In order to understand the uneven economic impact of COVID-19 crisis across euro area countries, we first analyze the differences in the severity of the health crisis and the productive structure across countries. Secondly, we provide an empirical quantification of these two factors, and also of some additional ones. We find that the course of the pandemic, the severity of mobility restrictions and the weight of sectors most exposed to social interaction played a key role in explaining the differential economic impact during 2020.

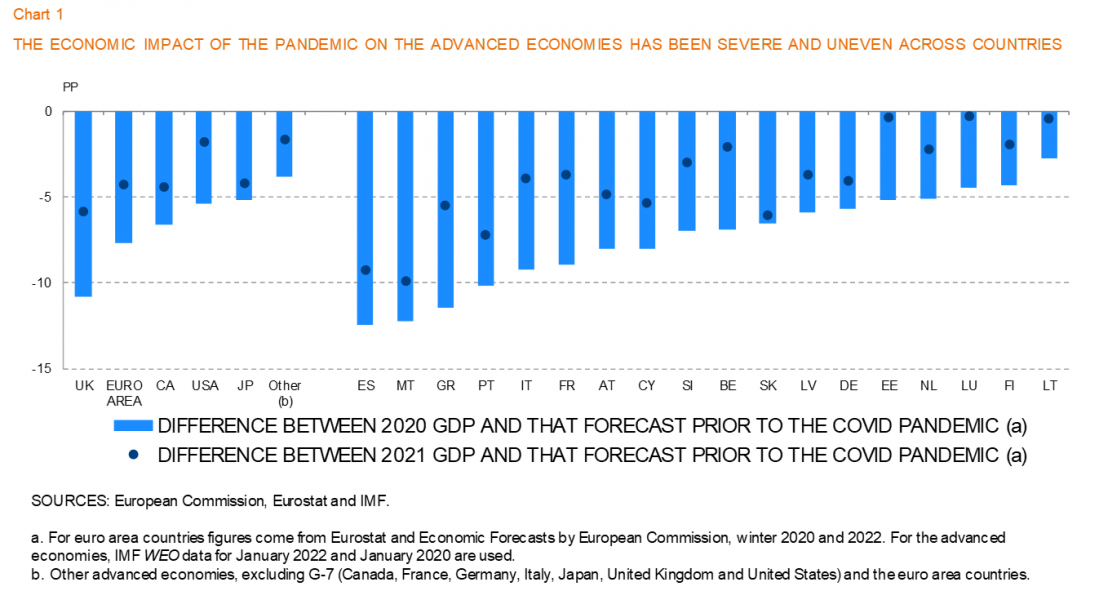

The COVID-19 pandemic led to a sharp contraction of the world economy during 2020, but the intensity and duration of the shock was not uniform across countries. Among advanced economies, the economic impact was higher in the United Kingdom and in the euro area, where the difference between the 2020 GDP level and that forecast before the outbreak of the pandemic was near 11 pp and 8 pp, respectively, compared with an impact of around 5 pp in the United States or Japan (see bars in Chart 1). Among euro area countries, the economic impact in 2020 was highest in Spain, Malta and Greece.

Most economies showed a strong rebound in 2021, underpinned by the vaccination rollout, the gradual easing of the restrictions and the reopening of activities in the services sector, in a context of ample policy support. Notwithstanding, as can be seen in Chart 1, the speed of recovery was also uneven, compounded by the differing impact of supply bottlenecks that emerged over the past year. The economies hardest hit by the pandemic crisis will take longer to recover the GDP levels that were forecast prior to the covid pandemic.

Against this background, we explore the factors that explain these differences, with a focus on euro area countries.

