References

R.J. Caballero, E. Farhi, P.-O. Gourinchas, Rents, technical change, and risk premia accounting for secular trends in interest rates, returns on capital, earning yields, and factor shares, Am. Econ. Rev., 107 (5) (2017), pp. 614-620, 10.1257/aer.p20171036

G.B. Eggertsson, N.R. Mehrotra, J.A. Robbins, A model of secular stagnation: theory and quantitative evaluation, Am. Econ. J., 11 (1) (2019), pp. 1-48, 10.1257/mac.20170367

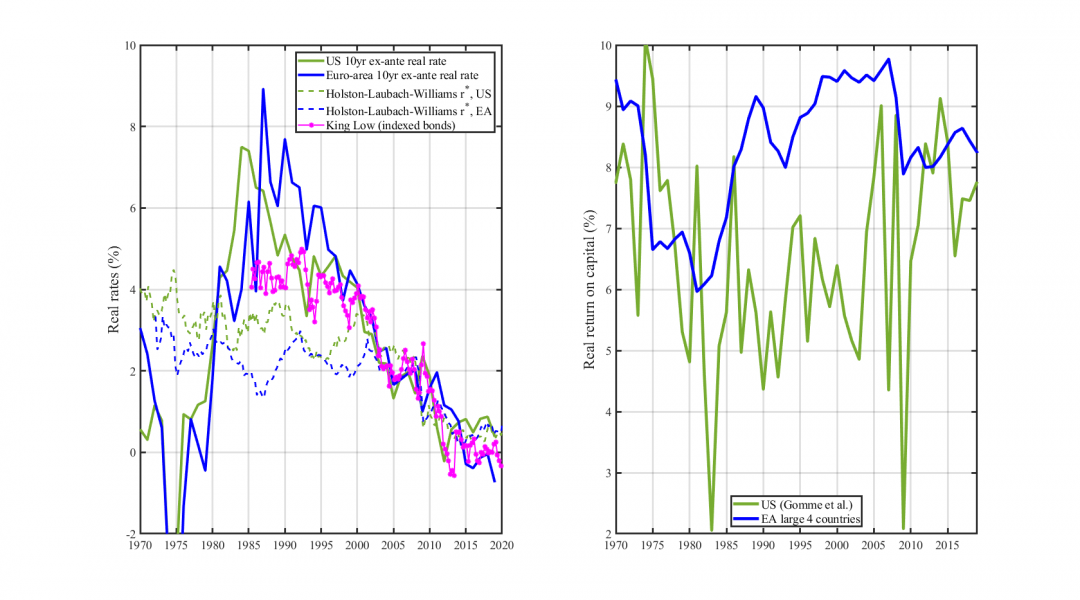

P. Gomme, B. Ravikumar, P. Rupert, The return to capital and the business cycle, Rev. Econ. Dyn., 14 (2) (2011), pp. 262-278.

P. Gomme, B. Ravikumar, P. Rupert, Secular stagnation and returns on capital, Fed. Reserve Bank St. Louis Econ. Synop., 19 (2015), pp. 1-3.

J.D. Hamilton, E.S. Harris, J. Hatzius, K.D.West, The equilibrium real funds rate: past, present and future, IMF Econ. Rev., 64 (4) (2016), pp. 660-707, 10.1057/s41308-016-0015-z

K. Holston, T. Laubach, J.C. Williams, Measuring the natural rate of interest: international trends and determinants, J. Int. Econ., 108 (2017), pp. S59-S75, 10.1016/j.jinteco.2017.01.004

M. King, D. Low, Measuring the “World” Real Interest Rate, Working Paper, NBER (2014).

A. Krishnamurthy, Comment, Brook. Pap. Econ. Act., 2019 (1) (2019), pp. 63-69, 10.1353/eca.2019.0010

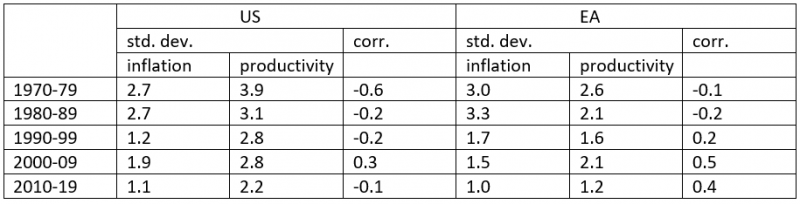

M. Marx, B. Mojon, F. R. Velde, Why have interest rates fallen far below the return on capital?, Journal of Monetary Economics, 2021, https://www.sciencedirect.com/science/article/pii/S0304393221001008

Ł. Rachel, L.H. Summers, On secular stagnation in the industrialized world, Brook. Pap. Econ. Act., 2019 (1) (2019), pp. 1-54, 10.1353/eca.2019.0000