This column has benefitted notably from comments by Janine Aron and Sean Dougherty.

Land prices, as reflected in house prices relative to incomes, are near all-time records, pricing younger citizens out of home-ownership and affordable rents. This column argues that a green land value tax – a charge on the land plus a charge on the house minus a discount related to efficiency of the building’s energy usage – would help resolve conflicts around meeting climate goals, equity and housing affordability, reduce intergenerational injustice and benefit growth. The evolution from existing property tax systems would be aided by a simple new tax deferral mechanism, removing much of the sting of property tax reform.

It should be high on the agenda of every government to reform annual property taxes to incorporate discounts for energy-efficient buildings, and apply subsidies and stronger building regulations that will lower CO2 emissions. Astonishingly, the cooling and heating of buildings contributes about one-third of CO2 emissions. COP27 in 2022 warned that greenhouse gas emissions are fast approaching tipping points that will make “climate chaos” irreversible.

Land value taxes have long been considered the most efficient form of taxation. Discussion around their use has intensified as land values have risen strongly relative to incomes (Bonnet et al., 2021). A tax reform shifting taxes away from productive labour and capital (where they reduce incentives to work and save), and onto land (where they do not), would produce major long-run increases in output (Kumhof et al., 2022). Proposals for land value taxes have begun to enter the policy discussion, notably in Detroit, Michigan, and receiving significant news coverage, see the New York Times and the Economist. The optimal tax literature argues (Mirrlees Review, 2011) for a split-rate, with a higher tax rate on land than on buildings – the latter a kind of consumption tax.

Carbon emissions from the use of fossil fuels result in the most extreme negative externalities that mankind faces. Correcting this massive market failure through the property tax system is highly desirable. The climate-related potential for split-rate property taxation has not previously been addressed (e.g. by Bonnet et al. and Kumhof et al.). Muellbauer (2023) proposes that tax rates on buildings should embody discounts related to the carbon-efficiency of buildings. With fossil fuel sources of energy used in buildings still so dominant, energy efficiency offers a close substitute. In practice, the use of Energy Performance Certificates is widespread, and EPCs currently offer the only easily available tag for offering green discounts on recurrent property taxes.

Lower-income households often live in poorly insulated homes, and hence benefit less from green tax rebates or discounts. They spend a large fraction of their budgets on energy and housing, and hence can be hurt more in the short run by carbon taxes and tougher building regulations. These negative distributional effects could be offset by applying a more progressive property tax that includes green discounts. A tax that is proportional to property values, and especially one with higher rates on the land component, is progressive.

A key objection to annual property taxes (often voiced by the wealthiest property owners), is that cash-poor households in expensive properties could face hardship. This can be addressed by permitting deferral of payment until the property is sold or transferred, OECD (2022, p.87). Some jurisdictions, such as Canada, Denmark and Ireland, offer tax deferral by accumulating debt (OECD, 2021a). In the US, 24 states operate deferral options for retirees. However, take-up is remarkably low, and this is true in other countries too. Munnell, Hou and Walters (2022) suggest as possible reasons onerous and complex eligibility restrictions, and concern about high interest rate risk and downside house price risk.

These risks are eliminated1 in a simple equity-based deferral scheme, first proposed by Muellbauer (2018). Every household, or at least those headed by a person of retirement age, would have the right to defer the property tax. The tax authority would register a proportionate interest at the land registry equal to the unpaid tax for each year deferred, to be settled when the property was sold or transferred.2 For example, with a 1% tax, after ten years of deferral, the property owner would retain 90% of the then-current value of the registered property title. Moreover, an incentive in the form of a small discount for cash payments of property tax could be offered, which would help stabilise annual revenue flows for the tax authority, and roughly offset what otherwise could be seen as a subsidy to the deferrers.3

This ‘proportion of equity’ deferral proposal is easy for taxpayers to understand. Ticking a box on the property tax form requesting deferral without having to be means-tested or to undergo complex form-filling is an advantage. Moreover, this avoids complex interest rate calculations. Research on the financial sophistication of consumers suggests many do not understand compound interest. In contrast, the fraction of value of a home owned is a simple concept. The above applies to a property tax whether in the form of a split tax or not.

