Disclaimer: The views expressed in this policy brief and all errors and omissions should be regarded as those of the authors and not necessarily those of the Deutsche Bundesbank, the Eurosystem, Qatar Central Bank, or the Bank of England.

This article studies the impact of a digital euro on financial stability. Our survey findings indicate that German households are open to the digital euro – suggesting they perceive that there are benefits to accessing a central bank digital currency. However, demand for the digital euro raises concerns about strong outflows of deposits from the banking sector, with potential implications for financial stability. We study this issue in a new macroeconomic model and conclude that the digital euro – if complemented with an appropriate holding limit, i.e. the maximum digital euro amount that an individual is permitted to hold – can actually strengthen financial stability and improve welfare.

In October 2023, the ECB Governing Council moved to the preparation phase of the digital euro (D€) project – a significant step towards the possible introduction of central bank digital currency (CBDC) in the euro area. In a new study (Bidder, Jackson and Rottner, 2024), we examine the impact of CBDC on banks and financial stability – a key subsidiary debate within the broader CBDC context (see, for example, Niepelt, 2021; Bindseil, Cipollone and Schaaf, 2024).

Using survey data to explore the public’s attitude towards the D€, we find that a large portion of German households would hold D€ if given the option. Part of this demand for D€ implies withdrawals from bank accounts. In normal times, this could reduce banks’ ability to raise funds cheaply through deposits but also reduce leverage. During periods of banking distress, banks may be vulnerable to runs, and we find that a D€ could exacerbate that risk. Why? Because the D€ would be a risk-free asset that can be held in large amounts – a safe haven in a bank run. Indeed, given news of banking distress, the surveyed households predict that they would withdraw more money from banks if they had access to the D€.