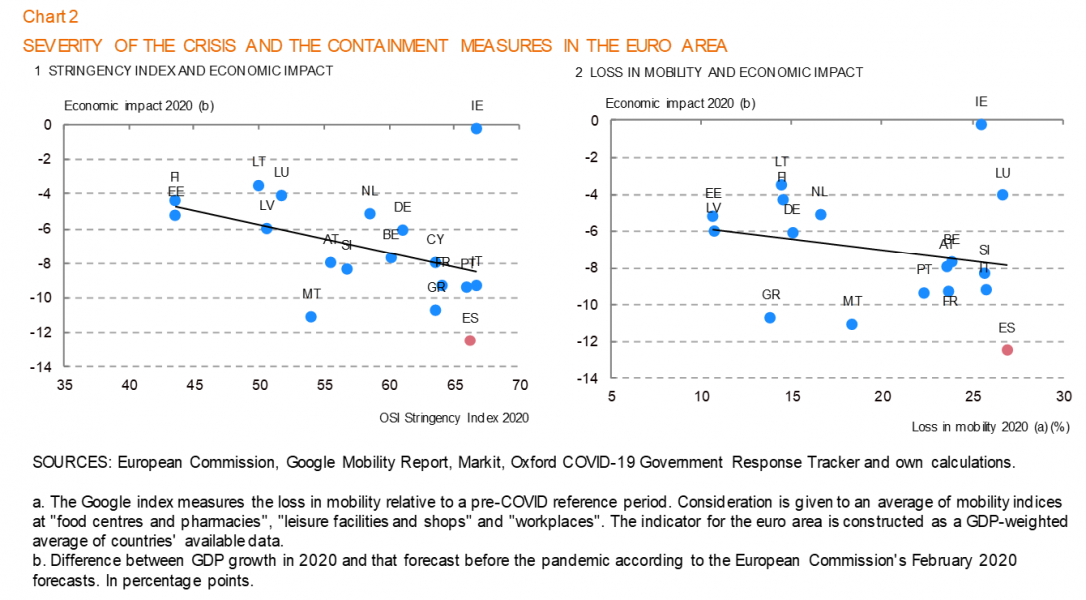

The intensity of the health crisis in each territory and the severity and duration of the containment measures applied to limit the spread of the virus were a key factor behind the intensity of the economic crisis in 2020. This is illustrated in Chart 22 using Google mobility indicators and the Oxford stringency index for the euro area economies.

But the loss of mobility and its impact on the economic activity was not uniform throughout the health crisis. The correlation was greater during the first wave, when the severity and duration of the lockdown containment measures were particularly harsh in some countries. Government responses varied, conditioned by the course of the pandemic. In general, the greater understanding of how the virus spreads and the availability of stronger health measures and testing capacity led to more targeted restrictions, mainly focused on activities entailing a greater contagion risk.

