Using an extensive dataset on public speaking events by ECB and euro area National Central Bank (NCB) officials, we show that communication outside of ECB regular monetary policy meeting days has a significant effect on daily movements of several key euro area financial variables. Remarks of ECB presidents are the most important in driving market reactions outside regular meeting days. In addition, ECB presidents’ remarks given ahead of meetings with policy changes have a significant effect on Eonia OIS rates of the same sign as the subsequent policy decision. Our results highlight the importance of inter-meeting communication when studying the effects of monetary policy.

Central bank communication is important in ensuring the effectiveness of monetary policy, and in supporting the credibility, accountability and legitimacy of independent central banks. To assess its effectiveness, the literature has focused on market movements around announcements on policy meeting days. However, central banks also communicate substantially in the inter-meeting periods. In fact, within a year, this communication is at least 10 times the number of ECB Governing Council policy meetings. Does inter-meeting communication provide a systematic policy signal and move markets?

In a recent study, we assess the importance of various dimensions of the ECB’s and the Eurosystem’s communication for financial markets (Istrefi, Odendahl and Sestieri, 2022). To this aim, we constructed a Euro Area Communication Event-Study Database (EA-CED) containing daily and intra-day changes of more than 60 financial variables around different ECB/Eurosystem communication events. This database provides ample opportunity to investigate the effect of central bank communication (including policy actions) on financial markets.

The EA-CED database comprises two types of communication events: on ECB Governing Council (ECB GC) policy meeting days (i.e. the policy announcement2 and the meeting Accounts publication) and outside of monetary policy meeting days (CoMPDs). CoMPD events comprise remarks by (i) ECB presidents, (ii) other members of the ECB Executive Board (EB), (iii) ECB Governing Council members representing the French, German, Italian and Spanish national central banks (NCBs), and (iv) European Parliament hearings of the ECB president.

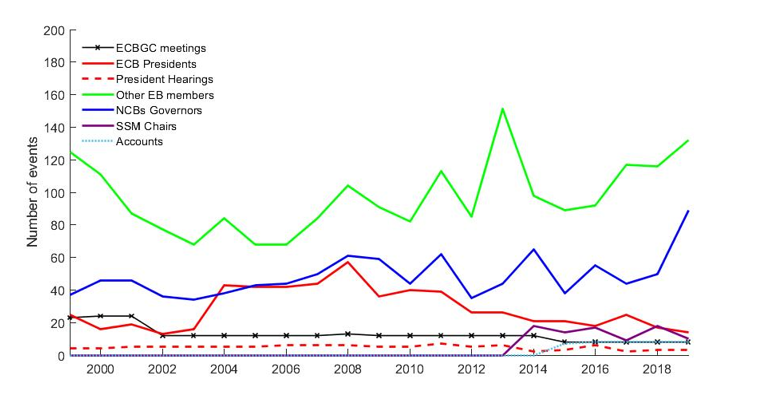

Looking at the evolution of ECB-related communication since 1999, we observe that there is a considerable amount of communication outside of monetary policy meeting days (Chart 1). On average, in our sample, there are 185 CoMPDs events per year compared to 12 ECB Governing Council policy meetings. The beginning of the euro started with extensive communication from all the ECB/Eurosystem officials, with about 180 CoMPDs events in 1999. In the following years, CoMPDs decreased and then picked up during the financial crisis of 2007-2008, culminating in 2013, the year the ECB announced forward guidance on interest rates. Interestingly, the ECB president has delivered fewer speeches since the financial crisis while speaking events of other Governing Council members have increased over the years.

Chart 1. ECB/Eurosystem communication events

Source: Istrefi, Odendahl, Sestieri (2022). The chart shows CoMPDs by the ECB presidents, other members of the ECB Executive Board, NCB governors (BdF,Buba, BdI, BdE) and the SSM Chairs; number of EU Parliament Hearings of the ECB president, ECB Governing Council monetary policy meetings and Accounts’ publications. All events are displayed at an annual frequency.