Economists often argue that there is trade-off between growth and an equitable distribution of income and wealth, so that policies favouring equity will damage economic growth and efficient resource allocation. However, well-designed annual property taxes do exactly the opposite: they enhance growth, efficiency and equity.

Land ownership is far more unequally distributed than income in most countries, making a split-rate property tax, with higher rates on land, necessarily progressive, as well as efficient. Lowering of mobility-restricting transaction taxes like stamp duty while increasing recurrent property taxes would improve the utilisation of the housing stock, increase the flexibility of labour and housing markets (OECD, 2021b), and ease adaption to shifts in the economic environment.

Evidence has mounted that credit-fuelled real estate booms crowd out more productive investment, with negative consequences for growth and increased risks of financial crisis.4 These booms are mainly in land rather than building values. Property taxes, especially split-rate taxes linked to annual valuations, would dampen such booms. With appropriate green discounts, green property taxes can enhance sustainable growth. Green property tax discounts also sharpen incentives for green mortgage pricing, in the form of lower interest rates, or more favourable lending criteria for homes with better EPC ratings.

Some authors question whether with a split-rate tax, an increase in tax rates on land relative to buildings would reduce income inequality.5 However, these studies focus only on cash income, rather than on disposable income which includes the imputed rent of owner-occupiers (owners do not pay rent). It then becomes realistic to examine the distributional implications of property taxes in terms of household disposable income. With an easy deferral mechanism, the link is broken between cash income and annual property tax. No longer is a cash-poor home-owner in an expensive location considered ‘poor’ in terms of household disposable income, but instead is well-off compared to a tenant with the same cash income but paying rent. The outcome is transformative: income inequality is reduced by raising tax rates on land relative to buildings.

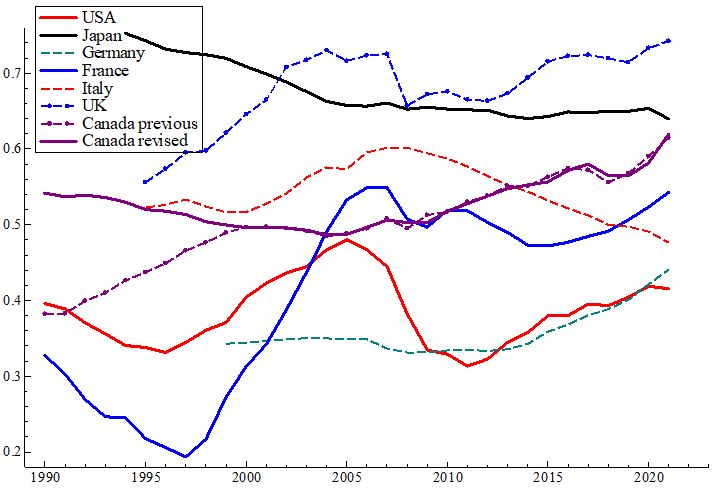

In four G7 countries, the UK, France, Canada and Japan, more than half the value of housing wealth is accounted for by land (over 70 percent in the UK), and no less than 40 percent in any of the G7. Thus, in the UK, on average, less than 30 percent of the value of a home is in the building itself. The share of land has risen strongly in all G7 countries, except for Italy and Japan. House values are a combination of volatile and cyclical land values and far more stable building values, given by construction costs. High and volatile land prices pose significant risks to the stability of the financial system and wider economy. Land value or split-rate taxation is especially useful to promote economic stability, and better targeted than standard property taxation.

Figure: Shares of land in housing wealth

Source: OECD, National balance sheets for non-financial assets owned by households and non-profit institutions serving households, share of land in fixed non-financial assets, revised data for Canada from Statistics Canada. Household fixed non-financial assets is a close approximation to housing wealth.