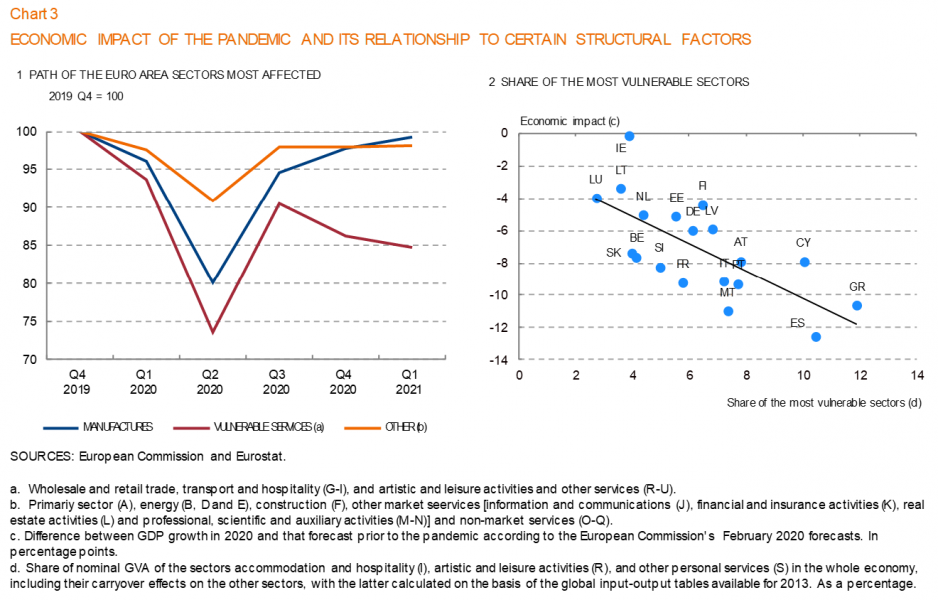

At the same time, the economy showed greater resilience as individuals also learned and adapted to living with the virus in parallel with advances in the digitisation of workplaces, teaching and domestic spaces. Thus, for example, heightened technological diffusion allowed for a considerable increase in e-commerce and other digital services and in remote working. As the data in Alfonso et al. (2021) show, for example, the growth of e-commerce was sharper in countries with more stringent lockdown measures. Global value chains were not so affected, and trade and manufacturing activity sustained sound growth globally during the second half of 2020. Consequently, as can be seen in the left panel in Chart 3, in early 2021, much of manufacturing activity in the euro area had recovered, while the aggregate comprising the distributive trade, transport and hospitality posted losses in activity of over 13% relative to its pre-crisis level. Such losses amounted to 24% in the case of leisure, culture and other personal services.

This brings us to the second major factor behind the heterogeneity of the economic impact of the COVID-19 crisis, which is the different productive specialisation of countries. For example, focusing on the largest economies of the euro area, the share of market services in France, Italy and Spain is greater than in the euro area as a whole, although different patterns of specialization can also be seen in each of these countries. France stands out in the information and communications and professional, scientific and auxiliary activities sectors, where the possibility of teleworking is greater. Conversely, Italy and, above all, Spain evidence a greater share in the sectors encompassing retail, transport and hospitality, and artistic, recreational and other services activities. On the contrary, industrial activity (especially the manufacture of vehicles and of machinery and equipment) has a significantly greater presence in Germany than in the other three main economies. Details on subsectors can be found in Gómez and del Río (2021).

As can be seen in the right panel in Chart 3, the impact of the crisis was higher in those countries where the share of services most exposed to social interaction is larger. Among euro area countries, this is the case of Spain or Greece, where accommodation and restaurant services, arts and entertainment activities and other services account for more than 10 % of GVA, compared with 6 % in the euro area.