Using an event study approach on daily data, we find that various forms of CoMPDs have significant effects on Eonia Overnight Index Swap (OIS) rates, on country-specific sovereign bond yields, and market-based inflation expectations, at different maturities. These results are robust to controlling for other relevant economic events like main macroeconomic releases for the euro area and the U.S., the Federal Reserve’s monetary policy events, and day/month effects.

With regard to the speaker, we find that CoMPDs events by the ECB president have the strongest effect on daily market movements. These effects are comparable in size to those on ECB meeting days3. These results hold systematically and are not driven by a few key speeches, such as Mario Draghi’s “Whatever it takes” speech in London in July 2012 among others, or exclusively by the communication of one particular ECB president. However, we also find that there is a difference between the effect of CoMPDs before and after the financial crisis. In the pre-crisis period, the communication of NCB governors and ECB Executive Board members moved markets significantly. In the post-crisis period, it is mainly the ECB president’s communication.

Finally, an intra-day analysis of CoMPDs events confirms the evidence of systematic movements in the Eonia OIS yield curve using short windows of time around speeches of ECB presidents, in line with the daily regression analysis.

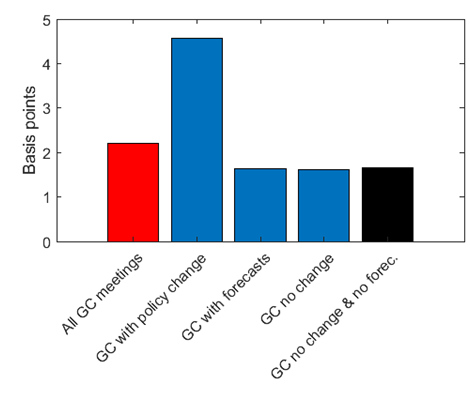

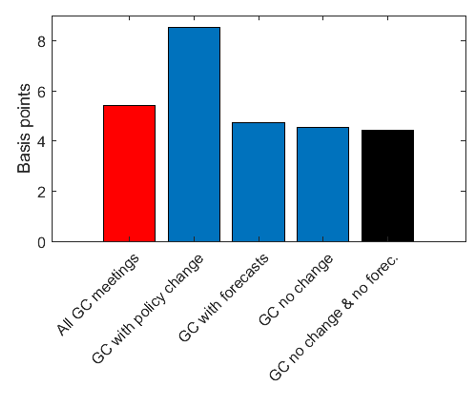

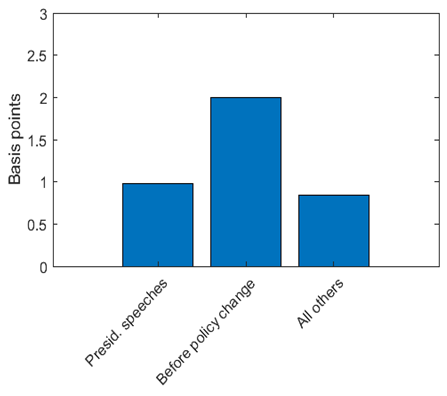

To investigate this issue, we focused on CoMPDs events taking place in the few weeks before ECB meetings with announcements of a monetary policy change (easing or tightening of both conventional and unconventional monetary policy measures). First, looking at stylized facts, we observe that market movements are stronger on days with ECB presidents speaking events ahead of meetings with policy changes (Chart 2, panel c, d). We also observe that not all ECB GC meetings are the same, as market movements are larger on days of meetings with a policy change (Chart 2, panel a, b)4.

