This Policy Note is based on “Rethinking Electricity Tariff Design in the Era of Empowered Customers”, RaboResearch, 2023.

Electricity tariff design can reduce costs and create efficiencies for the electricity value chain and consumers alike. With more consumers investing in distributed energy resources (DERs) like solar panels and electric vehicles, strategic tariff design – for example, incorporating time-variant pricing structures – can make the entire system more efficient and economical for all. Well-designed, cost-reflective electricity tariffs can strategically influence customers’ investment in DERs, grid usage, and consequently grid reinforcement.

Distributed energy resources, or DERs, are typically small-scale energy resources located near a source of electricity demand. They are mainly used in residential and commercial sectors to provide on-site energy to associated users or owners. DERs include photovoltaic systems (PVs), electricity storage, electric vehicles, and heat pumps. Owners typically use or install DERs to reduce costs, namely, their electricity bills. Other incentives may include securing backup off-grid power generation to avoid supply interruptions, or reducing one’s carbon footprint. Through DERs, owners become “prosumers” (producer-consumers) or even “prosumagers” (encompassing production, consumption, and storage). These owners can optimize their energy portfolio to avoid paying part of the costs charged by their electricity provider, depending on the local tariff structure in place.

The emergence of prosumers and prosumagers is causing policymakers and regulators to rethink the design of electricity tariffs to ensure efficient grid utilization by encouraging customers to behave in a certain way, as well as the avoidance of unintended consequences. How tariffs are designed highly influences how customers react and, consequently, the size of their electricity bills. Understanding the interaction between electricity tariffs and customers’ behavior, including their adoption of DERs, can help designers shape efficient electricity tariffs in an era of active customers.

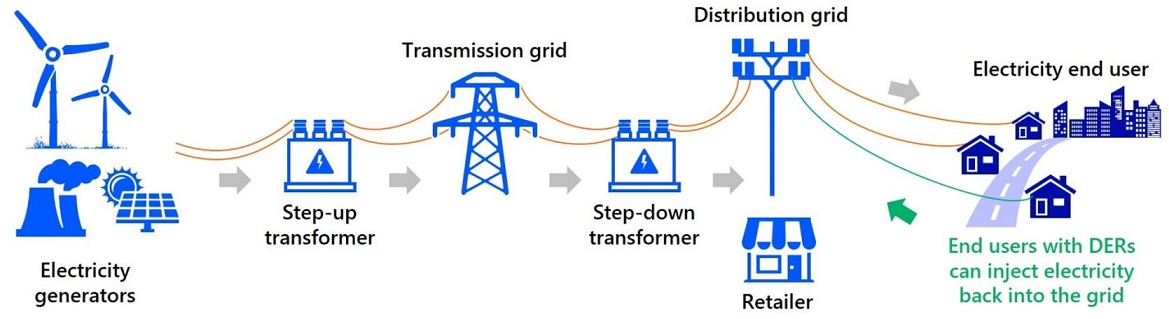

Electricity bills represent the combined costs of the main activities carried out by all parties in the chain to deliver electricity to the customer, as illustrated in Figure 1. This is true worldwide, regardless of the type of customer. Costs include electricity generation (energy prices), transport (the use of transmission and distribution grids), retail services (via entities that purchase wholesale energy from generators and offer end users a contract for supplying electricity), administrative activities, and taxes. In the EU, the energy price component in liberalized electricity markets is based on the wholesale electricity market, whereas transport costs are typically fixed by the regulator. The total cost of these main activities are translated into an electricity tariff imposed on customers.

Source: Rabobank 2023.

