This policy brief is based on an earlier published journal article Gevorkyan, A.V. and T. Khemraj. 2019. Exchange rate targeting and gold demand by central banks: modeling international reserves composition. Emerging Markets Finance and Trade, Vol. 55(1): 168-180. And an earlier version of this policy brief appeared as a blog entry in Developing Economics: Gevorkyan, A.V. and T. Khemraj. 2018. “How We Learned Not to Say No to Gold… In International Reserves.” Developing Economics https://goo.gl/gwtkYU

This brief explores the optimal ex ante share of gold in central banks’ foreign exchange reserves under the condition of an exchange rate management system. The policy maker’s objective function includes the notion of a desired exchange rate subject to a risk-reward constraint. A risk-reward constraint allows us to numerically estimate a shadow price – interpreted as the central bank’s sacrifice of policy precision given an additional unit of international reserve portfolio variance or a return generated from holding more gold. The simulations indicate a two-regime demand for gold, suggesting that the monetary authority can have a wide percentage range of gold demand. Demanding a higher share of gold is appropriate if the central bank prefers to accumulate international reserves for precautionary reasons. The central bank would tend to incur greater exchange rate target sacrifice if it wants to achieve higher portfolio returns. The results suggest that ability to manage the exchange rate is unaffected by the higher volatility of monthly returns on gold over the stable regime.

In late November 2022, Ghana, one of the world’s top ten gold producers, implemented a new rule requiring the large mining companies to sell 20 percent of gold to the country’s central bank and for the smaller miners to sell their output to the state-run Precious Minerals Marketing Co. The intention is to use the bullion to barter for crude oil imports. The expectation is that adding gold to the Bank of Ghana’s reserves would stem the persistent depreciation of the country’s currency. Reliance on gold would limit the exchange rate pass through into the domestic utility prices (and general inflation), as foreign exchange would no longer be needed for local firms’ energy imports (Inveen and Akorlie 2022).

Ghana’s move, as idiosyncratic as it may appear on surface, is just one step in a larger trend across emerging markets. As early as 2009, China began buying gold. And according to the latest data from the World Gold Council (2023), the year 2022 was the strongest in gold buying over the past decade by the central banks. Emerging markets have been among the most active buyers, though under-allocated compared to the developed economies, for which gold holdings represent significantly higher shares (on average 20%) of total central bank reserves.

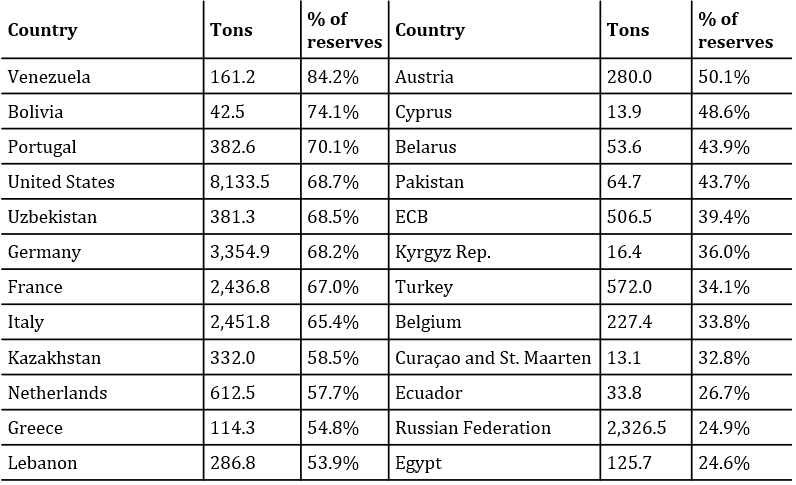

Impressing the rising significance of gold in the central banks’ holdings is the data in Table 1 reporting for countries with gold representing over 20% shares of reserves. According to the World Gold Council (2023), the average holdings for the emerging markets at the end of 2022 added up to just under 10% of reserves. However, Table 1, also reflects a significant variation of gold holdings by country. For examples, consider Venezuela (at 84.2%) in contrast to Uzbekistan (68.5%) and Russia or Egypt both averaging approximately 25% of gold in reserves. Behind the percentage shares there is also a wide variation in the absolute gold holdings and advanced economies (e.g., U.S.A., Germany, Italy, France, Switzerland) are the main hoarders of the world’s gold. Russia (at 2.3 million tons) and China (at 2.1 million tons) are the only two emerging market economies to match the advanced economies’ holdings.

Table 1: World gold official holdings, latest available

Source: World Gold Council (2023).