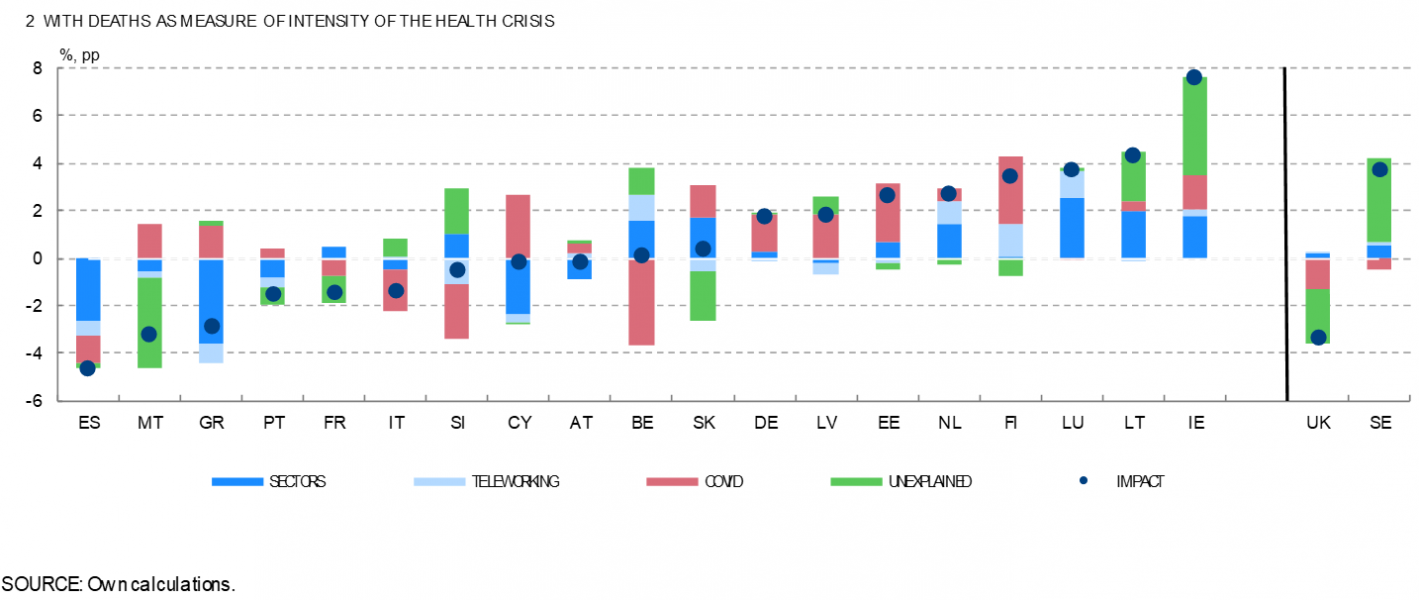

In order to identify the various contributions of the aforementioned explanatory factors, we estimate a cross-section regression for the European Union countries3 plus the United Kingdom, following the approach by Sapir (2020). The dependent variable is the difference between the decline in GDP in 2020 and the pre-pandemic growth forecast. As with Sapir (2020), the European Commission’s winter forecasts published on 13 February 2020 are used, when the coronavirus was still considered only as a downside risk to the economic scenario then envisaged. Results are presented in Table 2 in Gómez and del Río (2021).

Among the determinants, consideration is first given to the intensity and duration of the health crisis and the containment measures applied. A Google mobility indicator which includes voluntary social distancing elements is used as a proxy. The Oxford Stringency Index is also considered, as a measure of the severity of the restrictions applied during the pandemic [see Hale et al. (2020)]. Alternatively, the cumulative COVID-19-related deaths in 2020, expressed per 100,000 inhabitants in order to adjust for the different sizes of the countries, is used.

In approaching the differences in productive structure, we include the weight of the sectors most vulnerable to the health crisis. In particular, the variable sectors reflects the share in the economy-wide nominal Gross Value Added of the accommodation and food services (I), artistic activities and leisure (R), and other personal services (S) sectors.

The analysis considers other variables, such as teleworking or fiscal policy enabling a possible explanatory role to be given to the different fiscal impulse deployed by countries. Teleworking turns out to be significant in most specifications, though its contribution explaining the uneven impact of the crisis is not always very large. Note that teleworking captures each country’s ability to set teleworking in place, not only in terms of the capacity of and access to digital infrastructures, but also of the productive structure, insofar as many productive processes and services cannot be undertaken remotely. As regards the fiscal variable, use is made of discretionary fiscal measures as an indicator, in addition to the role of the automatic stabilizers. Alternatively, the 2019 level of public debt is included (as a proxy of the fiscal space available to deploy a forceful fiscal response), but it does not prove significant either, in line with the findings of Sapir (2020). The absence of significance might be associated with the effectiveness of the ECB’s stimulus measures and their contribution to increasing countries’ fiscal space to act in the face of the health crisis.