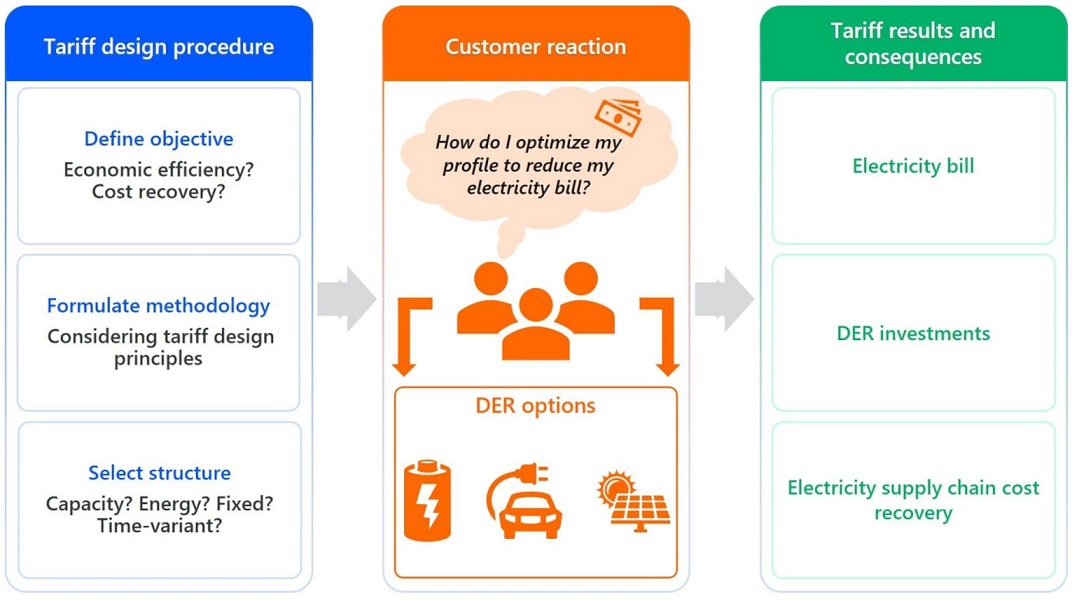

Tariffs – also called charges or rates – refer to the fee charged to customers for the electricity service they receive. In the EU, energy regulators first define the objectives of electricity tariffs. At a time when active customers are taking on the role of prosumer or prosumager, a tariff’s primary objective should be economic efficiency. This means providing electricity at the minimum possible cost to customers by incentivizing them to behave and use electricity in a way that minimizes total system costs. Second, energy regulators formulate a methodology to achieve these objectives following various tariff design principles that include sustainability/sufficiency, equity, economic efficiency, additivity, simplicity, consistency, stability, and transparency. A well-designed tariff should transmit the right economic signals to trigger customer behavior aligned with the tariff’s objectives. For example, regulators who want to reduce pressure on electricity grids might increase prices during peak hours. Finally, a tariff structure is selected and imposed on the customer (see Figure 2).

Source: Rabobank 2023.

Globally, tariff structures combine one or more charge components, plus an optional temporal element related to the time of energy use. The three main charge components include:

Some tariff structures may also include a temporal aspect, aimed at encouraging an implicit customer response. The most popular time-variant tariff options are:

Different tariff structures incentivize electricity customers to change their behavior in different ways. Volumetric charges are widely preferred as the concept is simple and socially acceptable: You pay for the energy you use. Many countries use these charges, following the outdated assumption that customers’ consumption profiles are passive/unresponsive and monolithic. This is also because traditional meters are unable to provide detailed data such as peak consumed power. However, nowadays, with the growing use of smart meters, energy-saving appliances, and DERs, the assumption of a homogenous, passive consumer is no longer valid. Consumption patterns can differ vastly between electricity users, and customers can potentially avoid or decrease some electricity costs by reducing their consumption or investing in DERs under volumetric charges.

Since grid investments are driven by capacity magnitudes to deal with peaks rather than by energy magnitudes, capacity is a better proxy for a customer’s contribution to grid costs. Capacity charges tend to incentivize customers to reduce their peak consumption. In increasingly congested electricity grids, this type of tariff structure can help prevent the need for system operators to overly invest in the grid to accommodate a brief peak moment. However, in underutilized grids, capacity-based tariffs are not recommended, as it is inefficient to encourage customers to unnecessarily reduce their peak consumption. In this case, fixed charges are an attractive way to minimize deadweight loss1 while maintaining stable revenue, because fixed tariff structures do not incentivize customers to change their electricity consumption behavior.