Chart 2: Mean absolute changes in EONIA three-month rates and ILS2Y2Y

| (a) Eonia 3-months on ECBGC days | (b) ILS 2Y2Y on ECBGC days |

|

|

| (c) Eonia 3-months on CoMPDs by Presidents | (d) ILS 2Y2Y on CoMPDs by Presidents |

|

|

Note: Panel (a) and (b) present mean absolute changes computed at a daily frequency over different ECBGC monetary policy meeting days (all meetings, meetings with policy changes, meetings with new ECB/Eurosystem staff macroeconomic forecasts, meetings with no policy changes and meetings with neither policy changes nor new forecasts). Panel (c) and (d) display mean absolute changes computed at a daily frequency on days of CoMPDs events by ECB presidents for (i) all speaking events, (ii) speaking events given ahead (within three weeks) of meetings with policy change, and (iii) the remaining other speaking events.

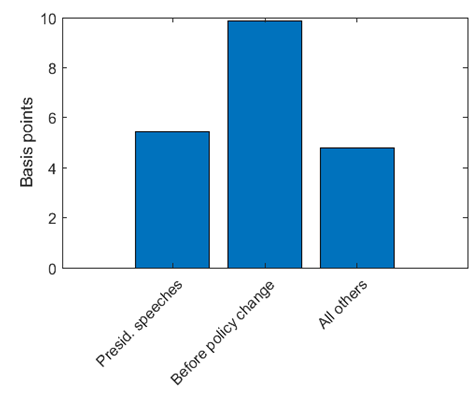

Second, using our event study approach, we find that ECB presidents’ remarks given ahead of meetings with policy changes have a significant effect on Eonia rates of the same sign as the subsequent policy decision. Thus, there is an easing (tightening) signal in the ECB presidents’ speeches ahead of policy meetings with monetary policy accommodation (tightening). Interestingly, the easing signal is mainly reflected on the movement of short-term OIS rates while the tightening signal in medium to long-term OIS rates.

Reading of Bloomberg news coverage of those ECB president speaking events ahead of meetings with policy changes corroborates our finding, revealing that some of the remarks contain a clear signal about the upcoming policy move. For instance, Bloomberg News reported the following after a speech of the ECB president in June 2011:

“We are taking the decision progressively to anchor inflation expectations,” Trichet said at a [non-GC meeting] press conference in Amsterdam today […]” As far as we’re concerned, we’re in strong vigilance mode,” he said, repeating a phrase the ECB uses to indicate a rate increase is imminent. The euro rose more than a cent after the comment to $1.435 at 1:50p.m. in New York.”

Indeed, the ECB GC raised the main refinancing operations rate of the Eurosystem by 25 basis points on its next meeting on July 7, 2011.

In this policy brief, we highlight the importance of communication outside of meeting days for understanding the transmission of monetary policy to financial markets. Our findings suggest that looking only at announcements during monetary policy meetings to identify monetary policy shocks or surprises, neglects potentially relevant policy signals coming from the inter-meeting communication of ECB policy makers. In the near future, we will investigate further the implications of this finding across different dimensions.

Altavilla C., Brugnolini L., Gürkaynak R., Motto R., Ragusa G., (2019): ”Measuring Euro Area Monetary Policy”, Journal of Monetary Economics, Vol. 108, p. 162-179

Istrefi K., Odendahl F. and Sestieri G. (2022): “ECB Communication and its Impact on Financial Markets”, Banque de France Working Paper No. 859.

The views expressed in this brief are those of the authors and do not necessarily reflect those of the Banque de France, the Banco de España or the Eurosystem.

Altavilla et al. (2020) have compiled and regularly update a comprehensive database of movements of key euro area financial variables over short windows of time around official ECB Governing Council monetary policy announcements. Our database is similar to theirs with respect to movements on regular meeting days but, in addition, includes daily and higher frequency movements around CoMPDs events for a larger set of financial variables.

For a given variable, we compare the sum of the effects on ECB GC meetings days with the sum of the effects of the average number of speaking events at a quarterly frequency.

A policy change here being defined as the announcement of a change in the policy rate, the announcement of a new unconventional measure, or the adjustment of parameters of an unconventional measure.