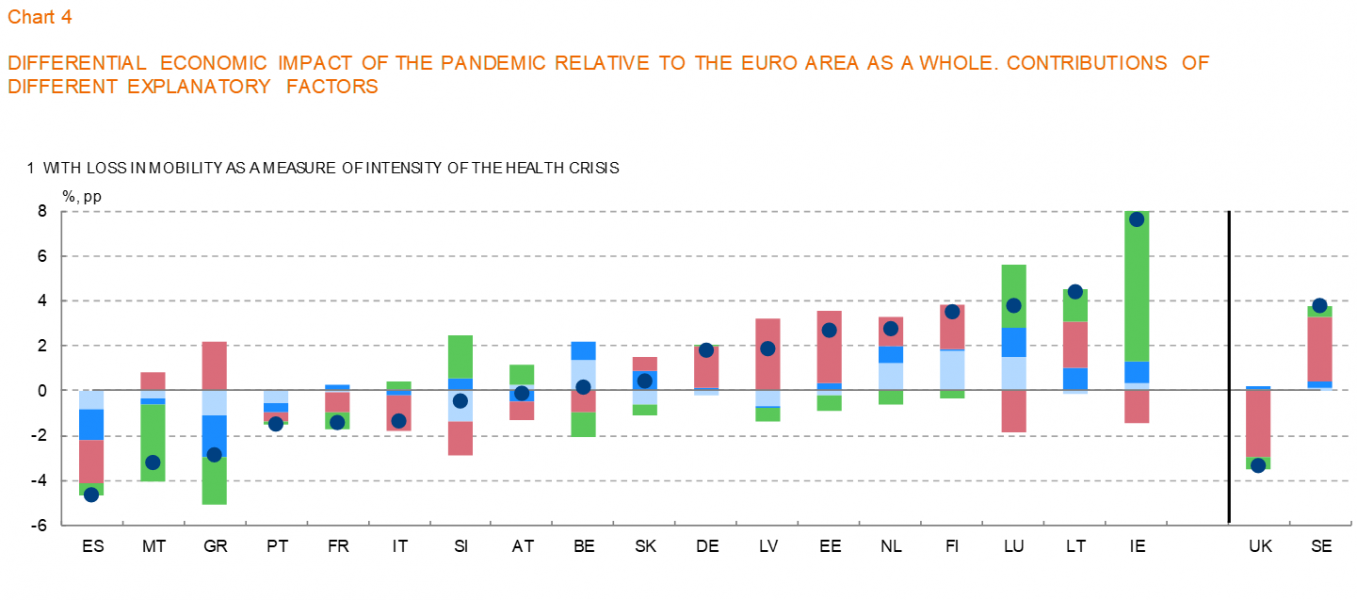

Chart 4 depicts the contribution of the factors to the economic impact of the pandemic in 2020, according to specifications in column (3) and (2) of Table 2 in Gómez and del Río (2021). Figures are calculated in differences compared with the euro area. As can be seen, for Spain and Greece, their productive structure has been a key factor behind the economic impact of the crisis, which is proving greater in Spain, moreover, owing to the very incidence of the pandemic. The contribution of productive specialisation has also been relevant in the differential impact in other countries, such as Portugal, Austria, Cyprus and, to a lesser extent, Italy. The intensity of the health crisis has contributed significantly to the economic impact of the pandemic having been greater in Spain, France, Italy and Slovenia. A health-crisis contribution higher than the euro area average has also been experienced in Belgium and, in terms of mobility, Luxembourg, but this was more than offset by the positive contributions (relative to this average) of the productive structure and teleworking. Conversely, the relative contribution of teleworking was negative in the three countries most affected by their productive structure (Spain, Greece and Cyprus), partly as a consequence of the correlation between both variables (since the sectors most affected by the health crisis offer fewer possibilities of teleworking), as well as in Malta, Slovenia, Slovakia and Latvia.

The COVID-19 health crisis has particularly punished economic activity in the services sectors that entail most social interaction and, therefore, the economies most dependent on them. These latter sectors are particularly labor-intensive. Their share in terms of activity accounts for between 20-30% of GDP in the euro area countries; however, they concentrate between 30-40% of total employment. Moreover, employment in these sectors is more geared to a younger, female and less skilled population [see European Commission (2020)]; and that made economic policy intervention all the more necessary in order to mitigate the social impact of the pandemic.

In addition, some sectors will foreseeably witness a structural decline in demand (e.g. as a result of more extensive teleworking). Accordingly, the measures needed should not only provide for recovery, but also for the transformation and reallocation of the labor factor and of capital.

Alfonso V. C., C. Boar, J. Frost, L. Gambacorta and J. Liu (2021). E-commerce in the pandemic and beyond. BIS Bulletin, No 36.

European Commission (2020). Labour Market and Wage Developments in Europe, Annual Review 2020.

Gómez and del Río (2021) “The uneven impact of the health crisis on the euro area economies in 2020” Occasional Papers 2115, Banco de España.

Hale, T., N. Angrist, B. Kira, A. Petherick, T. Phillips, S. Webster (2020). Variation in Government Responses to COVID-19, version 5.0, Blavatnik School of Government Working Paper.

Sapir A. (2020). “Why has COVID-19 hit different European Union economies so differently?”, Policy Contribution 2020/18, Bruegel.

Hereafter, data are those appearing in Gomez and del Río (2021) with a cut-off date 9 March 2021; subsequent revisions in data are not included.