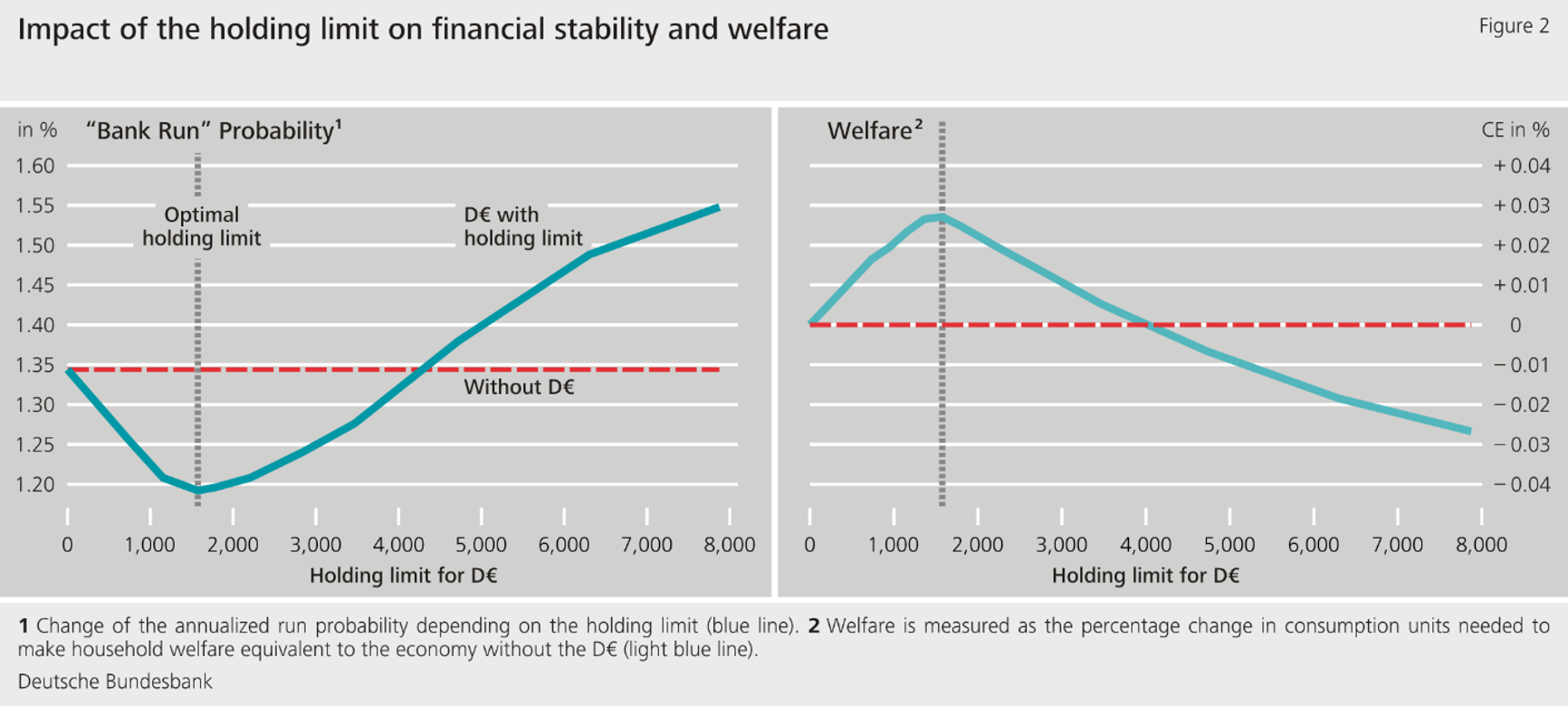

To examine these issues, we develop a macroeconomic model featuring CBDC and bank runs. We find that the introduction of the D€ with a holding limit – the maximum CBDC amount that an individual is permitted to hold – strengthens financial stability and improves welfare. Such a holding limit (our model suggests something between €1,500 and €2,500) would allow some room for demand for CBDC to be met and some benefits of a D€ to be realised whilst at the same time limiting the risk of a bank run.

As no large developed economy has yet issued a CBDC, our survey results are especially useful in benchmarking household interest. This information is vital in planning the introduction of the D€ in pilot form.

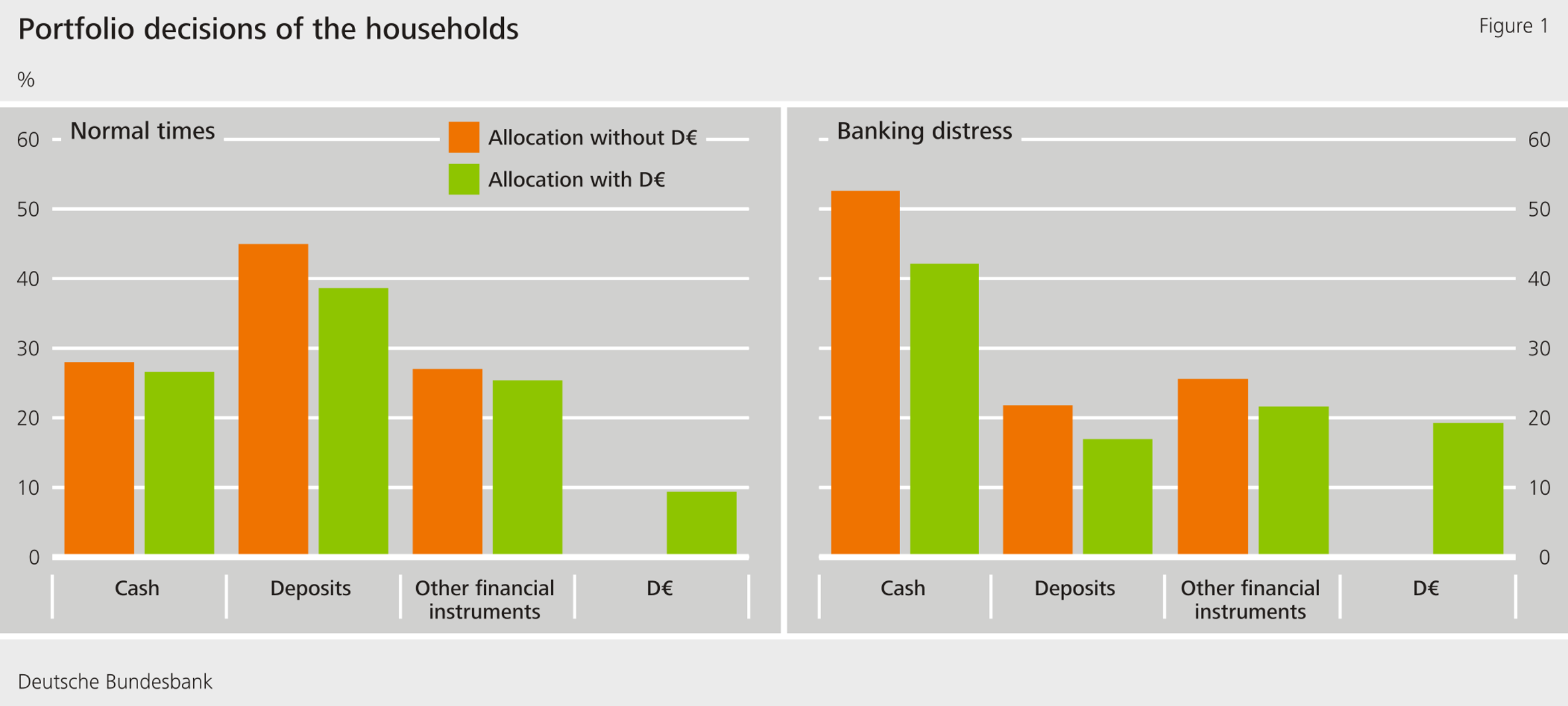

Based on the responses from approximately 6,000 survey participants, we gain insight into how people might allocate funds in a hypothetical portfolio. We ask how they would allocate funds in “normal times”, both with and without the option of holding D€. We also ask how much of their money they would withdraw from a commercial bank account during periods of “banking distress”, again both with and without the option of holding D€.

