This policy brief should not be reported as representing the views of the European Central Bank (ECB). The views expressed are those of the authors and do not necessarily reflect those of the ECB.

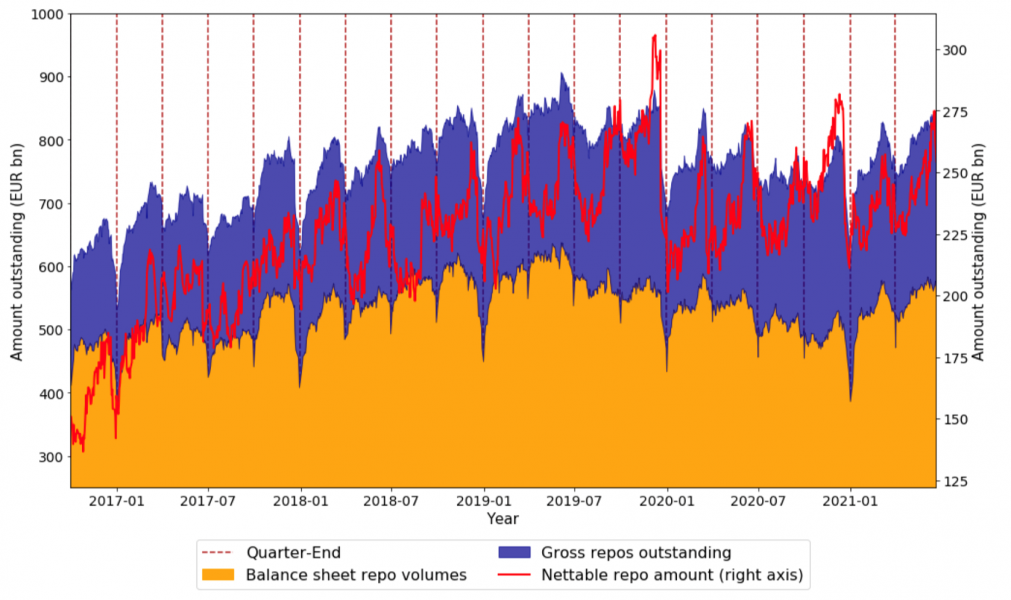

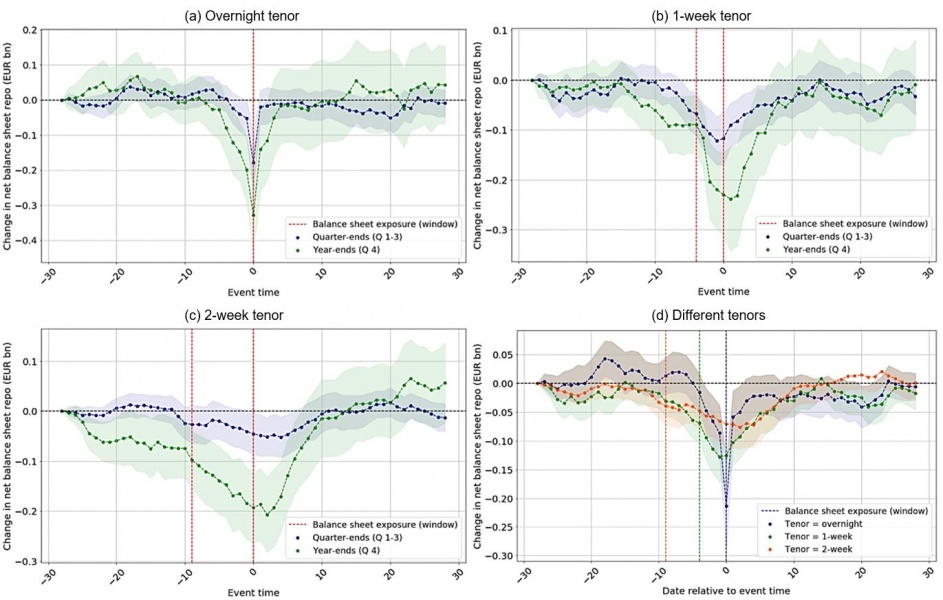

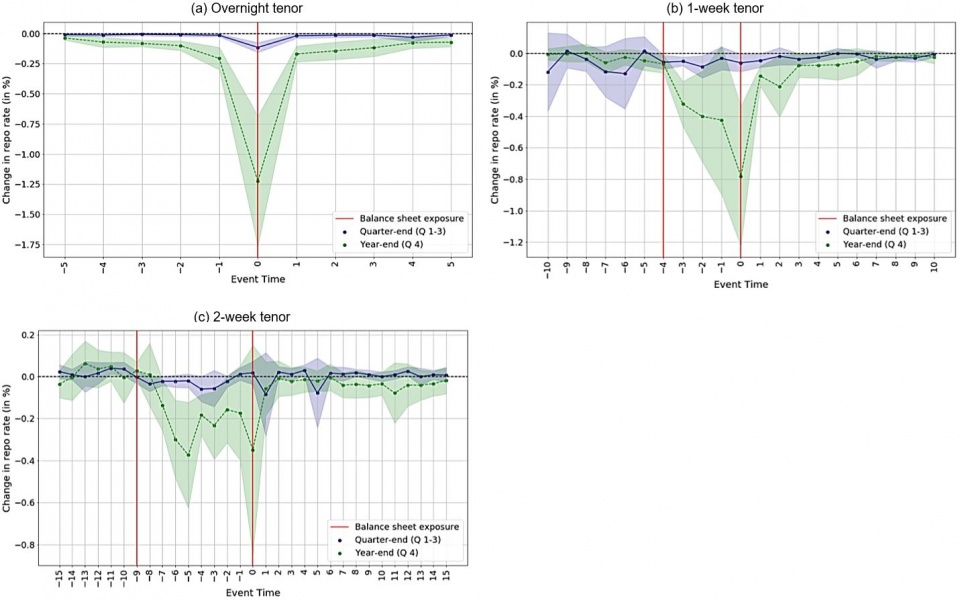

Banks’ ability to temporarily contract their balance sheets around reporting dates to report more favourable regulatory metrics – a regulatory arbitrage practice commonly referred to as window dressing – poses a risk to financial stability. In this paper, we investigate both the magnitude and the drivers of bank window dressing behaviour in euro-denominated repo markets. Using a confidential transaction-level data set, our analysis illustrates that banks engineer an economically sizeable contraction in their repo exposures around regulatory reporting dates. We establish a causal link between these reductions and banks’ incentives to window dress and document the role of the leverage ratio and the G-SIB framework as the most relevant drivers of window dressing behaviour. Our findings suggest that regulatory action is warranted to limit banks’ ability to window dress.

This contrasts with risk-weighted capital ratios. Cash has a risk weight of 0% and therefore does not enter the denominator of risk-weighted capital ratios.

For example, a one-week repo contract that is entered six trading days before the reporting date will have matured by the time of the reporting date. This contract is thus not balance sheet intensive from the perspective of the bank.