Compared to flat prices, prices that better reflect the time-varying costs of electricity can lead to a number of economic and environmental gains for society. For example, ToU tariffs influence customers to shift their peak usage to low-price periods. VPP tariffs provide an even stronger economic signal than ToU tariffs, in turn offering consumers a greater incentive to avoid peak periods. CPP tariffs, on the other hand, narrow the time periods for desired peak reduction, influencing customer behavior only during critical events. Finally, dynamic pricing bases tariffs on the most realistic status of current electricity costs. However, this is often considered unattractive due to its lack of predictability. Although other sectors such as airlines, hotels, rental car firms, and railroads regularly use dynamic pricing, it is still less socially acceptable for electricity prices because of its volatility.

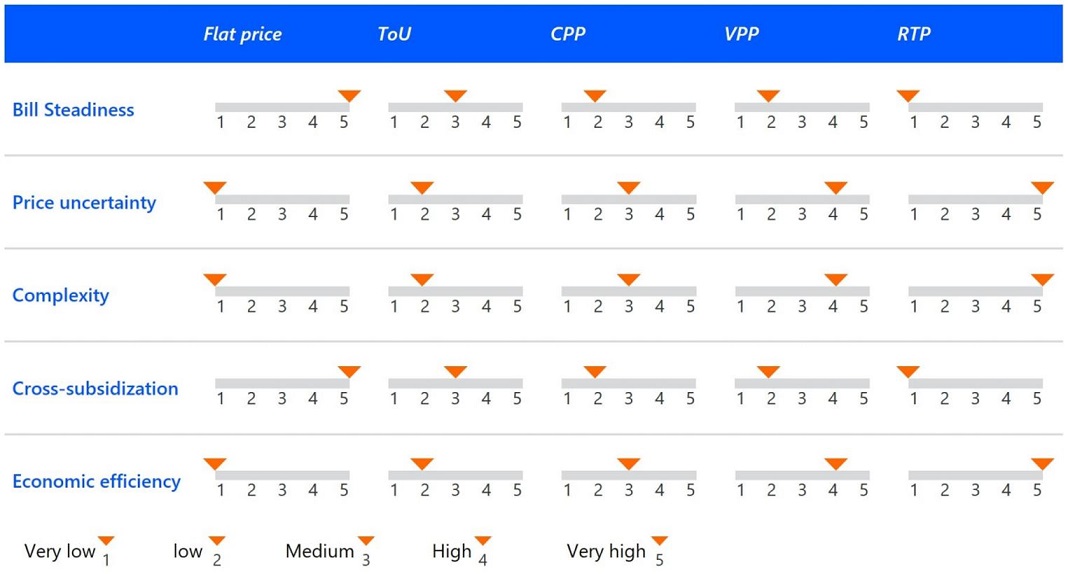

Figure 3 compares the different time-variant tariff options. Bill steadiness, price uncertainty, and tariff complexity are the main factors that influence customer acceptance, while cross-subsidization and economic efficiency are potential outcomes of different tariff structures. Cross-subsidization refers to when one set of customers receives favorable prices at the expense of other customers. This is the case for flat prices, which do not consider the time of electricity usage. Economic efficiency, on the other hand, refers to providing electricity to customers at least cost possible, through incentivizing efficient and coordinated behaviors and investments to minimize the total system cost. Hence, tariff options that convey the electricity system’s conditions are expected to encourage efficient customer behavior that maximizes economic efficiency.

Source: Rabobank 2023.

Fixed charges are commonly used to cover administrative and retail costs and are typically a relatively small portion of customer’s total bill. The remaining part of an electricity bill is a trade-off between energy and capacity charges. Although different approaches are deployed within the EU, the majority of countries follow the principle of energy-based tariffs, where most electricity costs are covered through energy charges. This is the case in Germany, France, Denmark, Sweden, Finland, and the Netherlands. For example, in the Netherlands, tariffs are based on contracted volumetric (energy) consumption, and households and small commercial customers pay no capacity charges. However, distribution costs are collected through fixed charges based on the connection capacity. Estimated annual energy consumption is distributed equally throughout the year to give customers a stable monthly payment. At the end of the year, based on their actual consumption, customers receive or pay the difference. ToU and dynamic tariff contracts are also available for customers who want them.