In the process of compiling these data, I could not make sense of the rise in the share of land in Canada from 1990 to 2000, as house prices relative to construction costs were flat, so that the same should have been true of land prices. Statistics Canada have acknowledged a serious error.6 An error of this kind could have important policy implications. The Bank of Canada’s LENS model of the economy uses net worth, including housing wealth to model consumption. Over the period 1990-2000, net worth rose rather less than implied by their incorrect data. This would have distorted forecasts and simulations from the Bank’s policy model.

Critics of split-rate property taxes argue it is hard to separately value land and buildings – though the recent property revaluation in Germany does exactly that. In general, there are many more transactions of ‘house plus land’ bundles than of vacant plots. Property (‘house plus land’) values are thus more transparent than underlying land values. One measure of land value is property value minus the replacement cost of a similar building. If LVT were based on such a residual measure, the replacement cost could overestimate the value of the structure where deterioration through age has occurred, and hence underestimate the land value.7 There could also be a misreporting incentive, by overstating the rebuilding cost to reduce tax, especially in high land-value locations.

However, superior hedonic mass-valuation measures can be applied to multi-year, cross-sectional house price data to extract land values (Diewert, de Haan and Hendriks, 2021, 2015).8 These exercises take account of the age of the building and other indicators of its condition. They also account for time variation in rebuilding costs as measured by construction price indices. These indices are largely national and not location-specific, helping in accurately separating land values from building values. Diewert et al. argue that, controlling in their models for common movements over time in national rebuilding costs, improves the identification of movements in building values relative to heterogeneous movements in local land values.

The evolution from existing property tax systems to a green split-rate system in which land and buildings are subject to separate tax rates needs to be handled with care.

Step 1, where necessary, is to invest in the land registration system, which is not complete in all countries. Vacant and agricultural land is sometimes not covered by the prevailing property tax systems, whether for households or businesses, but should be, subject to tax allowances for lower per hectare valuations. Some countries could reconsider the harmonisation of local, regional and national tax regimes and the funding structure of local government. Basic rules and valuations should be set at the national level, with limits on local tax-setting powers to prevent excessive tax competition between local governments.

Step 2 should be to invest, where necessary, in robust systems and trained staff for generating energy performance certificates.

Step 3 should be updating valuations to current market values, run concurrently with Steps 1 and 2. In many countries, valuations for the prevailing property tax are out of date (OECD, 2022).

Step 4, given the new valuations, would be to announce new tax rates for residential property and businesses with green discounts. Introducing the simple equity-based deferral system for residential property, with small discounts for cash payers, is highly desirable as part of Step 4, as it prevents revaluation shocks to the cash-flow of those with limited ability to pay. Even with a deferral and the green discount, it makes sense to phase in the taxes paid. For example, in the first year, the effective property value for taxation could be based on one-third of the new value and two-thirds of the old. In the second year, the effective value could be two-thirds of the new and one-third of the old, with the transition completed in the third year.

Both simple deferral and the green discount are crucial elements in gaining public acceptability for property tax reform. As public alarm about the climate crisis mounts, especially among younger generations, the rationale for the green discount will be increasingly widely appreciated. Initially, deferral should be offered to the over-65 age group. Later, given experience with take-up and administration, deferral can be extended to all owners of residential property. Throughout, a programme of education and consultation to build public acceptance and achieve a degree of cross-party consensus would be highly advisable.

Step 5 should implement improvements in valuation systems with a view, for each property, to split the overall value into land and building components.

Finally, in Step 6, tax rates for the two components can be separated, with tax rates on land values adjusted upwards relative to tax rates on buildings.

It is urgent to implement green property taxes globally, given the climate emergency. This column has explained how to implement green discounts as part of good tax design. As well as incentivising the green transition and reducing climate risk for the financial system, the green LVT would broaden the tax base and increase revenue. It will improve equity, stabilise the economy and the financial system, improve efficiency in resource allocation and promote growth. It has the advantage of simplicity in implementation and low costs of administration. It will help reduce housing supply constraints. In country-by-country implementation of the green LVT, localism – i.e. subsidiarity and democratic accountability – and national objectives will need to be balanced to achieve public acceptability and ease the transition from the prior property tax system.