A key finding from the survey is that German households are open to the D€, as shown in the portfolio allocations in Figure 1 (left panel). A substantial share of German respondents would include D€ in their portfolios in normal times – replacing, in part, deposits with commercial banks. This reallocation is hypothetical evidence of “slow” disintermediation within the banking system. It does indeed seem that, given the opportunity, consumers would switch from privately provided digital money (in the form of bank deposits) to publicly provided digital money. As banks are traditionally seen as a link between savers and borrowers, a decline in the volume of funds deposited with banks could lead to a loss of significance in their role as financial intermediaries.

Respondents’ willingness to shift to D€ appears even greater during period of banking distress, implying a risk of “fast” disintermediation, as shown in Figure 1 (right panel). The dominant asset to withdraw to is cash, but the D€ plays an important role too. If a D€ were available, almost one-fifth of deposits would be reallocated to the D€ in our distressed banks scenario. In addition, more bank deposits would also be withdrawn overall in this scenario. As such, concerns of a D€ increasing bank run risk should perhaps be taken seriously.

In order to explore how a D€ should be designed, we develop a macroeconomic model featuring CBDC and bank runs. As we do not have any historical data on CBDC usage, we set up our model to match the average ratio of cash to CBDC based on our survey. We also assume that CBDC does not pay interest, to align with plans for a digital euro.

Our model reveals two contrasting effects of CBDC on financial stability. First, it competes with bank deposits as a means of payment. Households reallocate money from bank accounts to CBDC, reducing the indebtedness of the banking sector whilst increasing liquidity in financial markets. Since banks in our model are prone to damaging runs, decreasing bank debt implies that CBDC strengthens financial stability through this “slow” disintermediation. However, CBDC could also spark destabilising “fast” disintermediation by increasing the likelihood of bank runs. Unlike cash, a D€ without holding limits can easily be held at scale. As a D€ is easy to run to, bank runs are more likely, leading to a dramatic fire sale of securities as banks fail. In our model calibrated for the euro area, the second effect is dominant, meaning that an unlimited D€ would lead to a net deterioration in financial stability.

Holding limits are a natural component of the D€’s design to counter the destabilising effect of CBDC. Correctly calibrated, they can prevent runs to CBDC in periods of banking distress whilst at the same time giving households sufficient latitude to hold adequate amounts of CBDC in normal times and to take advantage of the benefits of the D€.

Our study contributes to the active debate on the level at which holding limits should be set (e.g. Angeloni, 2023; Panetta, 2023; Deutsche Bundesbank, 2023). Our model calibrated for the euro area and our new survey data on D€ demand suggest that the holding limit should be set at around €1,500, as shown in Figure 2. Raising the holding limit initially reduces the probability (left panel) of a bank run. However, if the holding limit is too generous, the probability rises again due to the growing risk of fast disintermediation. For this reason, an increase in the holding limit initially has a positive effect on welfare (right panel), but this effect decreases again if the holding limit is too high. In a more optimistic scenario for CBDC demand, which is based solely on responses from households with positive D€ demand, the optimal holding limit would be closer to around €2,500 in our model.

Our survey results indicate that German households are open to using the D€ as a novel means of payment, but that it may also pose risks to financial stability. Our analysis has identified two opposing effects of CBDC on financial stability: first, a certain contraction of the banking sector is to be expected, and second, a means of payment is created that could, in principle, be held in large quantities during a banking crisis. If CBDC is introduced without a holding limit, the second (destabilising) effect could dominate and increase the likelihood of a bank run. However, a correctly calibrated holding limit reduces the risk of a bank run while preserving the benefits of a smaller banking system, meaning that a D€ paired with a holding limit may improve financial stability and, with it, welfare.

Angeloni, I. (2023), Digital Euro: When in doubt, abstain (but be prepared), European Parliament.

Bidder, R., Jackson, T., and Rottner, M. (2024), CBDC and Banks: Disintermediating Fast and Slow, Bundesbank Discussion Paper.

Bindseil, U., Cipollone, P., and Schaaf, J. (2024), The digital euro after the investigation phase: Demystifying fears about bank disintermediation, VoxEU.org, 19 February.

Deutsche Bundesbank (2023), Digital euro: holding limits and their potential impact on the liquidity of German banks, Financial Stability Review 2023.

Niepelt, D. (2021), Central bank digital currency: Considerations, projects, outlook, VoxEU.org, 24 November.

Panetta, F. (2023), Shaping Europe’s digital future: the path towards a digital euro – introductory statement at the Committee on Economic and Monetary Affairs of the European Parliament, speech, European Central Bank, 4 September.