In Belgium, in the Flanders region, a so-called “capacity tariff” was introduced earlier this year. This means that part of the user’s total electricity costs are covered through capacity charges based on the maximum capacity consumed. The remaining costs are covered through energy charges. Hence, customers are exposed to both: a capacity charge based on peak consumption and an energy charge based on total energy consumption.

In Spain, contracted capacity charges play a major role in the electricity bill and are complemented by energy charges. A pre-defined maximum capacity is contracted in advance, programmed into the fuse, and reflected in the bill accordingly. The fuse is a piece of equipment that prevents the customer from physically exceeding their contracted capacity.

Electricity customers need clear economic signals and incentives to convince them to change their patterns of energy consumption and/or injection of electricity back into the grid. They are generally loss averse and are expected to act rationally to economic signals. Still, a customer’s willingness to respond varies according to the value of the economic benefit they are expected to gain or the future economic burden they might incur. Ideally, customers evaluate the pros and cons of different choices or actions and select the option that is either the most beneficial or least costly to them. These choices include investing in different distributed energy resource options.

Depending on the DERs deployed, electricity customers are able to alter their electricity consumption/injection profile to opportunistically reduce their bills. For example, in the Netherlands, small residential or commercial customers (“kleinverbruikers”) with a volumetric-based flat price contract, net metering, and DERs (for example, rooftop solar panels) can inject excess electricity produced into the grid. Regardless of when they consume from or inject into the grid, the total energy injected into the grid is subtracted from the total amount consumed annually. The net electricity bill is settled according to a pre-defined price depending on whether the net amount is injected or withdrawn from the grid. The lack of a temporal factor in this scenario gives these prosumers the great advantage of using the grid as their own virtual seasonal storage. One could argue that they dump great amounts of energy into the grid during the summer through their solar panels and claim it back during the winter when they are not self-generating enough. However, customers exposed to dynamic prices, such as hourly alternating electricity prices, are less likely to behave this way. If prices differ greatly between seasons, then the virtual seasonal storage comes at a cost.

