks should reduce their balance sheets in normal times.2

ACHARYA, V. V., R. S. CHAUHAN, R. RAJAN, AND S. STEFFEN (2023): “Liquidity Dependence and the Waxing and Waning of Central Bank Balance Sheets,” NBER Working Papers 31050.

ALTAVILLA, C., F. BARBIERO, M. BOUCINHA, AND L. BURLON (2023): “The great lockdown: pandemic response policies and bank lending conditions”, European Economic Review, 2023, 156, 104478.

ALTAVILLA, C., M. BOUCINHA, L. BURLON, M. GIANNETTI, AND J. SCHUMACHER (2022): “Central Bank Liquidity Reallocation and Bank Lending: Evidence from the Tiering System,” Swedish House of Finance Research Paper, 17.

ALTAVILLA, C., M. ROSTAGNO, AND J. SCHUMACHER (2025): “When banks hold back: Credit and liquidity provision,” ECB Working paper n. 3009.

BARBIERO, F., L. BURLON, M. DIMOU, AND J. TOCZYNSKI (2022): “Dual interest rates and the transmission of monetary policy,” SUERF Policy Brief, No 461.

BERNANKE, B. S. (1983): “Nonmonetary Effects of the Financial Crisis in Propagation of the Great De- pression,” American Economic Review, 73, 257–276.

BURLON, L., A. FERRARI, S. KHO, N. TUSHTEVA (2025): “Why gradual and predictable? Bank lending during the sharpest quantitative tightening ever,” ECB Working paper n. 3010.

CHARI, A., K. DILTS STEDMAN, AND C. LUNDBLAD (2020): “Taper Tantrums: Quantitative Easing, Its Aftermath, and Emerging Market Capital Flows,” The Review of Financial Studies, 34, 1445–1508.

COPELAND, A., D. DUFFIE, AND Y. D. YANG (2024): “Reserves Were Not so Ample After All,” The Quarterly Journal of Economics, qjae034.

DIAMOND, W., Z. JIANG, AND Y. MA (2024): “The reserve supply channel of unconventional monetary policy,” Journal of Financial Economics, 159, 103887.

FINANCIAL TIMES (2022): “ECB to discuss blocking banks from multibillion-euro windfall as rates rise,” 3 July 2022.

FRICKE, D., S. GREPPMAIR, AND K. PALUDKIEWICZ (2023): “Transmission of interest rate hikes depends on the level of central bank reserves held by banks,” SUERF Policy Brief, No 738.

GAMBACORTA, L. AND H. S. SONG (2018): “Why bank capital matters for monetary policy,” Journal of Financial Intermediation, 35, 17–29.

JORDÀ, O. (2005): “Estimation and Inference of Impulse Responses by Local Projections,” American Economic Review, 95, 161–182.

KANDRAC, J. AND B. SCHLUSCHE (2021): “Quantitative Easing and Bank Risk Taking: Evidence from Lending,” Journal of Money, Credit and Banking, 53, 635–676.

KHWAJA, A. I. AND A. MIAN (2008): “Tracing the Impact of Bank Liquidity Shocks: Evidence from an Emerging Market,” American Economic Review, 98, 1413–1442.

LOGAN, L. AND U. BINDSEIL (2019): “Large Central Bank Balance Sheets and Market Functioning,” Bank of International Settlements Markets Committee Report.

See Altavilla et al. (2023) for an overview of the evidence on central bank funding and lending conditions.

On the relation between central bank reserves and bank credit, see e.g. Kandrac and Schlusche (2021); Altavilla et al. (2022); Acharya et al. (2023); Fricke et al. (2023); Diamond et al. (2024); Altavilla et al. (2025).