Note: all gold holdings data are as of Mar 2023, except for the following: Bolivia, Egypt, and Lebanon (as of Jan 2023), Ecuador (as of Feb 2023), Kyrgyz Rep and Turkey (as of Nov 2022), Venezuela as of (Jun 2018).

So, what may be driving this sustained interest in gold, especially for emerging markets? In May 2016, economist Kenneth Rogoff (Rogoff 2016) argued that central banks in emerging markets should add gold to their reserves. Rogoff stated “that a shift in emerging markets toward accumulating gold would help the international financial system function more smoothly and benefit everyone.” Despite our initial disagreement, we find there may actually be some justification for this view in our 2019 paper that was published in Emerging Markets Finance and Trade (Gevorkyan and Khemraj 2019).

Until recently, literature on the optimal composition of foreign exchange reserves could be divided into two groups. The first focused on demand for reserves for transaction purposes (Soesmanto et al. 2015, Eichengreen and Mathieson 2000, Dooley et al. 1989, Heller and Knight 1978). The second, using a Markowitz-type portfolio approach, studied currency composition of optimal foreign reserves (Ben-Bassat 1980, Papaioannou et al. 2006, Ito et al. 2015). On a more general level, some studies offer more comprehensive discussion of factors determining the optimal level of international reserves (e.g., Bahmani-Oskooee and Brown, 2002; Aizenman and Lee, 2007).

Instead, we develop an analytical model that allows for estimation of the shadow price of the target exchange rate. The shadow price measures how much of a sacrifice in terms of policy precision – meeting the exchange rate target – must the central bank incur in order to accumulate gold reserves. The idea is the volatility of gold price relative to Treasuries will have an implication for the stability of the stock of foreign reserves. Imperiling the portfolio stability could complicate the monetary authority’s ability to manage the exchange rate around a target that can be declared or undeclared. This means that while we explicitly assume that central banks in emerging (and frontier) markets target exchange rate stability, there may also be competing pressure to maximize portfolio returns based on the international reserves mix.

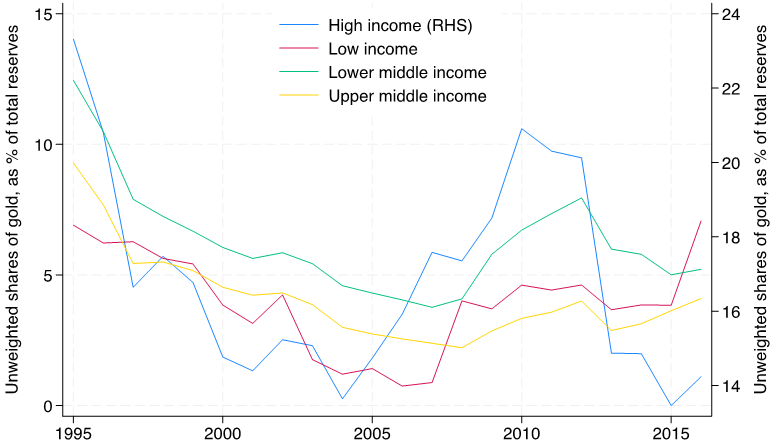

To be sure, gold is not a new asset to central banks’ portfolio, neither historically, nor recently (Fig 1.). However, there has been a steady decline in gold holdings as central banks shifted towards a hard currency (e.g. U.S. Treasuries) mix of reserves. The low income and middle-income economies have lowest shares with minor increases in the post-2008 years.

Figure 1: Percent of gold in central banks’ foreign reserves by country group

Source: Gevorkyan and Khemraj (2019).