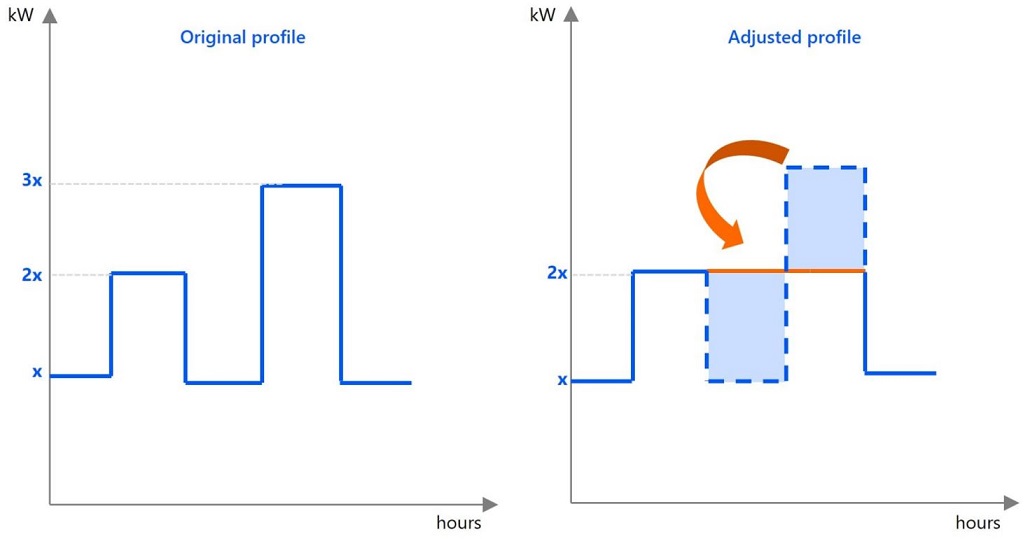

A different behavior is expected in Belgium, where customers were recently exposed to the aforementioned capacity charge, in which part of their electricity bill is based on their peak consumption/injection. Under this new tariff structure, customers are expected to focus primarily on reducing their peak capacity use by shifting their consumption or injection times to flatten their energy profile. For example, a customer with the “original profile” shown in Figure 4 may decide to adjust their energy profile – for example, by changing when they consume electricity – to reduce their bill. In this case, the customer is able to reduce their bill by approximately a third, depending on the other components within the bill.

Source: Rabobank 2023.

Many policies and subsidies in EU countries encourage DER deployment to meet their renewable energy targets. This, in turn, has several consequences for distribution system operators (DSOs), who manage the electricity distribution grid that DERs are connected to. These include:

Overall, DERs can provide several benefits to DSOs, like improving system reliability and resiliency. If optimally integrated in the distribution grid, DERs can also reduce grid congestion and replace costly grid investments. However, DERs can also create multiple challenges if poorly coordinated. Tariff design can potentially mitigate these challenges. Thus, tariffs should be efficiently designed and forward-looking to optimally guide DER investments and enhance grid usage.

With expected levels of electrification increasing across all sectors of the economy, plus more flexible energy consumption and volatile renewable energy production, the energy transition is creating new cost drivers. Therefore, future tariff design should preferably focus on better allocating costs to customers according to their contribution to these costs. It should also reward customers for their flexibility when they reduce overall costs in the electricity system.

Clear presentation of information, such as prices and the electricity system status, and use of automation and enabling technologies are key to guide customers efficiently. The simpler the tariff structure, and the easier it is to comprehend, the more likely customers will be able and willing to respond with the desired behavioral changes. Customers will not be able to respond to price signals if they cannot relate price structures to their electricity usage decisions. Enabling technologies, including display devices that allow customers to track and manage their electricity usage, can help.

On the grid side, transmission system operators (TSOs) and DSOs should clearly identify their grid’s needs and communicate them effectively to customers to unlock available flexibility within the system before pursuing costly grid reinforcements. TSOs and DSOs can have a relatively clear view of grid needs – especially TSOs, as it is pretty straightforward to monitor electricity flows and bulk generation investments to see what upgrades and flexibility services are needed in transmission grids. Accurate demand-side, or DSO-side, information remains as a challenge though. DSOs have a relatively complicated task, as they continue to work with an outdated approach that does not unlock the demand-side flexibility available within their grids. DSOs need to modernize, collect detailed electricity flow information (and preferably DER-related data as well), and efficiently value and utilize the available flexibility within their grids.

Finally, well-designed, cost-reflective electricity tariffs can be a strategic tool to influence customers’ DER investment decisions and grid usage in a way that maximizes economic efficiency. Tariff design should promote grid peak management and efficient DER investment decisions that benefit the customer while minimizing the need for grid reinforcement by DSOs. Time-variant tariffs should be widely deployed to reflect electricity costs, grid status, and the impact imposed by each customer in order to efficiently incentivize them to behave efficiently in a way that benefits all parties involved.

To future-proof electricity tariffs, regulators should focus on better allocating costs to customers according to their contribution to these costs. They should also reward customers for their flexibility when they reduce overall costs in the electricity system. Hence, well-designed, cost-reflective electricity tariffs can be a strategic tool to influence customers’ DER investment decisions and grid usage in a way that maximizes economic efficiency. For example, Net metering combined with volumetric tariffs unfairly give customers the opportunity to use the grid as their own virtual seasonal storage. Time-variant tariffs should be widely deployed to avoid cross-subsidization between customer groups. It should reflect electricity costs, grid status, and the impact imposed by each customer in order to efficiently incentivize them to behave efficiently in a way that benefits all parties involved.

Deadweight loss refers to inefficiency in the market due to overproduction or underproduction of products and services, causing a reduction in the total economic surplus.