Barbosa, R. and S. Skipka (2019), “Tax Housing or Land: Distributional Effects of Property Taxation in Germany”, CESifo Working Paper Series, No. 8039.

Basco, S., D. Lopez-Rodriguez and E. Moral-Benito (2022), “House Prices and Misallocation: The Impact of the Collateral Channel on Productivity”, Banco de Espana Working Paper, No. 2135, summarised in SUERF Policy Brief 284.

Bonnet, O., G. Chapelle, A. Trannoy and E. Wasmer (2021), “Land is back, it should be taxed, it can be taxed”, CEPR: VoxEU, March 2021.

Bowman, J. and M. Bell (2008), “Distributional Consequences of Converting the Property Tax to a Land Value Tax: Replication and Extension of England and Zhao”, National Tax Journal, Vol. 61/4.1, pp. 593-607.

Chakraborty, I., I. Goldstein and A. MacKinlay (2018), “Housing Price Booms and Crowding-Out Effects in Bank Lending”, The Review of Financial Studies, Vol. 31/7, pp. 2806-2853.

Diewert, W., J. de Haan and R. Hendriks (2011), “The Decomposition of a House Price Index into Land and Structures Components: A Hedonic Regression Approach”, The Valuation Journal, Vol. 6, pp. 58-106.

Diewert, W., J. de Haan and R. Hendriks (2015), “Hedonic Regressions and the Decomposition of a House Price Index into Land and Structure Components”, Econometric Reviews, Vol. 34/1-2, pp. 106-126.

Dougherty, S. and H. Kim (eds.) (2023), Bricks, Taxes and Spending: Solutions for Housing Equity across Levels of Government, OECD Fiscal Federalism Studies, OECD Publishing, Paris.

England, R. and M. Zhao (2005), “Assessing the Distributive Impact of a Revenue—Neutral Shift from a Uniform Property Tax to a Two-Rate Property Tax with a Uniform Credit”, National Tax Journal, Vol. 58/2, pp. 247-260.

Gervais, O. & M. Gosselin (2014), “Analyzing and Forecasting the Canadian Economy through the LENS Model,” Technical Reports 102, Bank of Canada.

Grjebine, T., J. Hericourt and F. Tripier (2022), “Real estate booms are behind Europe’s productivity divergence”, CEPR: VoxEU.

Hau, H. and D. Ouyang (2018), “Capital Scarcity and Industrial Decline: Evidence from 172 Real Estate Booms in China”, Swiss Finance Institute Research Paper Series, No. 18-38, Swiss Finance Institute.

Kumhof, M. C. Goodhart, M. Hudson and N. Tideman (2022) “Post-Corona Balanced-Budget Super-Stimulus: The Case for Shifting Taxes onto Land”, CEPR: VOxEU, January.

Kumhof, M., C. Goodhart, M. Hudson and N. Tideman (2021), “Post-Corona Balanced-Budget Super-Stimulus: The Case for Shifting Taxes onto Land”, CEPR Discussion Paper, No. 16652.

Mirrlees, J. et al. (2011), “The Taxation of Land and Property”, in Tax by Design, Oxford University Press, Oxford.

Muellbauer, J. (2018), “Housing, debt and the economy: A tale of two countries”, National Institute Economic Review, Vol. 245, pp. R20-R33.

Muellbauer, J. (2023), “Why we need a green land value tax and how to design it”, ch. 6, in Dougherty and Kim (2023).

Müller, K. and E. Verner (2021), “Credit Allocation and Macroeconomic Fluctuations”, SSRN Electronic Journal.

Munnell, A., W. Hou and A. Walters (2022), “Property Tax Deferral”, in Mitchell, O. (ed.), New Models for Managing Longevity Risk: Public-Private Partnerships, Oxford University Press, Oxford, UK.