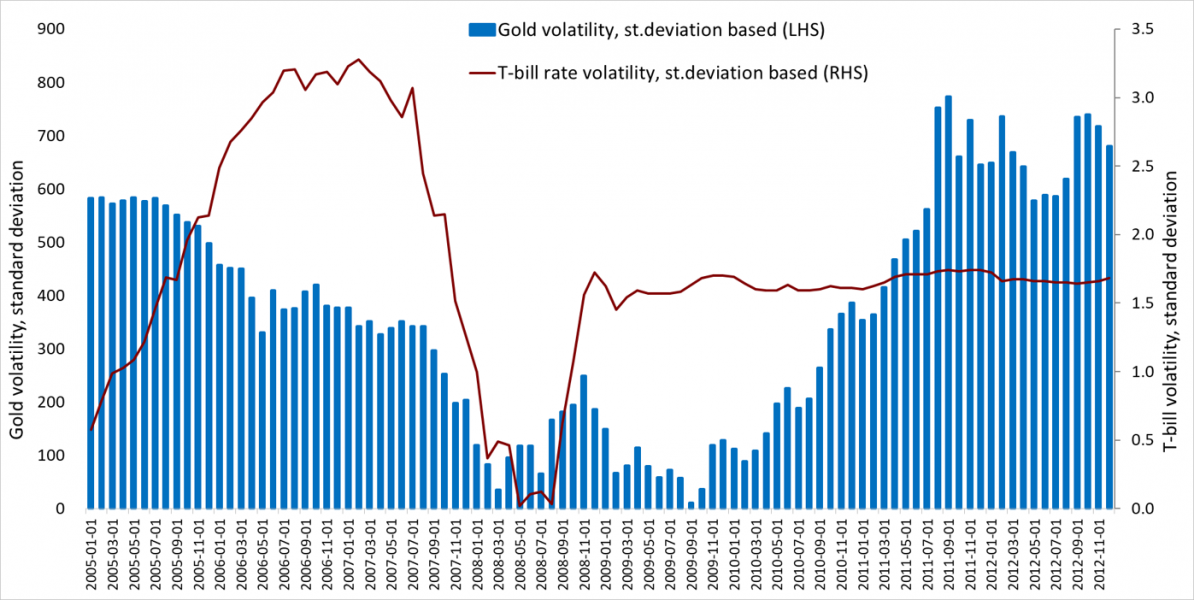

In the years before the 2008 Global Financial Crisis (GFC) both volatility of gold and U.S. Treasuries declined (Fig. 2). Gold dropped off first, rising momentarily, and then stabilizing. U.S. Treasuries followed, but on balance both assets may be seen as safe havens given their lower volatility during the GFC.

Figure 2: Estimated volatility of gold and U.S. Treasuries, 2005 to 2012

Source: Gevorkyan and Khemraj (2019).

In a simulated local economy in our paper, there may be range of preferences (and perceptions) towards currency depreciation (or policy devaluation) and appreciation, expressed by θ1 and θ2 respectively, given the central bank’s holdings of foreign reserves relative to the policy target. In many small open economies θ1 would tend to be greater than θ2 reflecting the higher aversion to devaluation or steep depreciation. At the same time π is the foreign exchange market’s expected subjective or calculated short-run probability of depreciation or devaluation.

The central bank’s exchange rate target – that requires foreign reserves balancing – is constrained by (i) the volatility introduced by adding gold to the portfolio of reserves; and (ii) a weighted reaction function that combines both portfolio variance and return. Some central banks might also want to manage foreign exchange reserves subject to returns (e.g. Pina 2017).

The central bank is assumed to react negatively to volatility and positively to returns. In the model this is captured by Ψ which takes values between 0 and 1. If Ψ = 1, then the monetary authority is completely in the corner of the precautionary motive as it targets the exchange rate. On the other hand, if Ψ = 0 the central bank is completely focused on high returns as it pursues the exchange rate target.

As such, we construct a model capturing domestic foreign exchange market, adding gold demand constraint and analyzing the policy sacrifice shares in two regimes. The first, which we define as precautionary case, focuses on maintaining a currency target rule. The second, which we define as a hybrid case, adds central bank’s considerations for both portfolio variance and returns.

A stylized central bank seeks to choose a level of gold that minimizes the loss function subject to portfolio volatility and some combination of volatility and returns. In other words, we want to choose a percent share of gold wG when the policy sacrifice (λ) is at a minimum when takes values from 0 to 100%.

We are also interested in whether the range of values increases or decreases sharply or gradually. If the sacrifice value is increasing or decreasing slowly, one could conclude that it is possible to demand gold over the said range without significantly preventing the central bank from achieving its exchange rate target.

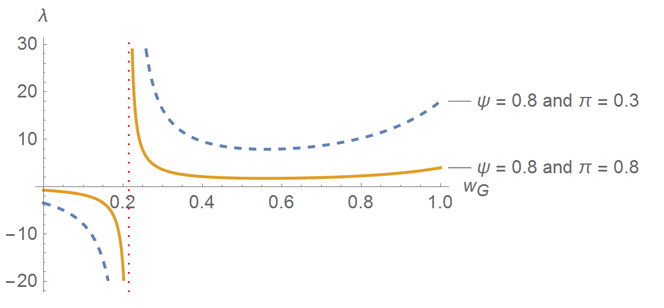

Our simulations (Figure 3 reports example of the Hybrid Case where the monetary authority is focused on a mix of return and risk) indicate possible existence of a two-regime demand for gold. In policy terms, multiple equilibria suggest the monetary authority possibly has a wide percentage range of gold demand. According to our calculation, a central bank that manages the exchange rate could hold anywhere between 45% to 60% of gold without jeopardizing their policy goal (higher λ indicates a greater policy sacrifice). The simulation also shows that holding less that 20% gold has an adverse effect on policy.