OECD (2022), Housing Taxation in OECD Countries, OECD Tax Policy Studies, No. 29, OECD Publishing, Paris.

OECD (2021a), Making Property Tax Reform Happen in China: A Review of Property Tax Design and Reform Experiences in OECD Countries, OECD Fiscal Federalism Studies, OECD Publishing, Paris.

OECD (2021b), Brick by Brick: Building Better Housing Policies, OECD Publishing, Paris.

Plummer, E. (2010), “Evidence on the Distributional Effects of a Land Value Tax on Residential Households”, National Tax Journal, Vol. 63/1, pp. 63-92.

By comparison with deferral taking the form of paying cumulative interest on unpaid tax bills, with the equity-based deferral the household’s net equity position is protected against the risk of higher interest rates over the deferral period, and lower property values at the point where the next transaction takes place and the debt needs to be settled. While deferral improves household cash flow, if interest rates turned out to be lower than expected and house prices higher, the household or its inheritors could eventually have a lower net-equity position under equity-based deferral. However, this does not necessarily follow since in current interest-based deferral schemes, interest rates are typically well above market rates.

This means that properties encumbered with a tax liability are not allowed to be sold.

Muellbauer (2023) points out that from 1997 to 2022, real returns on residential housing outpaced the real return in government bonds in the US, Canada, UK and France, but not in Italy and Japan. Though the future may not be like the past, it suggests that tax authorities should not be overly concerned with damage to tax revenue from this deferral method. Moreover, compared to the individual facing highly idiosyncratic risks, the tax authority’s revenue stream from deferral is an average spread out over a heterogeneous population and over time. Hence the tax authority faces far lower risks.

The prize-winning study by Müller and Verner (2021) examines the sectoral allocation of credit in 116 countries since 1940 and, inter alia, finds that greater credit to non-tradable sectors, including construction and real estate, is associated with a boom-bust pattern in output, similar to household credit booms. Such lending booms also predict elevated financial crisis risk and productivity slowdowns. Other evidence for a negative relationship between rising real estate values and productivity can be found in the US, China, Spain and other EU nations, see Doerr (2020) and Chakraborty et al. (2018) for the US, Hau and Ouyang (2021) for China, Basco et al (2022) on Spain, and Grjebine et al. (2022) on European countries.

England and Zhao (2005) examine the split-rate property tax in Dover, a small town in New Hampshire, finding that a shift to a pure land value tax would be regressive. For other cities, Bowman and Bell (2008) and Plummer (2010) find the opposite. Barbosa and Skipka (2019) analyse more comprehensive data than previous studies, but confined to owner-occupiers. For Germany, they find that land ownership is more concentrated than house ownership, but land values are slightly less correlated with cash income than overall house values. They find that among owner-occupiers a shift from a property tax to a pure LVT would create somewhat more losers than winners in the lower income quintiles. However, as over half of German households are renters, the opposite conclusion almost certainly holds for households in general.

After I raised the question of the error, it was corrected, and the following article explains what had happened. “For the period from 1990 to 2000, the residential real estate series, consisting of dwellings and land underlying dwellings, was previously understated due to a back-casting method that lacked complete coverage of dwellings to value the land underlying dwellings in Canada. The previous dwelling count used in the National Balance Sheet Account calculation represented only a subset of the 1991 census dwelling count”, see https://www150.statcan.gc.ca/n1/en/pub/13-605-x/2023001/article/00006-eng.pdf?st=GZ_03Jsj.

In the context of national balance sheets, Kumhof et al. (2021) argue that this ‘residual’ method tends to underestimate land values.

Contrasting the use of hedonic methods to value underlying land values in contrast to homes, it is likely that hedonic land value estimates are more accurate than home value estimates. This is because land price gradients tend to be smooth – adjoining parcels usually have very similar values – in contrast to homes, which often differ in size and character. Noisy idosyncratic differences in ‘building-plus-land’ parcels tend to be averaged out in the land value estimates.