Figure 3: Hybrid Case: returns and volatility constraint for Ψ = 0.8

Source: Gevorkyan and Khemraj (2019).

In Figure 3 the weight reflecting the central bank’s preference for precaution is higher at Ψ = 0.8 . The sacrifice values on the vertical axis are smaller. The conclusion here is that if the central bank is motivated by the precautionary motive, then an exchange rate target could be consistent with about 45 to 60 percent gold reserves in the portfolio without significant loss of policy precision, assuming that the parameter values capture the structure of the economy. In the hybrid case, a higher probability of devaluation causes the curve to shift downward and expand the range of possible gold percentages. This suggests that expectation of devaluation or steep market-based depreciation may justify holding more gold without sacrificing policy precision.

The overall conclusions suggest there is some justification to the original view of adding gold to the central bank’s reserves in emerging and frontier markets. Demanding a higher percentage of gold is more appropriate if the central bank prefers to accumulate international reserves for precautionary reason. At the same time, the central bank would tend to incur greater exchange rate target sacrifice if it wants to achieve higher portfolio returns. Our estimations suggest that ability to target the exchange rate is unaffected by the higher volatility of monthly returns on gold. That in turn suggests that gold might be replaced with another safe asset with similar characteristics. The latter observation opens up a much greater range of monetary policy flexibility to the countries susceptible to externalities from global capital flows and lacking strength in the domestic currency.

Aizenman, J. and J. Lee (2007) “International reserves: precautionary versus mercantilist views, theory and evidence.” Open Economies Review, 18 (2), 191 – 214.

Bahmani-Oskooee, M. and F. Brown (2002) “Demand for international reserves: a review article.” Applied Economics, 34 (10), 1209 – 1226.

Benn-Bassat, A. (1980) “The optimal composition of foreign exchange reserves.” Journal of International Economics, 10, 285 – 295.

Eichengreen, B. and D. Mathieson (2000) “The currency composition of foreign exchange reserves: prospect and retrospect.” IMF Working Paper No. 131, International Monetary Fund.

Dooley, M., J. S. Lizondo and D. Mathieson (1989) “The currency composition of foreign exchange reserves.” IMF Staff Paper, 36 (2), 385 – 434.

FRED (2017) FRED Economic Data. Online Database. St. Louis, MO: Federal Reserve Bank of St. Louis. Available online: https://research.stlouisfed.org

Gevorkyan, A.V. and T. Khemraj. (2024) [Forthcoming] Dominant Currency Shocks and Foreign Exchange Pressure in the Periphery. Review of Keynesian Economics. Available at SSRN: https://ssrn.com/abstract=4235710

Gevorkyan, A.V. and T. Khemraj (2019) Exchange rate targeting and gold demand by central banks: modeling international reserves composition. Emerging Markets Finance and Trade, Vol. 55(1): 168-180

Heller, H. R. and M. Knight (1978) “Reserve currency preferences of central banks.” Essays in International Finance, No. 131, Princeton University.

IFS (2017) International Financial Statistics. Online database. Washington, D.C.: International Monetary Fund. Available online: http://www.imf.org/en/Data

Inveen, C. and C. Akorlie. 2022. Ghana plans to buy oil with gold instead of U.S. dollars. Reuters. (November 24). Available online: https://www.nasdaq.com/articles/ghana-plans-to-buy-oil-with-gold-instead-of-u.s.-dollars-0

Ito, H., R. McCauley and T. Chan (2015) “Currency composition of reserves, trade invoicing and currency movements.” Emerging Markets Review, 25, 16 – 29.

Papaioannou, E., R. Portes and G. Siourounis (2006) “Optimal currency shares in international reserves: the impact of the euro and the prospects for the dollar.” Journal of Japanese and International Economies, 20, 508 – 457.

Pina, G. (2017) “International reserves and global interest rates.” Journal of International Money and Finance, 74, 371 – 385.

Rogoff, K. (2016) “Emerging markets should go for the gold.” Project Syndicate, May 3.

Soesmanto, T., E. Selvanathan and S. Selvanathan (2015) “Analysis of the management of currency composition of foreign exchange reserves in Australia.” Economic Analysis and Policy, 47, 82 – 89.

WDI (2017) Word Development Indicators. Online database. Washington, D.C.: World Bank. Available online: http://databank.worldbank.org/

World Gold Council. 2023. Gold Demands Trend Report. Online database. Available online: https://www.gold.org/goldhub/research/gold-demand-trends